MoneyGram 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Credit Risk

Credit risk represents the potential risk that the Company may not collect on interest and/or principal associated with its investments, as

well as counterparty risk associated with its derivative financial instruments. The Company is also exposed to the potential risk that the

Company may not collect on funds received by agents in connection with money transfers and money orders, which are due to be

remitted to the Company.

Approximately 89 percent of the Company's investment portfolio at December 31, 2006 consists of securities that are not issued or

guaranteed by the U.S. government. If the issuer of any of these securities or counterparties to any of our derivative financial instruments

were to default in payments or otherwise experience credit problems, the value of the investments and derivative financial instruments

would decline and adversely impact our investment portfolio and earnings. As it relates to the investment portfolio, the Company's

strategy is to maximize the relative value versus return on each security, sector and collateral class. The Company uses a comprehensive

process to manage its credit risk relating to investments, including active credit monitoring and quantitative sector analysis. The

Company also addresses credit risk by investing primarily in investments with ratings of A3/A− or higher or which are collateralized by

federal agency securities, as well as ensuring proper diversification of the portfolio by limiting individual investments to one percent of

the total portfolio. Approximately 96 percent of the Company's investment portfolio at December 31, 2006 consists of securities with an

A or better rating. The Company manages its credit risk related to its derivative financial instruments by entering into agreements only

with major financial institutions and regularly monitoring the credit ratings of these financial institutions.

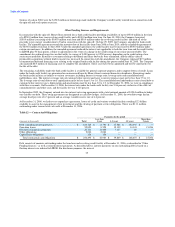

Due to the nature of our business, the vast majority of our Global Funds Transfer business is conducted through independent agents. Our

agents receive the proceeds from the sale of our payment instruments and we must then collect these funds from the agents. As a result,

we have credit exposure to our agents, which averages approximately $1.2 billion, representing a combination of money orders, money

transfers and bill payment proceeds. This credit exposure is spread across almost 29,000 agents, of which 13 owe us in excess of

$15.0 million each at any one time. Agents typically have from one to three days to remit the funds, with longer remittance schedules

granted to international agents and certain domestic agents under certain circumstances. The Company assesses the creditworthiness of

each potential agent before accepting it into our distribution network. The Company actively monitors the credit risk of our agents on an

on-going basis by conducting periodic comprehensive financial reviews and cash flow analysis of our agents who average high volumes

of money order sales. In addition, the Company frequently takes additional steps to minimize agent credit risk, such as requiring owner

guarantees, corporate guarantees and other forms of security where appropriate. The Company monitors remittance patterns versus

reported sales by agent on a daily basis. The Company also utilizes software embedded in each point of sale terminal to control both the

number and dollar amount of money orders sold. This software also allows the Company to monitor for suspicious transactions or

volumes of sales, assisting the Company in uncovering irregularities such as money laundering, fraud or agent self-use. Finally, the

Company has the ability to remotely disable money order dispensers or transaction devices to prevent agents from issuing money orders

or performing money transfers if suspicious activity is noted or remittances are not received according to the agent's contract. The point

of sale software requires each location to be re-authorized on a daily basis for transaction processing.

Foreign Currency Exchange Risk

Foreign currency exchange risk represents the potential adverse effect on the Company's earnings from fluctuations in foreign exchange

rates affecting certain receivables and payables denominated in foreign currencies. The company is primarily affected by fluctuations in

the U.S. dollar as compared to the British pound and the Euro. The foreign currency exposure that does exist is limited by the fact that

foreign currency denominated assets and liabilities are generally very short-term in nature. The Company primarily utilizes forward

contracts to hedge its exposure to fluctuations in exchange rates. These forward contracts generally have maturities of less than thirty

days. The forward contracts are recorded on the Consolidated Balance Sheets, and the net effect of changes in exchange rates and the

related forward contracts is not significant.

Had the British pound and Euro appreciated relative to the U.S. dollar twenty percent over actual exchange rates for 2006, pre-tax

operating income would have increased $2.0 million for the year. Had the British pound and Euro depreciated twenty percent over actual

rates for 2006, pretax operating income would have decreased $2.9 million for the year. This sensitivity analysis considers both the

impact on translation of our foreign denominated revenue and expense streams and the impact on our hedging program.

40