MoneyGram 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

use of its individual liquid assets. The Company is able to withdraw, deposit and/or sell its individual liquid assets at will, with no prior

notice or penalty, provided the Company maintains a total pool of liquid assets sufficient to meet the regulatory and contractual

requirements.

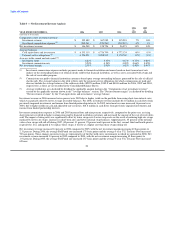

As of December 31, 2006 and 2005, we had unrestricted cash and cash equivalents, receivables, and investments to the extent those assets

exceed all payment service obligations as summarized in Table 8. These amounts are generally available; however, management

considers a portion of these amounts as providing additional assurance that regulatory requirements are maintained during the normal

fluctuations in the value of investments.

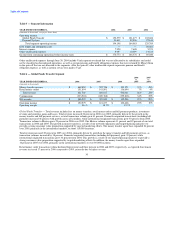

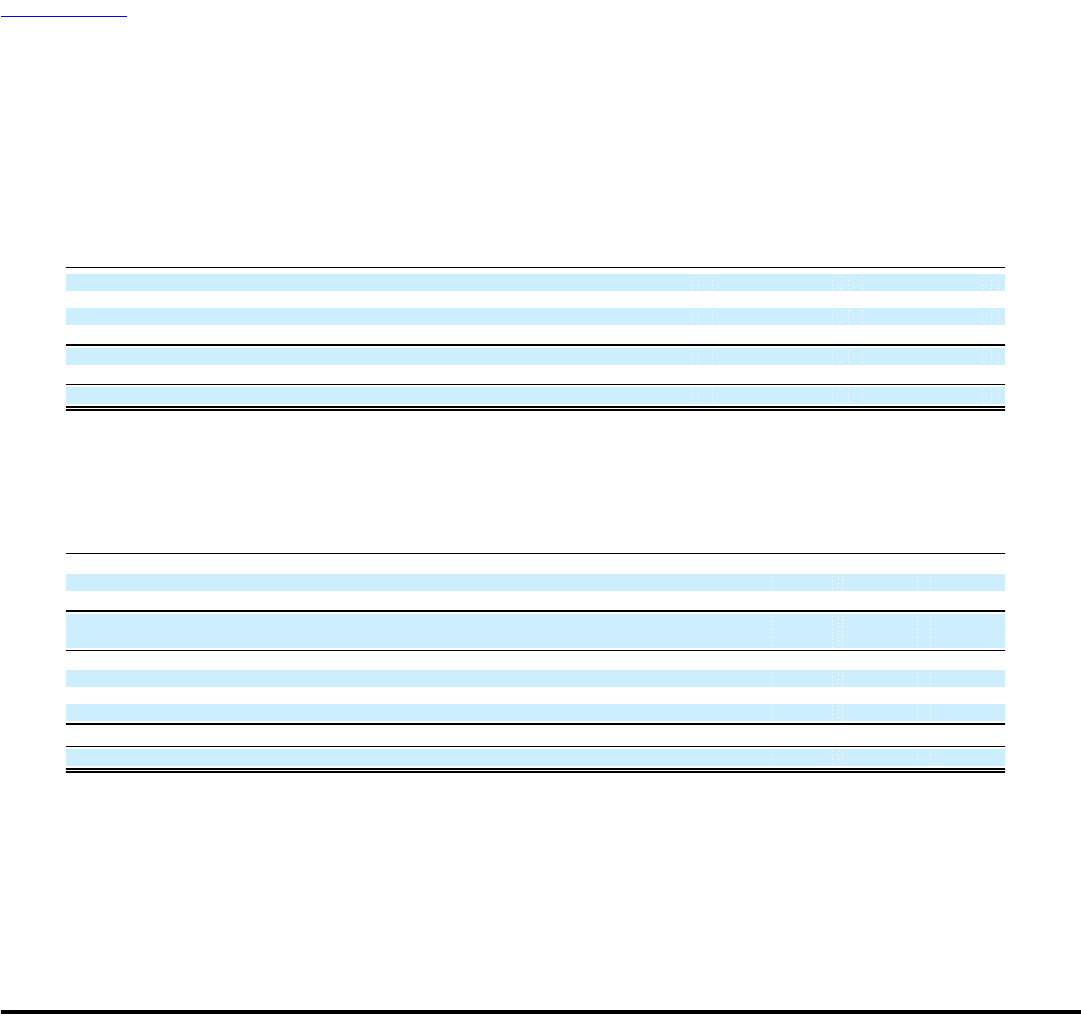

Table 8 — Unrestricted Assets

(Amounts in thousands) 2006 2005

Cash and cash equivalents $ 973,931 $ 698,691

Receivables, net 1,758,682 1,425,622

Trading investments 145,500 167,700

Available for sale investments 5,690,600 6,233,333

8,568,713 8,525,346

Amounts restricted to cover payment service obligations (8,209,789) (8,159,309)

Unrestricted assets $ 358,924 $ 366,037

The decline in unrestricted assets is primarily due to fluctuations in the market value of our investments and higher levels of capital

expenditures and repurchases of our common stock, payment of dividends and the acquisition of MoneyExpress, as well as changes in

our working capital resulting from the timing of normal operating activities.

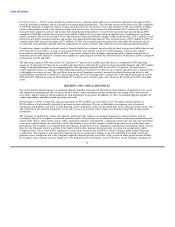

Table 9 — Cash Flows Provided By or Used In Operating Activities

YEAR ENDED DECEMBER 31, 2006 2005 2004

(Amounts in thousands)

Net income $ 124,054 $ 112,946 $ 86,412

Total adjustments to reconcile net income 42,485 68,278 86,150

Net cash provided by continuing operating activities before changes in payment service assets and

obligations 166,539 181,224 172,562

Change in cash and cash equivalents (substantially restricted) (261,725) (84,817) 308,587

Change in trading investments, net (substantially restricted) 22,200 153,100 (232,650)

Change in receivables, net (substantially restricted) (335,509) (666,282) (22,654)

Change in payment service obligations 38,489 518,728 219,100

Net change in payment service assets and obligations (536,545) (79,271) 272,383

Net cash (used in) provided by continuing operating activities $(370,006) $ 101,953 $ 444,945

Table 9 summarizes the cash flows (used in) provided by continuing operating activities. For 2006, net cash provided by continuing

operating activities before changes in payment service assets and obligations decreased $14.7 million to $166.5 million from

$181.2 million for 2005. This decrease was primarily due to the timing of payment on other assets and accounts payable and other

liabilities. Net cash provided by continuing operating activities before changes in payment service assets and obligations increased

$8.7 million in 2005 from $172.6 million for 2004. The increase was primarily due to the timing of payment on other assets and accounts

payable and other liabilities.

To understand the cash flow activity of our business, the cash provided by (used in) operating activities relating to the payment service

assets and obligations should be reviewed in conjunction with the cash provided by (used in) investing activities related to our investment

portfolio.

33