MoneyGram 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

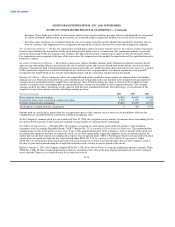

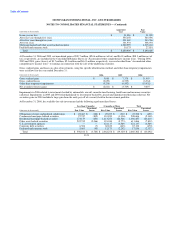

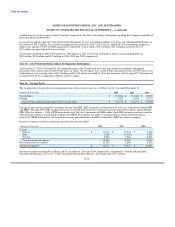

Statements of Income have therefore been restated. The results of operations of Game Financial, included in "Income and gain from

discontinued operations" include the following:

(Amounts in thousands) 2006 2005 2004

Revenue $ — $ — $ 10,668

Earnings before income taxes — — 852

Gain on disposition — 740 11,417

Income and gain from discontinued operations — 740 13,050

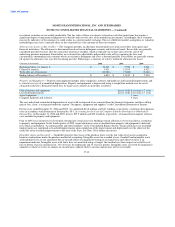

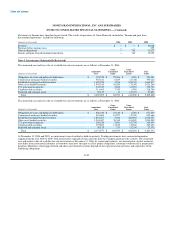

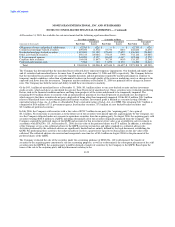

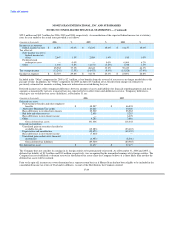

Note 4. Investments (Substantially Restricted)

The amortized cost and fair value of available-for-sale investments are as follows at December 31, 2006:

Gross Gross

Amortized Unrealized Unrealized Fair

(Amounts in thousands) Cost Gains Losses Value

Obligations of states and political subdivisions $ 765,525 $ 25,006 $ (490) $ 790,041

Commercial mortgage-backed securities 585,611 6,659 (2,148) 590,122

Residential mortgage-backed securities 1,623,220 3,876 (23,219) 1,603,877

Other asset-backed securities 1,992,164 36,920 (7,839) 2,021,245

U.S. government agencies 342,749 2,564 (6,589) 338,724

Corporate debt securities 311,465 7,745 (470) 318,740

Preferred and common stock 30,175 13 (2,337) 27,851

Total $ 5,650,909 $ 82,783 $ (43,092) $ 5,690,600

The amortized cost and fair value of available-for-sale investments are as follows at December 31, 2005:

Gross Gross

Amortized Unrealized Unrealized Fair

(Amounts in thousands) Cost Gains Losses Value

Obligations of states and political subdivisions $ 836,419 $ 35,610 $ (529) $ 871,500

Commercial mortgage-backed securities 691,604 10,297 (2,235) 699,666

Residential mortgage-backed securities 1,894,227 5,024 (20,800) 1,878,451

Other asset-backed securities 1,963,047 38,340 (10,885) 1,990,502

U.S. government agencies 360,236 5,641 (5,274) 360,603

Corporate debt securities 395,869 11,830 (2,266) 405,433

Preferred and common stock 30,175 217 (3,214) 27,178

Total $ 6,171,577 $ 106,959 $ (45,203) $ 6,233,333

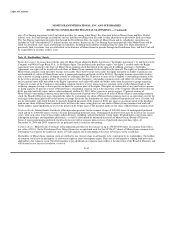

At December 31, 2006 and 2005, no investments were classified as held-to-maturity. Trading investments have contractual maturities

ranging from the year 2029 to 2049, with auction dates typically 28 days after the date the Company purchases the security. The amortized

cost and market value of available-for-sale investments at December 31, 2006, by contractual maturity, are shown below. Actual maturities

may differ from contractual maturities as borrowers may have the right to call or prepay obligations, sometimes without call or prepayment

penalties. Maturities of mortgage-backed and other asset-backed securities depend on the repayment characteristics and experience of the

underlying obligations.

F-20