MoneyGram 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

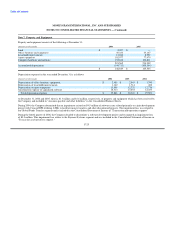

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

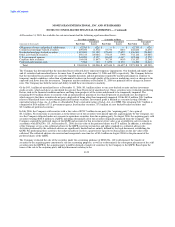

As the Company adopted SFAS No. 123R under the modified prospective method, prior period financial statements are not restated. No

modifications were made to existing share-based awards prior to, or in connection with, the adoption of SFAS No. 123R. The adoption of

SFAS No. 123R reduced income from continuing operations before income taxes by $1.5 million and reduced net income by $1.1 million,

respectively, for 2005. Basic and diluted earnings per share in 2005 were reduced by $0.01. Cash used by operating activities and cash

provided by financing activities during 2005 increased by $1.8 million as a result of the adoption of SFAS No. 123R.

Recent Accounting Pronouncements — In May 2005, the Financial Accounting Standards Board ("FASB") issued SFAS No. 154,

Accounting Changes and Error Corrections, which replaces APB No. 20, Accounting Changes, and SFAS No. 3, Reporting Accounting

Changes in Interim Financial Statements. This statement requires that an entity apply the retrospective method in reporting a change in an

accounting principle or the reporting entity. The standard only allows for a change in accounting principle if it is required by a newly issued

accounting pronouncement or the entity can justify the use of an allowable alternative accounting principle on the basis that it is preferable.

This statement also requires that corrections for errors discovered in prior period financial statements be reported as a prior period

adjustment by restating the prior period financial statements. Additional disclosures are required when a change in accounting principle or

reporting entity occurs, as well as when a correction for an error is reported. The statement is effective for the Company for fiscal 2006. The

adoption of this SFAS did not have a material impact to the Company's consolidated financial statements.

In January 2006, the FASB issued FASB Staff Position ("FSP") No. 45-3, Application of FASB Interpretation No. 45 ("FIN 45") to

Minimum Revenue Guarantees Granted to a Business or Its Owners. This FSP amends FIN 45 to include guarantees granted to a business

that its revenue for a specified period of time will be at least a specified amount. FIN 45 requires that a company record an obligation at the

inception of a guarantee equal to the fair value of the guarantee, as well as disclose certain information relating to the guarantee. The FSP is

applicable for minimum revenue guarantees issued or modified by the Company on or after January 1, 2006, with no revision or restatement

to the accounting treatment of such guarantees issued prior to the adoption date allowed. The disclosure requirements of FIN 45 will be

applicable to all outstanding minimum revenue guarantees. The Company has adopted FSP No. 45-3 effective January 1, 2006 with no

impact to the Company's consolidated financial statements.

In February 2006, the FASB issued FSP No. 123R-4, Classification of Options and Similar Instruments Issued as Employee Compensation

That Allow for Cash Settlement upon the Occurrence of a Contingent Event. This FSP amends SFAS No. 123R to require that stock options

issued to employees as compensation be accounted for as equity instruments until a contingent event allowing for cash settlement is probable

of occurring. The Company has adopted FSP No. 123R-4 effective January 1, 2006 with no impact to the Company's consolidated financial

statements.

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Instruments — an amendment of FASB Statements

No. 133 and 140. SFAS No. 155 permit companies to measure any hybrid instrument in its entirety at fair value. Changes in fair value are

recorded in income. Currently, hybrid instruments are required to be separated into two instruments, a derivative and host. Generally, the

derivative instrument is recorded at fair value. The election to measure the hybrid instrument at fair value is made on an

instrument-by-instrument basis and is irreversible. The standard also requires that beneficial interests in securitized financial assets be

evaluated for freestanding or embedded derivatives. SFAS No. 155 is applicable to all financial instruments acquired, issued or subject to a

remeasurement event effective January 1, 2007 for MoneyGram. The Company is currently evaluating the impact of this pronouncement on

its consolidated financial statements.

In July 2006, the FASB issued FIN No. 48, Accounting for Uncertainty in Income Taxes. FIN 48 is an interpretation of SFAS No. 109,

Accounting for Income Taxes. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition

and measurement of a tax position taken or expected to be taken in an entity's tax return. This interpretation also provides guidance on

derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition of tax positions. This FIN is

effective January 1, 2007 for MoneyGram. The Company is currently evaluating the impact of this pronouncement on its consolidated

financial statements.

F-17