MoneyGram 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information contained in the sections entitled "Proposal 1: Election of Directors," "Board of Directors and Governance," "Security

Ownership of Certain Beneficial Owners," and "Section 16(a) Beneficial Ownership Reporting Compliance" in our definitive Proxy

Statement for our 2007 Annual Meeting of Stockholders is incorporated herein by reference. Under the section of our definitive Proxy

Statement incorporated by reference herein entitled "Board of Directors and Governance — Board Committees — Audit Committee," we

identify the financial expert who serves on the Audit Committee of our Board of Directors. Information regarding our executive officers

is contained in "Executive Officers of the Registrant" in Part I, Item 1 of this Annual Report on Form 10-K.

All of our employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, or

persons performing similar functions (the "Principal Officers"), are subject to our Code of Ethics and our Always Honest policy. Our

directors are also subject to our Code of Ethics and our Always Honest policy. These documents are posted on our website at

www.moneygram.com in the Investor Relations section, and are available in print free of charge to any stockholder who requests them at

the address set forth below. We will disclose any amendments to or waivers of our Code of Ethics and our Always Honest Policy for

directors or Principal Officers on our website.

Item 11. EXECUTIVE COMPENSATION

The information contained in the sections entitled "Compensation Discussion and Analysis," "Executive Compensation" and

"2006 Director Compensation" in our definitive Proxy Statement for our 2007 Annual Meeting of Stockholders is incorporated herein by

reference.

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

The information contained in the sections entitled "Security Ownership of Management" and "Security Ownership of Certain Beneficial

Owners" in our definitive Proxy Statement for our 2007 Annual Meeting of Stockholders is incorporated herein by reference.

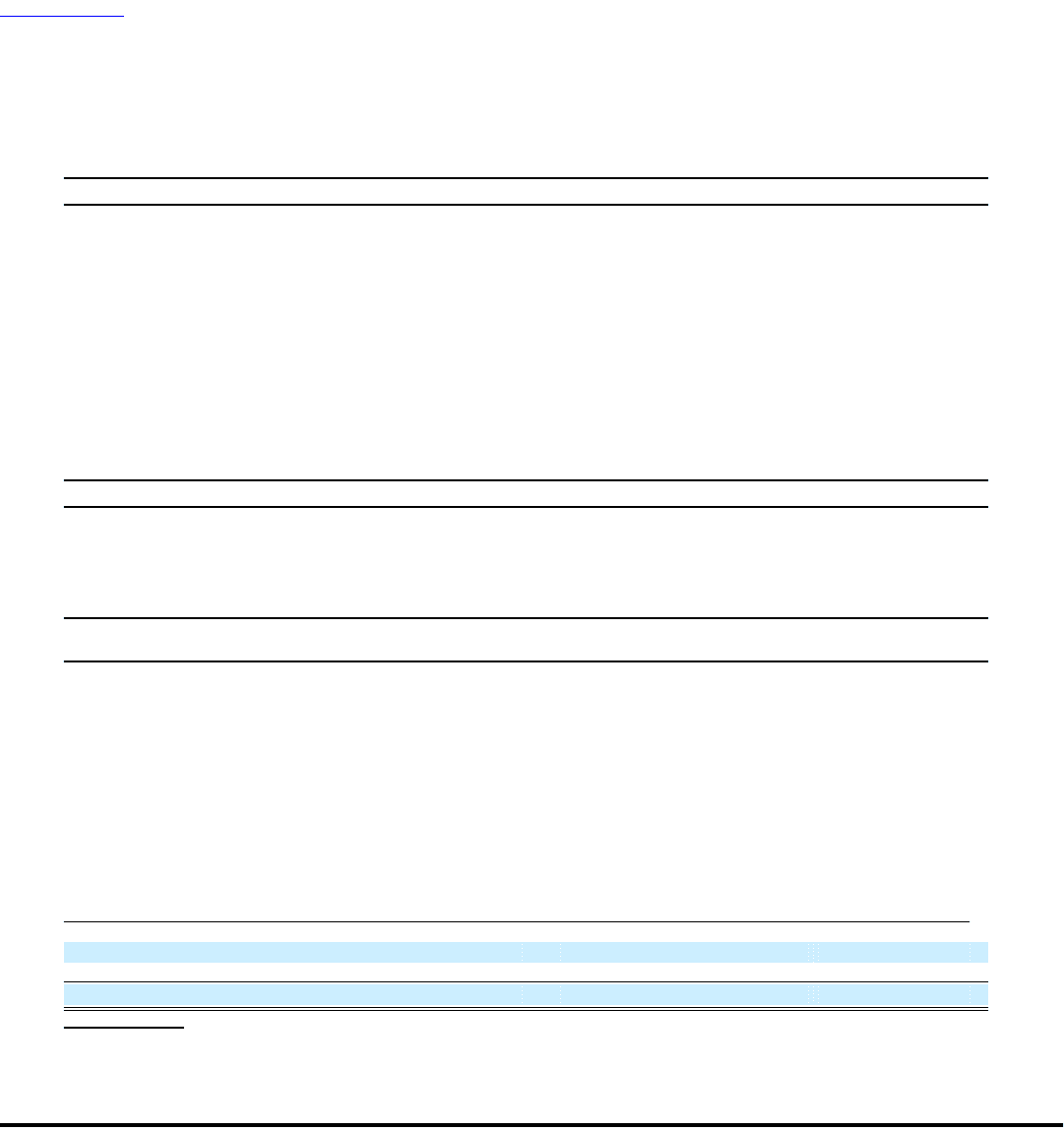

The following table provides information about our common stock that may be issued as of December 31, 2006 under our 2004 Omnibus

Incentive Plan and our 2005 Omnibus Incentive Plan, which are our only existing equity compensation plans. The 2004 Omnibus

Incentive Plan was approved by Viad, as our sole stockholder, prior to the spin-off, and our 2005 Omnibus Incentive Plan was approved

by our stockholders at the annual meeting in May 2005. No further awards can be made pursuant to the 2004 Omnibus Incentive Plan

following stockholder approval of the 2005 Omnibus Incentive Plan.

Number of securities

remaining available

Number of securities Weighted average for future issuance

to be issued upon exercise price of under equity

exercise of outstanding compensation plans

outstanding options, options, warrants (excluding securities

warrants and rights and rights reflected in column(a))

(a) (b) (c)

Equity compensation plans approved by security holders 4,099,514(1) $ 19.52 6,934,956(2)

Equity compensation plans not approved by security holders — $ — —

Total 4,099,514(1) $ 19.52 6,934,956(2)

(1) Column (a) does not include any restricted stock awards that have been issued under the 2004 Omnibus Incentive Plan or any

stock units granted under any deferred compensation plan. At December 31, 2006,

47