NetSpend 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

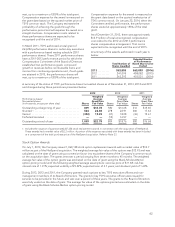

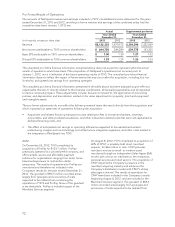

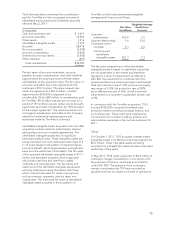

Pro Forma Results of Operations

The amounts of NetSpend revenue and earnings included in TSYS’ consolidated income statement for the years

ended December 31, 2013 and 2012, and the pro forma revenue and earnings of the combined entity had the

acquisition date been January 1, 2012 are:

Actual Supplemental pro forma

Years Ended

December 31, Years Ended

December 31,

(in thousands, except per share data) 2013 2012 2013 2012

Revenue ............................................ $2,132,353 1,870,972 2,354,396 2,222,069

Net income attributable to TSYS common shareholders .... $ 244,750 244,280 239,775 193,255

Basic EPS attributable to TSYS common shareholders ...... $ 1.30 1.30 1.27 1.03

Diluted EPS attributable to TSYS common shareholders .... $ 1.29 1.29 1.26 1.03

The unaudited pro forma financial information presented above does not purport to represent what the actual

results of operations would have been if the acquisition of NetSpend’s operations had occurred prior to

January 1, 2012, nor is it indicative of the future operating results of TSYS. The unaudited pro forma financial

information does not reflect the impact of future events that may occur after the acquisition, including, but not

limited to, anticipated cost savings from operating synergies.

The unaudited pro forma financial information presented in the table above has been adjusted to give effect to

adjustments that are (1) directly related to the business combination; (2) factually supportable; and (3) expected

to have a continuing impact. These adjustments include, but are not limited to, the application of accounting

policies; and depreciation and amortization related to fair value adjustments to property, plant and equipment

and intangible assets.

The pro forma adjustments do not reflect the following material items that result directly from the acquisition and

which impacted our statement of operations following the acquisition:

• Acquisition and related financing transactions costs relating to fees to investment bankers, attorneys,

accountants, and other professional advisors, and other transaction-related costs that were not capitalized as

deferred financing costs; and

• The effect of anticipated cost savings or operating efficiencies expected to be realized and related

restructuring charges such as technology and infrastructure integration expenses, and other costs related to

the integration of NetSpend into TSYS.

2012

On December 26, 2012, TSYS completed its

acquisition of ProPay for $123.7 million. ProPay

previously operated as a privately-held company, and

offers simple, secure and affordable payment

solutions for organizations ranging from small, home

based entrepreneurs to multi-billion dollar

enterprises. The results of operations for ProPay are

immaterial and therefore not included in the

Company’s results for the year ended December 31,

2012. The goodwill of $93.5 million recorded arises

largely from synergies and economies of scale

expected to be realized from combining the

operations of TSYS and ProPay. None of the goodwill

is tax deductible. ProPay is included as part of the

Merchant Services segment.

On August 8, 2012, TSYS completed its acquisition of

60% of CPAY, a privately held direct merchant

acquirer, for $66 million in cash. CPAY provides

merchant services to small- to medium-sized

merchants through an Independent Sales Agent (ISA)

model, with a focus on merchants in the restaurant,

personal services and retail sectors. The acquisition of

CPAY expands the Company’s presence in the

merchant acquiring industry and enhances the

Company’s distribution model with CPAY’s strong

sales agent channel. The results of operations for

CPAY have been included in the Company’s results

beginning August 8, 2012, and are included in the

Merchant Services segment. The goodwill of $68.6

million recorded arises largely from synergies and

economies of scale expected to be realized from

72