MoneyGram 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

period in an equal number of shares each year and have a term of ten years. Stock options granted in 2004 under the 2004 Omnibus

Incentive Plan become exercisable in a five-year period in an equal number of shares each year and have a term of seven years. All

outstanding stock options contain certain forfeiture and non-competition provisions.

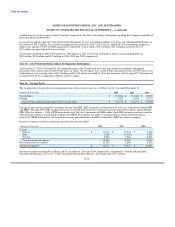

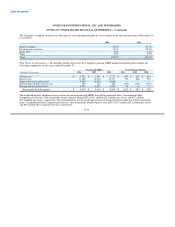

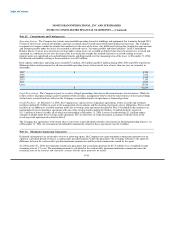

For purposes of determining the fair value of stock option awards, the Company uses the Black-Scholes single option pricing model and

the assumptions set forth in the following table. Expected volatility is based on the historical volatility of the price of the Company's

common stock since the spin-off on June 30, 2004. The Company uses historical information to estimate the expected term and forfeiture

rates of options. The expected term represents the period of time that options are expected to be outstanding, while the forfeiture rate

represents the number of options that will be forfeited by grantees due primarily to termination of employment. In addition, the Company

considers any expectations regarding future activity which could impact the expected term and forfeiture rate. The risk-free rate for

periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of grant. Compensation

cost, net of expected forfeitures, is recognized using a straight-line method over the vesting or service period.

2006 2005 2004

Expected dividend yield 0.6% 0.2% 0.2%

Expected volatility 26.5% 24.1% 25.2%

Risk-free interest rate 4.7% 3.8% 3.2%

Expected life 6.5 years 5 years 5 years

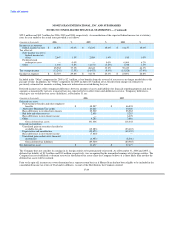

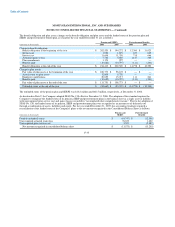

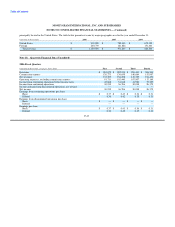

Following is a summary of stock option activity:

Weighted-

Weighted Average Aggregate

Average Remaining Intrinsic

Exercise Contractual Value

Shares Price Term ($000)

Options outstanding at December 31, 2005 4,883,262 $ 18.42

Granted 405,040 27.37

Exercised (1,112,011) 31.46

Forfeited (76,777) 20.24

Options outstanding at December 31, 2006 4,099,514 $ 19.52 5.00 years $ 48,557

Vested or expected to vest at December 31, 2006 4,010,110 $ 19.40 4.93 years $ 47,977

Options exercisable at December 31, 2006 3,150,951 $ 18.52 4.37 years $ 40,466

The weighted-average grant date fair value of an option granted during 2006, 2005 and 2004 was $10.38, $5.95 and $5.49, respectively.

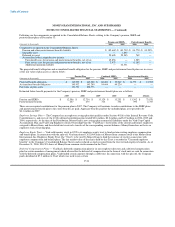

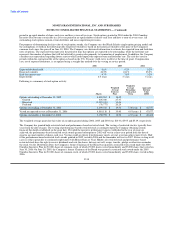

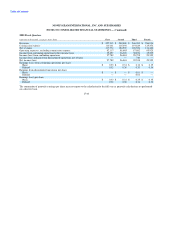

The Company has granted both restricted stock and performance-based restricted stock. The vesting of restricted stock is typically three

years from the date of grant. The vesting of performance-based restricted stock is contingent upon the Company obtaining certain

financial thresholds established on the grant date. Provided the incentive performance targets established in the year of grant are

achieved, the performance-based restricted stock awards granted subsequent to 2002 will vest in a three-year period from the date of

grant in an equal number of shares each year. Vesting could accelerate if performance targets are met at certain achievement levels. Half

of the performance-based restricted stock awards granted in 2002 vested in 2006 and the remainder will vest in 2007. Future vesting in all

cases is subject generally to continued employment with MoneyGram or Viad. Holders of restricted stock and performance-based

restricted stock have the right to receive dividends and vote the shares, but may not sell, assign, transfer, pledge or otherwise encumber

the stock. On the Distribution Date, the Company's former Chairman of the Board was granted a restricted stock award under the 2004

Omnibus Incentive Plan for 50,000 shares of common stock, of which 25,000 shares vested immediately and 25,000 shares that vested on

June 30, 2006. On June 30, 2005, the Company's former Chairman of the Board was granted a restricted stock award under the 2005

Omnibus Incentive Plan for 50,000 shares of common stock, of which 25,000 shares vested immediately and 25,000 shares vested in May

2006.

F-38