MoneyGram 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

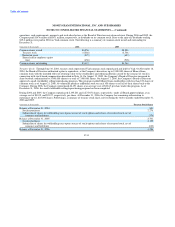

into a Tax Sharing Agreement with Viad which provides for, among other things, the allocation between MoneyGram and New Viad of

federal, state, local and foreign tax liabilities and tax liabilities resulting from the audit or other adjustment to previously filed tax returns.

The Tax Sharing Agreement provides that through the Distribution Date, the results of MoneyGram and its subsidiaries' operations are

included in Viad's consolidated U.S. federal income tax returns. In general, the Tax Sharing Agreement provides that MoneyGram will be

liable for all federal, state, local, and foreign tax liabilities, including such liabilities resulting from the audit of or other adjustment to

previously filed tax returns, that are attributable to the business of MoneyGram for periods through the Distribution Date, and that Viad will

be responsible for all other of these taxes.

Note 12. Stockholders' Equity

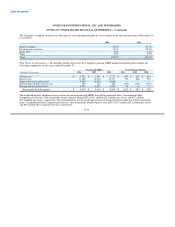

Rights Agreement: In connection with the spin-off, MoneyGram adopted a Rights Agreement ("the Rights Agreement") by and between the

Company and Wells Fargo Bank, N.A., as the Rights Agent. The preferred share purchase rights ("the rights") issuable under the Rights

Agreement were attached to the shares of MoneyGram common stock distributed in the spin-off. In addition, pursuant to the Rights

Agreement, one right will be issued with each share of MoneyGram common stock issued after the spin-off. The rights are inseparable from

MoneyGram common stock until they become exercisable. Once they become exercisable, the rights will allow its holder to purchase one

one-hundredth of a share of MoneyGram series A junior participating preferred stock for $100.00. The rights become exercisable ten days

after a person or group acquires, or begins a tender or exchange offer for, 15 percent or more of the Company's outstanding common stock.

In the event a person or group acquires 15 percent or more of the Company's outstanding common stock, and subject to certain conditions

and exceptions more fully described in the Rights Agreement, each right will entitle the holder (other than the person or group acquiring

15 percent or more of the Company's outstanding common stock) to receive, upon exercise, common stock of either MoneyGram or the

acquiring company having a value equal to two times the exercise price of the rights. The rights are redeemable at any time before a person

or group acquires 15 percent or more of MoneyGram's outstanding common stock at the discretion of the Company's Board of Directors for

$0.01 per right and will expire, unless earlier redeemed, on June 30, 2014. After a person or group acquires 15 percent or more of

MoneyGram's outstanding common stock, but before that person or group owns 50 percent or more of MoneyGram's outstanding common

stock, the Board of Directors may extinguish the rights by exchanging one share of MoneyGram common stock or an equivalent security for

each right (other than rights held by that person or group). Each one one-hundredth of a share of MoneyGram preferred stock, if issued, will

not be redeemable, will entitle holders to quarterly dividend payments of the greater of $0.01 per share or an amount equal to the dividend

paid on one share of MoneyGram common stock, will have the same voting power as one share of MoneyGram common stock and will

entitle holders, upon liquidation, to receive the greater of $1.00 per share or the payment made on one share of MoneyGram common stock.

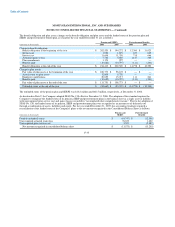

Preferred Stock: MoneyGram's Certificate of Incorporation provides for the issuance of up to 5,000,000 shares of undesignated preferred

stock and up to 2,000,000 shares of series A junior participating preferred stock. Undesignated preferred stock may be issued in one or more

series, with each series to have those rights and preferences, including, without limitation, voting rights, dividend rights, conversion rights,

redemption privileges and liquidation preferences, as shall be determined by unlimited discretion of MoneyGram's Board of Directors.

Series A junior participating preferred stock has been reserved for issuance upon exercise of preferred share purchase rights. At

December 31, 2006 and 2005, respectively, no preferred stock is issued or outstanding.

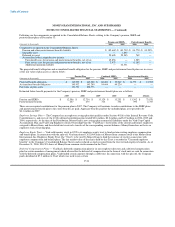

Common Stock: MoneyGram's Certificate of Incorporation provides for the issuance of up to 250,000,000 shares of common stock with a

par value of $0.01. On the Distribution Date, MoneyGram was recapitalized such that the 88,556,077 shares of MoneyGram common stock

outstanding was equal to the number of shares of Viad common stock outstanding at the close of business on the record date.

The holders of MoneyGram common stock are entitled to one vote per share on all matters to be voted upon by its stockholders. The holders

of common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions

applicable to the common stock. The determination to pay dividends on common stock will be at the discretion of the Board of Directors and

will depend on our financial condition, results of

F-30