MoneyGram 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

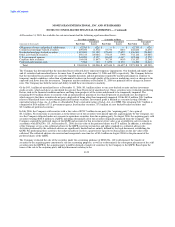

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This statement does not require any new fair value

measurement, but it provides guidance on how to measure fair value under other accounting pronouncements. SFAS 157 also establishes a

fair value hierarchy to classify the source of information used in fair value measurements. The hierarchy prioritizes the inputs to valuation

techniques used to measure fair value into three broad categories. This standard is effective for the Company on January 1, 2008. The

Company is currently evaluating the impact of this pronouncement on its consolidated financial statements.

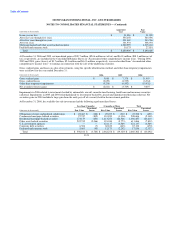

In September 2006, the FASB issued SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans,

an amendment of FASB Statements No. 87, 88, 106 and 132. This standard requires the recognition of the funded status of a pension or

postretirement plan in the balance sheet as an asset or liability. Unrecognized prior service cost and gains and losses are recorded to

accumulated other comprehensive income. SFAS 158 does not change previous guidance for income statement recognition. The standard

requires the plan assets and benefit obligations to be measured as of the annual balance sheet date of the Company. Prospective application

of this standard is required. The Company adopted the recognition and disclosure provisions of SFAS 158 at December 31, 2006. The

adoption of SFAS 158 increased pension and postretirement liabilities by $14.1 million, deferred tax asset by $6.5 million and other

comprehensive income by $9.2 million and decreased intangible assets by $1.6 million. The change in measurement date is effective for the

Company's 2008 year-end.

In September 2006, the SEC issued SAB 108, which expresses the SEC staff's view regarding the process of quantifying financial statement

misstatements. The SAB provides for a one-time cumulative effect transition adjustment to correct for misstatements that are now

considered material as a result of implementing SAB 108. The Company adopted SAB 108 effective December 31, 2006 with no impact to

the Company's consolidated financial statements.

In January 2007, the FASB issued SFAS No. 133 Implementation Issue No. B40, Embedded Derivatives: Application of Paragraph 13(b) to

Securitized Interests in Prepayable Financial Assets ("DIG B40"), which relates to SFAS No. 155. SFAS No. 155 requires the evaluation of

interest in securitized financial assets to identify interests that are derivatives. DIG B40 provides the circumstances in which a securitized

interest in prepayable financial assets would not be subject to the SFAS No. 155 requirement.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities. SFAS No. 159

permits companies to choose to measure certain financial instruments and certain other items at fair value. The election to measure the

financial instrument at fair value is made on an instrument-by-instrument basis for the entire instrument, with few exceptions, and is

irreversible. SFAS No. 159 is effective for MoneyGram on January 1, 2008. The Company is currently evaluating the impact of this

pronouncement on its consolidated financial statements.

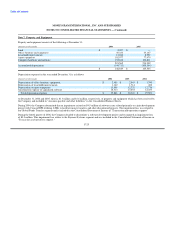

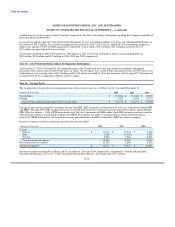

Note 3. Acquisitions and Discontinued Operations

Money Express — On May 31, 2006, MoneyGram completed the acquisition of Money Express, the Company's former super agent in Italy.

In connection with the acquisition, the Company formed MoneyGram Payment Systems Italy, a wholly-owned subsidiary, to operate the

former Money Express network. The acquisition provides the Company with the opportunity for further network expansion and more control

of marketing and promotional activities in the region.

MoneyGram acquired Money Express for $15.0 million, subject to purchase price adjustments. The acquisition cost includes $1.3 million of

transaction costs and the forgiveness of $0.7 million of liabilities. The Company is in the process of finalizing the valuation of intangible

assets, among other items from this acquisition, which may result in adjustment to the purchase price allocation. Purchased intangible assets

of $7.2 million, consisting primarily of agent contracts and a non-compete agreement, will be amortized over useful lives ranging from 3 to

5 years. Preliminary goodwill of $17.0 million was recorded and assigned to our Global Funds Transfer segment.

The operating results of Money Express subsequent to May 31, 2006 are included in the Company's Consolidated Statement of Income. The

financial impact of the acquisition is not material to the Consolidated Balance Sheet or Consolidated Statement of Income.

F-18