MoneyGram 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

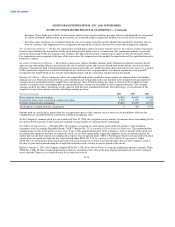

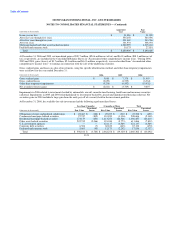

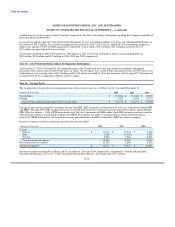

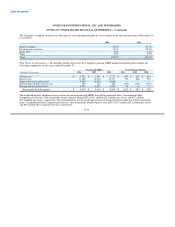

Note 8. Intangibles and Goodwill

Intangible assets at December 31 were as follows:

2006 2005

Gross Net Gross Net

Carrying Accumulated Carrying Carrying Accumulated Carrying

(Amounts in thousands) Value Amortization Value Value Amortization Value

Amortized intangible assets:

Customer lists $ 33,350 $ (21,762) $ 11,588 $ 29,312 $ (19,942) $ 9,370

Patents 13,208 (12,262) 946 13,200 (11,636) 1,564

Trademarks and other 3,751 (832) 2,919 630 (206) 424

50,309 (34,856) 15,453 43,142 (31,784) 11,358

Unamortized intangible assets:

Pension intangible assets — — — 1,890 — 1,890

Total intangible assets $ 50,309 $ (34,856) $ 15,453 $ 45,032 $ (31,784) $ 13,248

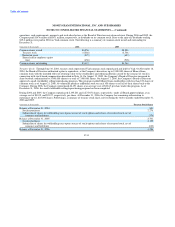

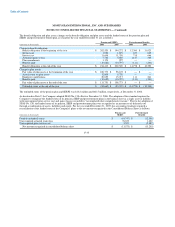

During the third quarter of 2004, the Company evaluated the recoverability of certain purchased customer list intangibles due to the expected

departure of a particular customer. To determine recoverability, the Company estimated future cash flows over the remaining useful life and

calculated the fair value. An impairment loss of $2.1 million was recognized for the amount in which the carrying amount exceeded the fair

value amount. This loss is included on the Consolidated Statement of Income in "Transaction and operations support" and relates to our

Payment Systems segment. No impairments were identified during 2006 and 2005.

The Company recorded intangible assets of $7.2 million in connection with the acquisition of MoneyExpress, consisting principally of

customer lists and a noncompetition agreement.

Intangible asset amortization expense for 2006, 2005 and 2004 was $3.1 million, $2.1 million and $2.1 million, respectively. The estimated

intangible asset amortization expense is $3.6 million, $3.2 million, $2.3 million, $1.7 million and $1.0 million for fiscal 2007, 2008, 2009,

2010 and 2011, respectively.

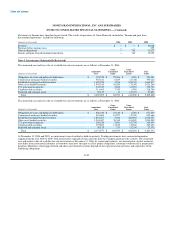

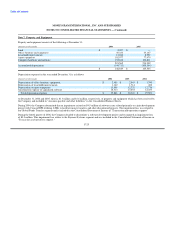

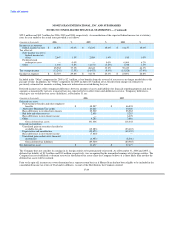

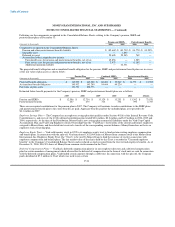

Following is a reconciliation of goodwill:

Global Funds Payment Total

(Amounts in thousands) Transfer Systems Goodwill

Balance as of January 1, 2004 $ 378,451 $ 17,075 $ 395,526

Goodwill acquired 8,744 — 8,744

Impairment losses — — —

Balance as of December 31, 2005 387,195 17,075 404,270

Goodwill acquired 17,046 — 17,046

Impairment losses — — —

Balance as of December 31, 2006 $ 404,241 $ 17,075 $ 421,316

Goodwill acquired in 2006 and 2005 relates to the acquisition of Money Express and ACH Commerce, respectively, and was allocated to the

Global Funds Transfer segment. The amount of goodwill expected to be deductible for tax purposes is not significant. The Company

performed an annual assessment of goodwill during the fourth quarters of 2006, 2005 and 2004 and determined that there was no

impairment.

F-26