NetSpend 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

deferred income tax liability on these undistributed

earnings is not practicable.

TSYS is the parent of an affiliated group that files a

consolidated U.S. federal income tax return and most

state and foreign income tax returns on a separate

entity basis. In the normal course of business, the

Company is subject to examinations by these taxing

authorities unless statutory examination periods

lapse. TSYS is no longer subject to U.S. federal

income tax examinations for years before 2009 and

with few exceptions, the Company is no longer

subject to income tax examinations from state and

local or foreign tax authorities for years before 2005.

There are currently federal income tax examinations

in progress for the years 2009 and 2010 for a

subsidiary which was acquired this year. Additionally,

a number of tax examinations are in progress by the

relevant state tax authorities. Although TSYS is

unable to determine the ultimate outcome of these

examinations, TSYS believes that its recorded liability

for uncertain tax positions relating to these

jurisdictions for such years is adequate.

TSYS adopted the provisions of ASC 740 on

January 1, 2007 which prescribes a recognition

threshold and measurement attribute for the financial

statement recognition, measurement and disclosure

of a tax position taken or expected to be taken in a

tax return. During the year ended December 31,

2013, TSYS decreased its liability for prior year

uncertain income tax positions as a discrete item by a

net amount of approximately $6.3 million (net of the

federal tax effect). This decrease resulted from refunds

received and TSYS reassessing its tax positions. The

Company is not able to reasonably estimate the

amount by which the liability will increase or decrease

over time; however, at this time, the Company does

not expect any significant changes related to these

obligations within the next twelve months.

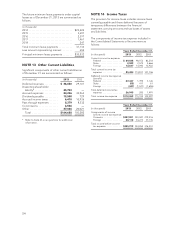

A reconciliation of the beginning and ending amount

of unrecognized tax liabilities is as follows 1:

(in millions)

Year Ended

December 31,

2013

Beginning balance .................... $9.0

Current activity:

Additions based on tax positions related

to current year .................... 0.7

Additions for tax positions of prior

years ............................ 1.5

Reductions for tax positions of prior

years ............................ (6.0)

Settlements ........................ (2.5)

Net, current activity ............... (6.3)

Ending balance ....................... $2.7

1 Unrecognized state tax liabilities are not adjusted for

the federal tax impact.

TSYS recognizes potential interest and penalties

related to the underpayment of income taxes as

income tax expense in the Consolidated Statements

of Income. Gross accrued interest and penalties on

unrecognized tax benefits totaled $0.3 million and

$0.9 million as of December 31, 2013 and

December 31, 2012, respectively. The total amounts

of unrecognized income tax benefits as of

December 31, 2013 and December 31, 2012 that, if

recognized, would affect the effective tax rates are

$2.8 million and $8.8 million (net of the federal

benefit on state tax issues), respectively, which

includes interest and penalties of $0.2 million and

$0.7 million, respectively.

NOTE 15 Commitments and Contingencies

LEASE COMMITMENTS: TSYS is obligated under

noncancelable operating leases for computer

equipment and facilities.

The future minimum lease payments under

noncancelable operating leases with remaining terms

greater than one year for the next five years and

thereafter and in the aggregate as of December 31,

2013, are as follows:

(in thousands)

2014 ............................... $123,807

2015 ............................... 121,904

2016 ............................... 111,455

2017 ............................... 43,517

2018 ............................... 23,210

Thereafter .......................... 42,208

Total future minimum lease payments . . . $466,101

The majority of computer equipment lease

commitments come with a renewal option or an

option to terminate the lease. These lease

commitments may be replaced with new leases which

allow the Company to continually update its

computer equipment. Total rental expense under all

operating leases in 2013, 2012 and 2011 was

$95.7 million, $99.0 million and $97.5 million,

respectively.

CONTRACTUAL COMMITMENTS: In the normal

course of its business, the Company maintains long-

term processing contracts with its clients. These

processing contracts contain commitments,

including, but not limited to, minimum standards and

time frames against which the Company’s

performance is measured. In the event the Company

does not meet its contractual commitments with its

clients, the Company may incur penalties and certain

clients may have the right to terminate their contracts

56