MoneyGram 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

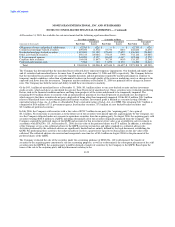

investment securities are not readily marketable. The fair value of these investments is based on cash flow projections that require a

significant degree of management judgment as to default and recovery rates of the underlying investments. Accordingly, these estimates

may not be indicative of the amounts we could realize in a current market exchange. The use of different market assumptions or valuation

methodologies may have a material effect on the estimated fair value amounts of these investments.

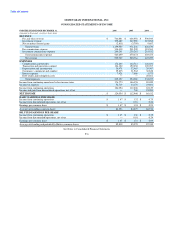

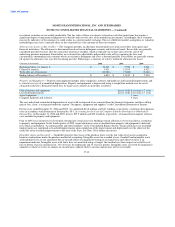

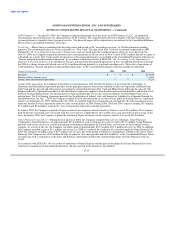

Allowance for Losses on Receivables — The Company provides an allowance for potential losses from receivables from agents and

financial institutions. The allowance is determined based on known delinquent accounts and historical trends. Receivables are generally

considered past due two days after the contractual remittance schedule, which is typically one to three days after the sale of the

underlying payment instrument. Receivables are evaluated for collectibility and possible write-off by examining the facts and

circumstances surrounding each customer where an account is delinquent and a loss is deemed possible. Receivables are generally written

off against the allowance one year after becoming past due. Following is a summary of activity within the allowance for losses:

(Amounts in thousands) 2006 2005 2004

Beginning balance at January 1, $ 13,819 $ 7,930 $ 6,968

Charged to expense 3,931 12,935 6,422

Write-offs, net of recoveries (10,926) (7,046) (5,460)

Ending balance at December 31, $ 6,824 $ 13,819 $ 7,930

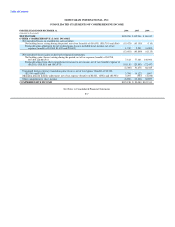

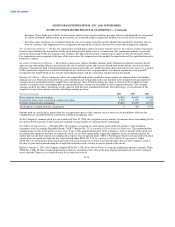

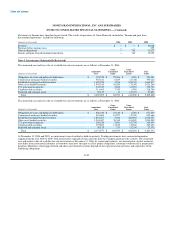

Property and Equipment — Property and equipment includes office equipment, software and hardware and leasehold improvements and

is stated at cost, net of accumulated depreciation. Property and equipment is depreciated using a straight-line method over the assets'

estimated useful lives. Estimated useful lives by major asset category are generally as follows:

Office furniture and equipment Lesser of the lease term or 7 years

Leasehold improvements Lesser of the lease term or 7 years

Agent equipment 3 years

Computer hardware and software 3 years

The cost and related accumulated depreciation of assets sold or disposed of are removed from the financial statements and the resulting

gain or loss, if any, is recognized under the caption "Occupancy, equipment and supplies" in the Consolidated Statement of Income.

For the years ended December 31, 2006 and 2005, we capitalized $14.8 million, and $12.3 million, respectively, of software development

costs in accordance with Statement of Position No. 98-1, Accounting for the Costs of Computer Software Developed or Obtained for

Internal Use. At December 31, 2006 and 2005, there is $39.9 million and $35.4 million, respectively, of unamortized computer software

costs included in property and equipment.

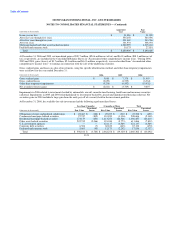

Prior to 2005, lease incentives received upon entering into certain leases for buildings (tenant allowances) were classified as a reduction

to property and equipment. In the fourth quarter of 2005, tenant allowances were reclassified from property and equipment to deferred

rent, which is included in "Accounts payable and other liabilities" in the Consolidated Balance Sheets. Tenant allowances for leasehold

improvements are capitalized as leasehold improvements upon completion of the improvement and depreciated over the shorter of the

useful life of the leasehold improvement or the term of the lease. See Note 15 for further discussion.

Intangible Assets and Goodwill — Goodwill represents the excess of the purchase price over the fair value of net assets acquired in

business combinations under the purchase method of accounting. Intangible assets are recorded at cost. Goodwill and intangible assets

with indefinite lives are not amortized, but are instead subject to impairment testing on an annual basis and whenever there is an

impairment indicator. Intangible assets with finite lives are amortized using a straight- line method over their respective useful lives of

four to fifteen years for customer lists, 36 to 40 years for trademarks and 15 years for patents. Intangible assets are tested for impairment

annually or whenever events or changes in circumstances indicate that its carrying amount may not be recoverable.

F-14