NetSpend 2013 Annual Report Download - page 44

Download and view the complete annual report

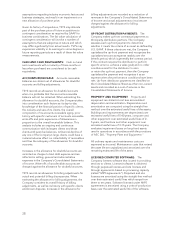

Please find page 44 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.period. Net gains or losses resulting from the

currency translation of assets and liabilities of the

Company’s foreign operations, net of tax when

applicable, are accumulated in a separate section of

shareholders’ equity titled accumulated other

comprehensive income (loss). Gains and losses on

transactions denominated in currencies other than

the functional currencies are included in determining

net income for the period in which exchange rates

change.

TREASURY STOCK: The Company uses the cost

method when it purchases its own common stock as

treasury shares or issues treasury stock upon option

exercises and displays treasury stock as a reduction of

shareholders’ equity.

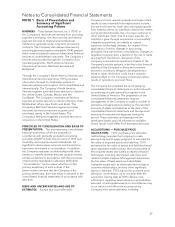

REVENUE RECOGNITION: The Company

recognizes revenues in accordance with the

provisions of SAB No. 104. SAB No. 104 sets forth

guidance as to when revenue is realized or realizable

and earned when all of the following criteria are met:

(1) persuasive evidence of an arrangement exists;

(2) delivery has occurred or services have been

performed; (3) the seller’s price to the buyer is fixed

or determinable; and (4) collectability is reasonably

assured. The Company accrues for rights of refund,

processing errors or penalties, or other related

allowances based on historical experience.

The Company’s North America and International

Services revenues are derived from long-term

processing contracts with financial and nonfinancial

institutions and are generally recognized as the

services are performed. Payment processing services

revenues are generated primarily from charges based

on the number of accounts on file, transactions and

authorizations processed, statements mailed, cards

embossed and mailed and other processing services

for cardholder accounts on file. Most of these

contracts have prescribed annual revenue minimums,

penalties for early termination, and service level

agreements which may impact contractual fees if

certain service levels are not achieved.

Revenue is recognized as the services are performed,

primarily on a per unit basis. Processing contracts

generally range from three to ten years in length.

When providing payment processing services, the

Company frequently enters into customer

arrangements to provide multiple services that may

also include conversion or implementation services,

business process outsourcing services such as call

center services, web-based services, and other

payment processing-related services. Revenue for

these services is generally recognized as they are

performed on a per unit basis each month or ratably

over the term of the contract.

The Company’s Merchant Services revenues are

derived from long-term processing contracts with

large financial institutions, other merchant acquirers

and merchant organizations which generally range

from three to eight years and provide for penalties

for early termination. Merchant services revenue is

generated primarily from processing all payment

forms including credit, debit, electronic benefits

transfer and check truncation for merchants of all

sizes across a wide array of retail market segments.

The products and services offered include

authorization and capture of electronic transactions,

clearing and settlement of electronic transactions,

information reporting services related to electronic

transactions, merchant billing services, and point-of-

sale terminal services. Revenue is recognized for

merchant services as those services are performed,

primarily on a per unit basis. When providing

merchant processing services, the Company

frequently enters into customer arrangements to

provide multiple services that may also include

conversion or implementation services, business

process outsourcing services such as call center

services, terminal services, and other merchant

processing-related services. Revenue for these

services is generally recognized as they are

performed on a per unit basis each month or ratably

over the term of the contract. Revenues on point-of-

sale terminal equipment are recognized upon the

transfer of ownership and shipment of product.

When a sale involves multiple deliverables, revenue

recognition is affected by the determination of the

number of deliverables in an arrangement, whether

those deliverables may be separated into separate

units of accounting, and the valuation of each unit of

accounting which affects the amount of revenue

allocated to each unit. Pursuant to ASC 605, the

Company uses vendor-specific objective evidence of

selling price (VSOE) when it exists to determine the

amount of revenue to allocate to each unit of

accounting. The Company establishes VSOE of

selling price using the price charged when the same

service is sold separately. In certain situations, the

Company does not have sufficient VSOE. In these

situations, TSYS considered whether sufficient third

party evidence (TPE) of selling price existed for the

Company’s services. However, the Company typically

is not able to determine TPE and has not used this

measure of selling price due to the unique and

proprietary nature of some of its services and the

42