MoneyGram 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

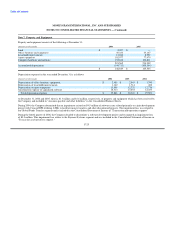

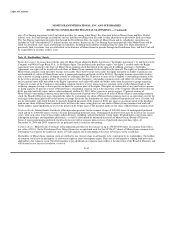

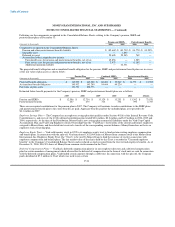

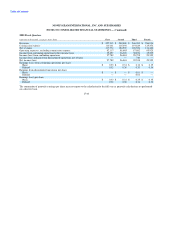

The Company's weighted average asset allocation for the funded pension plan by asset category at the measurement date of November 30

is as follows:

2006 2005

Equity securities 58.5% 55.7%

Fixed income securities 38.1% 39.0%

Real estate 2.6% 2.4%

Other 0.8% 2.9%

Total 100.0% 100.0%

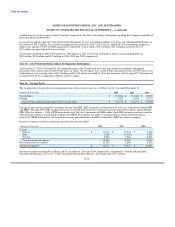

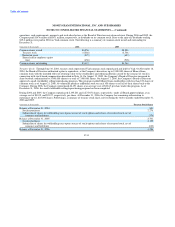

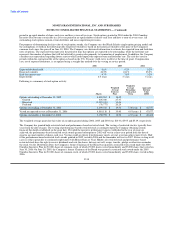

Plan Financial Information — Net periodic benefit expense for the Company's pension, SERP and postretirement plans includes the

following components for the years ended December 31:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2006 2005 2004 2006 2005 2004

Service cost $ 1,922 $ 1,893 $ 1,717 $ 637 $ 619 $ 515

Interest cost 11,698 11,320 11,333 715 644 593

Expected return on plan assets (9,082) (8,604) (8,804) — — —

Amortization of prior service cost 703 714 768 (294) (294) (294)

Recognized net actuarial loss 4,302 4,092 3,990 24 16 14

Net periodic benefit expense $ 9,543 $ 9,415 $ 9,004 $ 1,082 $ 985 $ 828

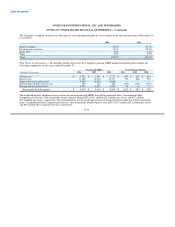

The estimated net loss and prior service cost for the pension plan and SERPs that will be amortized from "Accumulated Other

Comprehensive Income" into net periodic benefit expense during 2007 is $4.1 million ($2.5 million net of tax) and $0.7 million

($0.4 million net of tax), respectively. The estimated prior service credit and net loss for the postretirement plan that will be amortized

from "Accumulated Other Comprehensive Income" into net periodic benefit expense over 2007 is $0.3 million ($0.2 million net of tax)

and $0.1 million ($0.1 million net of tax), respectively.

F-34