MoneyGram 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

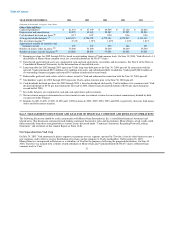

yields, which were partially offset by lower average investable balances. Net securities losses were flat in 2006 as compared to 2005.

Investment revenue increased 24 percent in 2005 compared to 2004 primarily due to higher average investable balances. Net securities

losses in 2005 were $0.8 million as compared to net securities gains of $2.3 million in 2004.

Commissions expense in 2006 was up 34 percent compared to 2005, primarily driven by the 28 percent growth in fee and other revenue.

Commissions expense as a percentage of revenue was 40.6 percent in 2006 increased from 38.4 percent in 2005 primarily due to tiered

commissions rates paid to certain agents and product mix (as growth in the money transfer business outpaces money orders). Tiered

commissions are commissions rates that are adjusted upward, subject to certain caps, as an agent's transaction volume grows. We use

tiered commissions rates as an incentive for select agents to grow transaction volume by paying the agents for performance and allowing

the agent to participate in adding market share for MoneyGram. As compared to 2004, commissions expense in 2005 was up 25 percent,

primarily driven by the 23 percent growth in fee and other revenue. Commissions expense as a percentage of revenue increased from

37.6 percent in 2004 to 38.4 percent in 2005 primarily due to product mix as growth in the money transfer business outpaced money

orders.

Operating income in 2006 and 2005 increased 25 percent and 19 percent, respectively, over the previous years due to the growth in

money transfer and bill payment services and the higher investment revenue. The operating margin of 18.6 percent in 2006 was

essentially flat compared to 2005. The additional provision for agent loss impacted the 2005 operating margin by (0.9) percentage points.

The operating margin decreased in 2005 to 18.7 percent from a margin of 19.3 percent in 2004 as a result of our investment in marketing,

higher provisions for uncollectible agent receivables and the continued product mix shift from retail money orders to money transfer.

Operating income in 2004 included a $4.5 million impairment charge for capitalized technology costs.

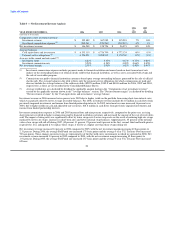

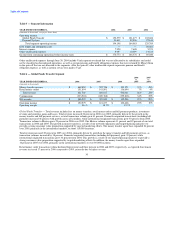

Table 7 — Payment Systems Segment

2006 2005

vs. vs.

YEAR ENDED DECEMBER 31, 2006 2005 2004 2005 2004

(Amounts in thousands)

Official check outsourcing services $ 306,760 $ 297,289 $ 269,971 3% 10%

Other revenue 30,337 24,330 24,495 25% (1%)

Total revenue 337,097 321,619 294,466 5% 9%

Commissions (230,135) (220,704) (203,655) 4% 8%

Net revenue $ 106,962 $ 100,915 $ 90,811 6% 11%

Operating income $ 41,619 $ 42,406 $ 27,163 (2%) 56%

Operating margin 12.3% 13.2% 9.2%

Taxable equivalent basis (1):

Revenue $ 354,544 $ 340,655 $ 315,207 4% 8%

Commissions $ (230,135) $ (220,704) $ (203,655) 4% 8%

Operating income 59,064 61,441 47,905 (4%) 28%

Operating margin 16.7% 18.0% 15.2%

(1) The taxable equivalent basis numbers (commonly used by financial institutions) are non-GAAP measures that are used by the

Company's management to evaluate the effect of tax-exempt securities on the Payment Systems segment. The tax-exempt

investments in the investment portfolio have lower pre-tax yields, but produce higher income on an after-tax basis than

comparable taxable investments. An adjustment is made to present revenue and operating income resulting from amounts invested

in tax-exempt securities on a taxable equivalent basis. The adjustment is calculated using a 35 percent tax rate and is $17.4 million,

$19.0 million and $20.7 million for 2006, 2005 and 2004, respectively. The presentation of taxable equivalent basis numbers is

supplemental to results presented under GAAP and may not be comparable to similarly titled measures used by other companies.

These non-GAAP measures should be used in addition to, but not as a substitute for measures presented under GAAP.

31