NetSpend 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

credit facility and the term loan in whole or in part at

any time without premium or penalty, subject to

reimbursement of the lenders’ customary breakage

and redeployment costs in the case of prepayment of

LIBOR borrowings. The Credit Agreement included

covenants requiring the Company to maintain certain

minimum financial ratios. The Company did not use

the revolving credit facility in 2012 or 2011.

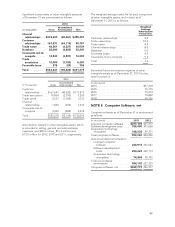

TSYS acquired additional mainframe and distributed

software licenses to increase capacity as a result of

continued increases in transaction volumes. The

Company entered into a $20.0 million financing

agreement in December 2013 to purchase these

additional software licenses. The balance at

December 31, 2013 was $20.0 million.

TSYS also acquired additional mainframe software

licenses to increase capacity in 2012. The Company

entered into an $8.6 million and an $11.9 million

financing agreement in June and December 2012,

respectively, to purchase these additional software

licenses. The balance at December 31, 2013 was $4.6

million and $8.3 million, respectively.

In December 2010, the Company obtained a

$39.8 million note payable from a third-party vendor

related to financing the purchase of distributed

systems software. The note was no longer

outstanding at December 31, 2013.

On October 30, 2008, the Company’s International

Services segment obtained a credit agreement from

a third-party to borrow up to ¥2.0 billion, or

approximately $21 million, in a Yen-denominated

three-year loan to finance activities in Japan. The rate

is LIBOR plus 80 basis points. The Company initially

made a draw of ¥1.5 billion, or approximately

$15.1 million. In January 2009, the Company made

an additional draw down of ¥250 million, or

approximately $2.8 million. In April 2009, the

Company made an additional draw down of

¥250 million, or approximately $2.5 million. On

December 30, 2011, the Company modified its loan

to extend the maturity date to November 5, 2014. In

December 2013, the Company repaid this loan.

In addition, TSYS maintains an unsecured credit

agreement with Columbus Bank and Trust. The credit

agreement has a maximum available principal

balance of $5.0 million, with interest at prime. TSYS

did not use the credit facility during 2013, 2012 or

2011.

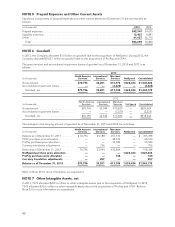

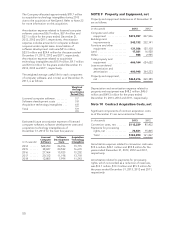

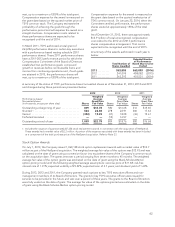

Long-term debt as of December 31 consists of:

(in thousands) 2013 2012

$550,000,000 2.375% Senior

Notes, due June 1, 2018 (5

year tranche), net of

discount ................... $ 549,858 —

$550,000,000 3.75% Senior

Notes, due June 1, 2023 (10

year tranche), net of

discount ................... 546,027 —

LIBOR + 1.125%, unsecured term

loan, due April 8, 2018, with

quarterly principal and interest

payments .................. 195,000 —

LIBOR + 1.125%, unsecured term

loan, due September 10, 2017,

with quarterly principal and

interest payments ............ 138,750 146,250

LIBOR + 0.80%, unsecured term

loan, due November 5, 2014,

with principal paid at

maturity .................... —23,236

1.50% note payable, due

December 31, 2015, with

monthly interest and principal

payments .................. 20,000 —

1.50% note payable, due

December 31, 2013, with

monthly interest and principal

payments .................. —13,452

1.50% note payable, due January

31, 2016, with monthly interest

and principal payments ....... 8,269 11,825

1.50% note payable, due July 31,

2015, with monthly interest and

principal payments ........... 4,604 7,457

Total debt .................. 1,462,508 202,220

Less current portion .......... 34,257 27,361

Noncurrent portion of long-

term debt ................ $1,428,251 174,859

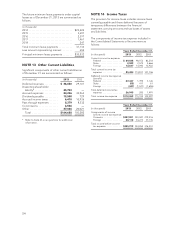

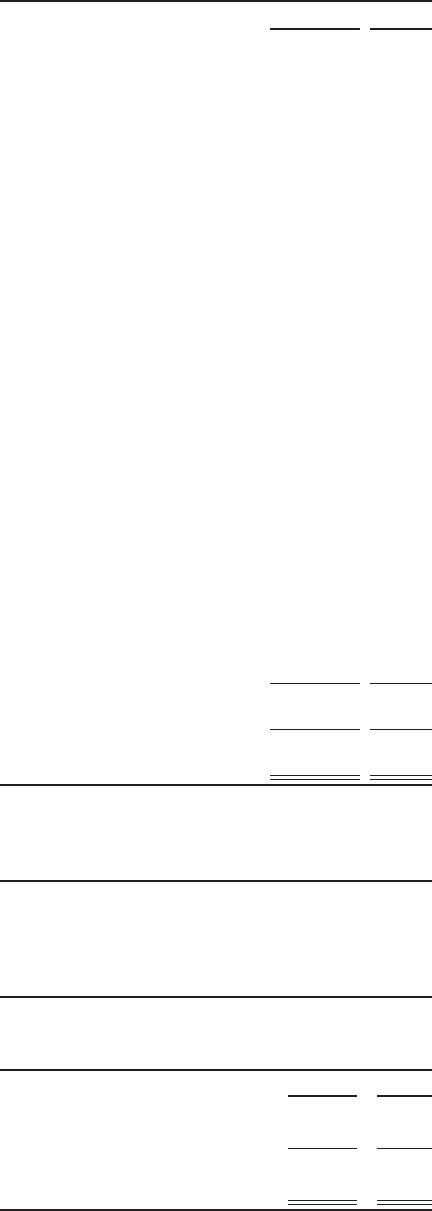

Required annual principal payments on long-term

debt for the five years subsequent to December 31,

2013 are summarized as follows:

(in thousands)

2014 ............................... $ 34,257

2015 ............................... 37,030

2016 ............................... 30,336

2017 ............................... 125,000

2018 ............................... 690,000

Capital lease obligations as of December 31 consist

of:

(in thousands) 2013 2012

Capital lease obligations ....... $30,532 30,418

Less current portion ........... 23,032 13,263

Noncurrent portion of capital

leases ..................... $ 7,500 17,155

53