MoneyGram 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

At December 31, 2006, MoneyGram has $11.3 million of unrealized losses on derivative financial instruments recorded in accumulated

other comprehensive income. While MoneyGram intends to continue to meet the conditions to qualify for hedge accounting treatment

under SFAS No. 133, if hedges did not qualify as highly effective or if forecasted transactions are no longer probable of occurring or did

not occur, the changes in the fair value of the derivatives used as hedges would be reflected in earnings. MoneyGram does not believe it

is exposed to more than a nominal amount of credit risk in its hedging activities as the counterparties are generally well-established, well-

capitalized financial institutions.

Goodwill — SFAS No. 142, Goodwill and Other Intangible Assets, requires annual impairment testing of goodwill based on the

estimated fair value of MoneyGram's reporting units. The fair value of MoneyGram's reporting units is estimated based on discounted

expected future cash flows using a weighted average cost of capital rate. Additionally, an assumed terminal value is used to project future

cash flows beyond base years. Assumptions used in our impairment evaluations, such as forecasted growth rates and our cost of capital,

are consistent with our internal forecasts and operating plans.

The estimates and assumptions regarding expected cash flows, terminal values and the discount rate require considerable judgment and

are based on historical experience, financial forecasts, and industry trends and conditions. We did not recognize any impairment charges

for goodwill in the years presented.

Pension obligations — On December 31, 2006, MoneyGram adopted SFAS No. 158, Employers' Accounting for Defined Benefit Pension

and Other Postretirement Plans, which requires recognition of the funded status of pension plans in the balance sheet. Unrecognized

prior service costs and gains and losses are recorded to accumulated other comprehensive income.

MoneyGram provides defined benefit pension plan coverage to certain employees of MoneyGram, as well as former employees of Viad

and of sold operations of Viad. Pension benefits and the related expense (income) are based upon actuarial assumptions regarding

mortality, discount rates, long-term return on assets and other factors.

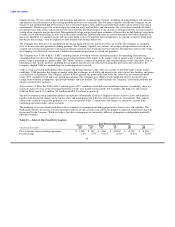

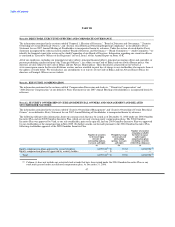

MoneyGram's discount rate used in determining future pension obligations is measured on November 30 ("measurement date") and is

based on rates determined by actuarial analysis and management review. Following are the assumptions used to measure the projected

benefit obligation as of December 31, and the net periodic benefit cost for the year ended December 31:

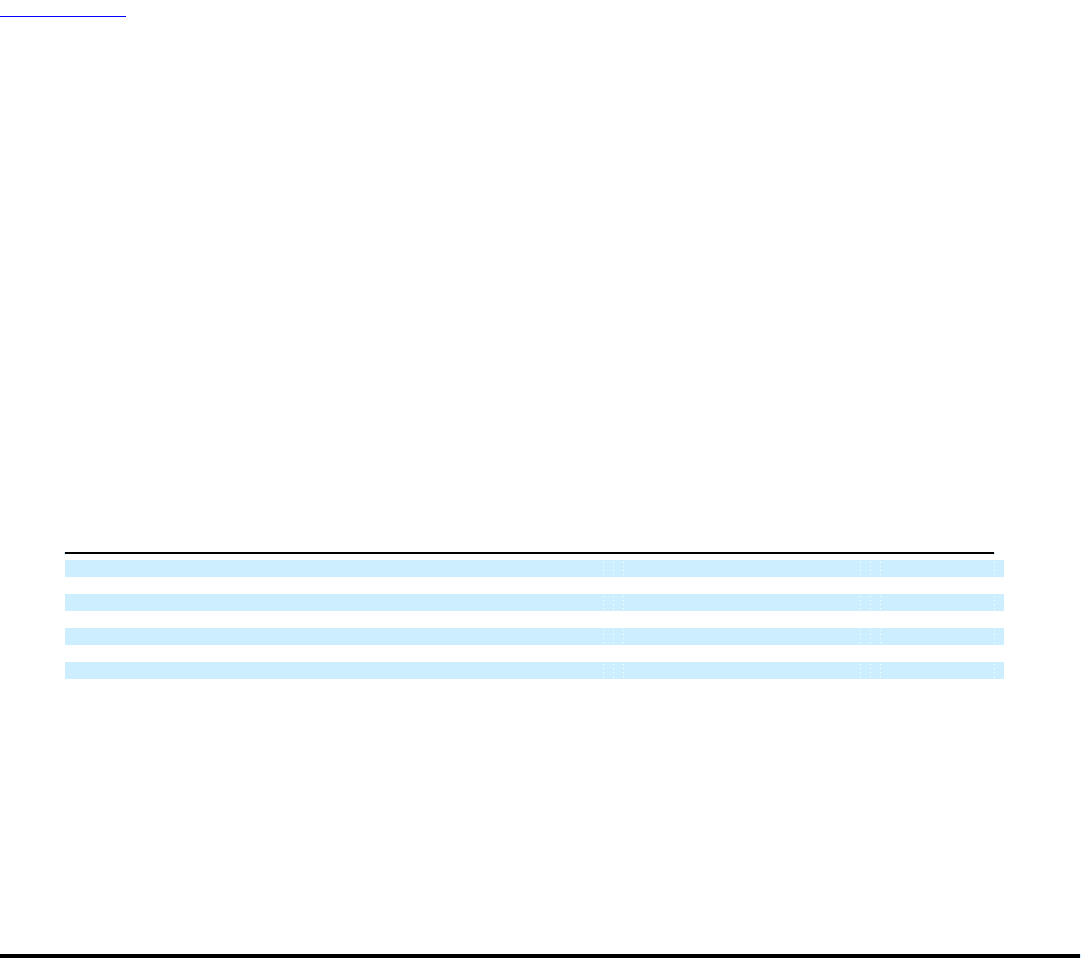

2006 2005 2004

Net periodic benefit cost:

Discount rate 5.90% 6.00% 6.25%

Expected return on plan assets 8.00% 8.50% 8.75%

Rate of compensation increase 5.75% 4.50% 4.50%

Projected benefit obligation:

Discount rate 5.70% 5.90% 6.00%

Rate of compensation increase 5.75% 5.75% 4.50%

MoneyGram's pension expense for 2006, 2005 and 2004 was $9.5 million, $9.4 million and $9.0 million, respectively. Pension expense is

calculated in part based upon the actuarial assumptions shown above. At each measurement date, the discount rate is based on interest

rates for high-quality, long-term corporate debt securities with maturities comparable to our liabilities.

The expected return on pension plan assets is based on our historical experience, our pension plan investment strategy and our

expectations for long-term rates of return. Current market factors such as inflation and interest rates are evaluated before long-term

capital market assumptions are determined. Peer data and historical returns are reviewed for reasonableness and appropriateness. Our

pension plan investment strategy is reviewed annually and is based upon plan liabilities, an evaluation of market conditions, tolerance for

risk, and cash requirements for benefit payments. MoneyGram's asset allocation at December 31, 2006 consists of approximately

59 percent in large capitalization and international equity stock funds, approximately 38 percent in fixed income securities such as global

bond funds and corporate obligations, approximately 3 percent in a real estate limited partnership interest and less than 1 percent in other

securities. The investment portfolio contains a diversified blend of equity and fixed

43