MoneyGram 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

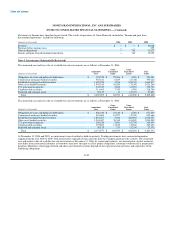

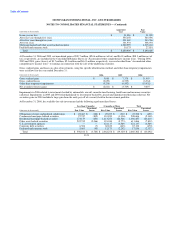

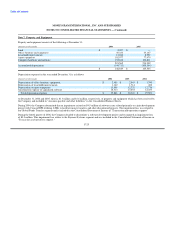

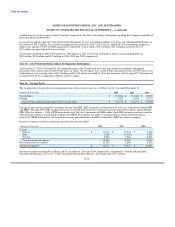

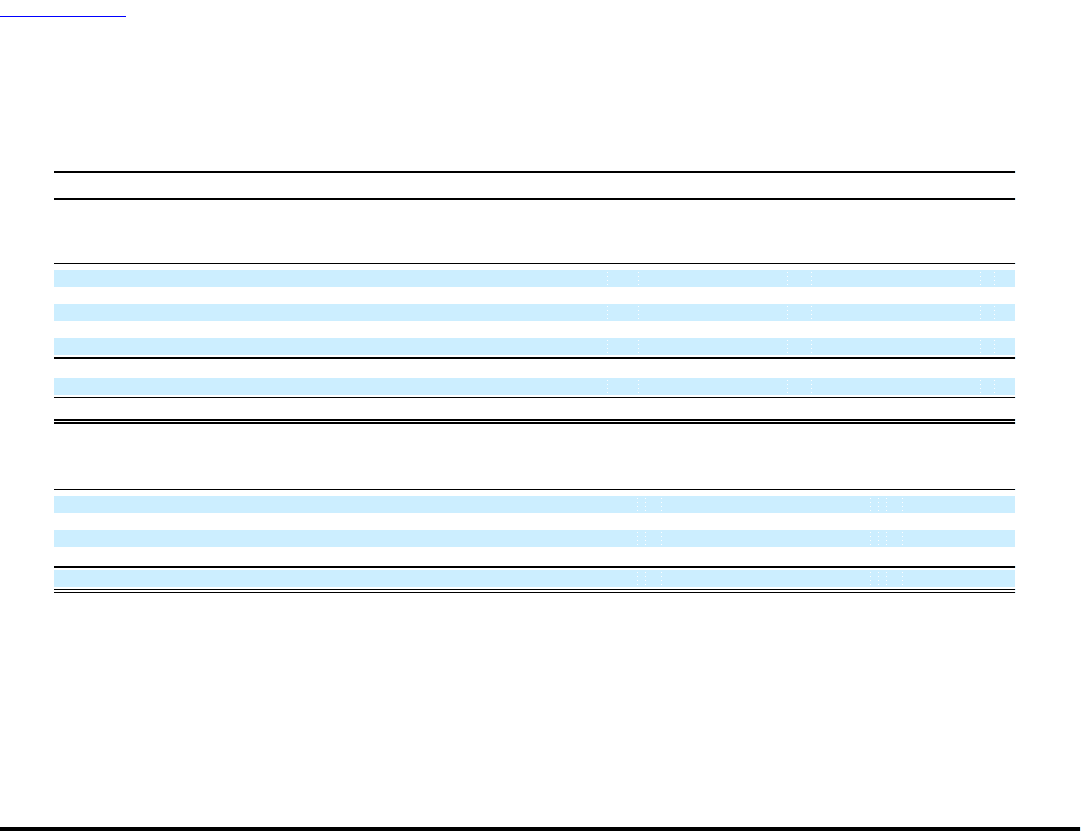

Note 7. Property and Equipment

Property and equipment consists of the following at December 31:

(Amounts in thousands) 2006 2005

Land $ 2,907 $ —

Office furniture and equipment 40,222 23,167

Leasehold improvements 13,248 8,952

Agent equipment 102,077 77,979

Computer hardware and software 135,108 104,811

293,562 214,909

Accumulated depreciation (144,713) (109,364)

$ 148,849 $ 105,545

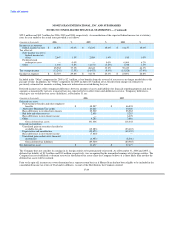

Depreciation expense for the year ended December 31 is as follows:

(Amounts in thousands) 2006 2005 2004

Depreciation of office furniture, equipment, $ 2,485 $ 2,043 $ 1,790

Depreciation of leasehold improvements 1,142 1,714 482

Depreciation on agent equipment 13,905 12,732 12,776

Amortization expense of capitalized software 18,314 13,854 12,453

Total depreciation expense $ 35,846 $ 30,343 $ 27,501

At December 31, 2006 and 2005, there is $1.3 million and $1.6 million, respectively, of property and equipment which has been received by

the Company and included in "Accounts payable and other liabilities" in the Consolidated Balance Sheets.

During 2004, the Company determined that an impairment existed on $4.5 million of software costs related primarily to a joint development

project with Concord EFS utilizing ATMs to facilitate money transfers and other discontinued projects. The impairment loss was related to

our Global Funds Transfer segment and is included in the Consolidated Statement of Income in "Transaction and operations support."

During the fourth quarter of 2006, the Company decided to discontinue a software development project and recognized an impairment loss

of $0.9 million. This impairment loss relates to the Payment Systems segment and was included in the Consolidated Statement of Income in

"Transaction and operations support."

F-25