MoneyGram 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

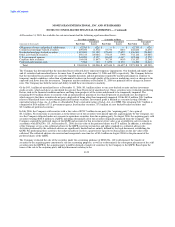

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

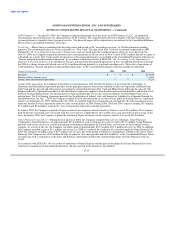

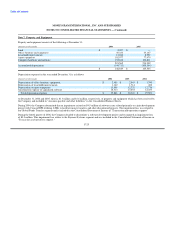

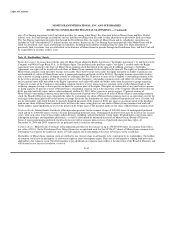

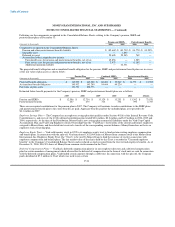

$22.9 million and $35.7 million for 2006, 2005 and 2004, respectively. A reconciliation of the expected federal income tax at statutory

rates for year ended to the actual taxes provided is as follows:

(Amounts in thousands) 2006 % 2005 % 2004 %

Income tax at statutory

federal income tax rate $ 61,870 35.0% $ 51,232 35.0% $ 31,157 35.0%

Tax effect of:

State income tax, net of

federal income tax

effect 2,647 1.5% 2,084 1.4% 910 1.0%

Preferred stock

redemption costs — 0.0% — 0.0% 6,004 6.7%

Other 1,445 0.8% (4,673) (3.2%) 1,348 1.5%

65,962 37.3% 48,643 33.2% 39,419 44.3%

Tax-exempt income (13,243) (7.5%) (14,473) (9.9%) (15,528) (17.4%)

Income tax expense $ 52,719 29.8% $ 34,170 23.3% $ 23,891 26.8%

Included in the "Other" component for 2005 is $2.1 million, of tax benefits from the reversal of tax reserves no longer needed due to the

passage of time. In addition, the "Other" component for 2005 includes $3.5 million of tax benefits from changes in estimates to

previously estimated tax amounts resulting from new information received during the year.

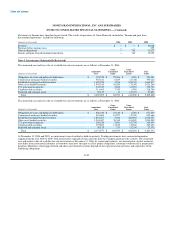

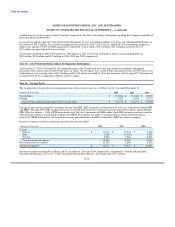

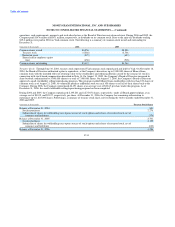

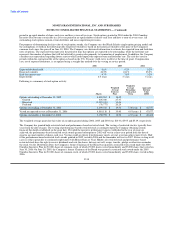

Deferred income taxes reflect temporary differences between amounts of assets and liabilities for financial reporting purposes and such

amounts as measured by tax laws at enacted tax rates expected to be in effect when such differences reverse. Temporary differences,

which give rise to deferred tax assets (liabilities), at December 31 are:

(Amounts in thousands) 2006 2005

Deferred tax assets:

Postretirement benefits and other employee

benefits $ 48,587 $ 46,835

Alternative Minimum Tax credits 20,202 30,468

Basis difference in revalued investments 25,502 25,582

Bad debt and other reserves 2,630 5,263

Basis difference in investment income — 6,678

Other 4,285 3,616

Gross deferred tax assets 101,206 118,442

Deferred tax liabilities:

Unrealized gain on securities classified as

available-for-sale (15,083) (23,467)

Depreciation and amortization (59,673) (49,132)

Basis difference in investment income (7,820) —

Unrealized gain on derivative financial

instruments (6,953) (8,366)

Gross deferred tax liabilities (89,529) (80,965)

Net deferred tax asset $ 11,677 $ 37,477

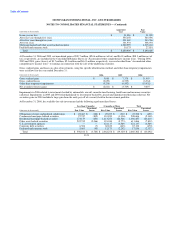

The Company does not consider its earnings in its foreign entities to be permanently reinvested. As of December 31, 2006 and 2005, a

deferred tax liability of $1.9 million and $5.8 million, respectively, was recognized for the unremitted earnings of its foreign entities. The

Company has not established a valuation reserve for the deferred tax assets since the Company believes it is more likely than not that the

deferred tax assets will be realized.

Prior to the spin off, income taxes were determined on a separate return basis as if MoneyGram had not been eligible to be included in the

consolidated income tax return of Viad and its affiliates. As part of the Distribution, the Company entered

F-29