NetSpend 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

* 2011 FDIC National Survey of Unbanked and Underbanked Households

2

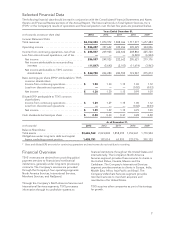

• Earnings Per Share: Adjusted cash earnings

per share (EPS) was $1.72, an increase of

17.8 percent. For the year, adjusted EBITDA

was $634.2 million, an increase of 16 percent.

Basic EPS was $1.30, which was the same as 2012.

Diluted EPS was $1.29, a decrease of 0.2 percent.

• Return to Shareholders: For the year, net

income attributable to common shareholders

was $244.8 million, an increase of 0.2 percent.

Our closing stock price at year’s end was $33.28,

and our total shareholder return for 2013 was

57.2 percent. In the fourth quarter, we repurchased

3.1 million shares of our stock for $97.6 million.

Our Board of Directors has approved increasing

the number of shares that may be repurchased

under our current share repurchase plan from

20 million shares to 28 million shares, and

extended the expiration date of the plan to

April 30, 2015. With the increase, we have

approximately 12 million shares available

to be repurchased under the plan.

Our Strategic Plays

For years, TSYS’ core business has been third-party

processing for bank issuers and merchant acquirers.

In the United States, our issuer processing business

has achieved steady growth, as financial institutions

outsource services not core to their businesses in

order to avoid mounting technology costs and

dealing with a challenging and ever-increasing

regulatory environment.

Since 2010, we have been on a journey to transform

our merchant acquiring business from a third-party

merchant processor to a direct merchant acquirer.

We’ve made solid progress toward this trans-

formation, but we are only at the beginning of

this multi-year journey.

Here are four key areas we focused on in 2013,

with reports on our progress.

• Direct to Merchant: We achieved a significant

milestone in 2013, as our direct merchant

acquiring business now comprises 55 percent

of the revenue for the merchant segment. Our

long-term goal is to grow the direct merchant

acquiring business to be more than 80 percent

of the segment’s revenue through a combination

of organic and acquisition-based growth plays.

• Direct to Consumer: NetSpend® is our first venture

that connects directly with consumers. Through

research, analytics and usability testing, we hone

these product offerings and services to better

meet the needs of the more than 65 million

consumers in the United States* who either don’t

have a bank account or don’t want a bank account.

NetSpend is a leading provider of general purpose

reloadable prepaid cards in the United States. Its

mission is to give consumers the convenience,

security and freedom to be self-banked.

• Processing and Other Solutions for Card

Issuers: We continue to win in the commercial

and consumer credit card processing space.

Later this year, we expect to complete the

migration of Bank of America to our TS2®

processing platform. At that time, TSYS will

process 40 percent of the Visa and MasterCard

consumer credit card accounts issued by the