MoneyGram 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

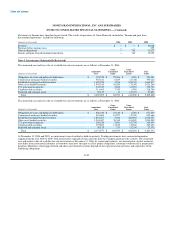

Note 9. Debt

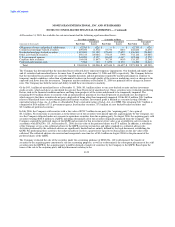

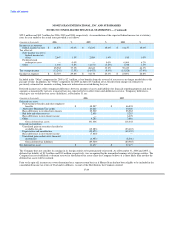

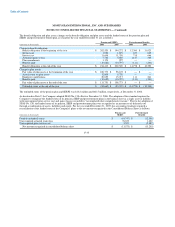

Debt consisted of the following at December 31:

2006 2005

Weighted Weighted

Average Average

(Amounts in thousands) Amount Interest Rate Amount Interest Rate

Senior term note, due through 2010 $ 100,000 5.59% $ 100,000 3.85%

Senior revolving credit facility, due through 2010 50,000 5.59% 50,000 3.85%

$ 150,000 $ 150,000

In connection with the spin-off, the Company entered into a bank credit facility providing availability of up to $350.0 million in the form of

a $250.0 million 4 year revolving credit facility and a $100.0 million term loan. On June 30, 2004, the Company borrowed $150.0 million

(consisting of the $100.0 million term loan and $50.0 million under the revolving credit facility) and paid the proceeds to Viad. The interest

rate on both the term loan and the credit facility was an indexed rate of LIBOR plus 60 basis points, subject to adjustment in the event of a

change in the credit rating of our senior unsecured debt. On December 31, 2004, the interest rate was 3.1 percent, exclusive of the effects of

commitment fees and other costs. The Company paid a fee on the facilities regardless of the usage ranging from 0.1 percent to 0.375 percent

depending upon our credit rating. The Company incurred $1.2 million of financing costs in connection with this transaction. These costs

were capitalized and were being amortized over the life of the debt.

On June 29, 2005, the Company amended its bank credit facility. The amended agreement extends the maturity date of the facility from June

2008 to June 2010, and the scheduled repayment of the $100.0 million term loan to June 2010. Under the amended agreement, the credit

facility may be increased to $500.0 million under certain circumstances. In addition, the amended agreement reduced the interest rate

applicable to both the term loan and the credit facility to LIBOR plus 50 basis points, subject to adjustment in the event of a change in the

credit rating of our senior unsecured debt. The amendment also reduced fees on the facility to a range of 0.080 percent to 0.250 percent,

depending on the credit rating of our senior unsecured debt. Restrictive covenants relating to dividends and share buybacks were eliminated,

and the dollar value of permissible acquisitions without lender consent was increased. In connection with the amendment, the Company

expensed $0.9 million of unamortized deferred financing costs relating to the original bank credit facility during the quarter ended June 30,

2005. The Company also incurred $0.5 million of financing costs to complete the amendment. These costs have been capitalized and will be

amortized over the life of the debt. On December 31, 2006, and 2005, the interest rate under the bank credit facility was 5.86 percent and

5.02 percent, respectively, exclusive of the effect of commitment fees and other costs, and the facility fee was 0.125 percent.

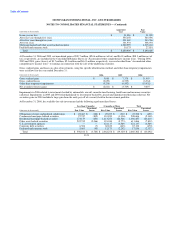

The loans under these facilities are unsecured obligations of MoneyGram, and are guaranteed on an unsecured basis by MoneyGram's

material domestic subsidiaries. The proceeds from any future advances may be used for general corporate expenses and to support letters of

credit. Any letters of credit issued reduce the amount available under the revolving credit facility (see Note 15). Borrowings under the

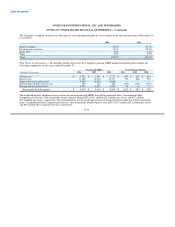

facilities are subject to various covenants, including interest coverage ratio, leverage ratio and consolidated total indebtedness ratio. The

interest coverage ratio of earnings before interest and taxes to interest expense must not be less than 3.5 to 1.0. The leverage ratio of total

debt to total capitalization must be less than 0.5 to 1.0. The consolidated total indebtedness ratio of total debt to earnings before interest,

taxes, depreciation and amortization must be less than 3.0 to 1.0. At December 31, 2006, the Company was in compliance with these

covenants. There are other restrictions customary for facilities of this type, including limits on indebtedness, asset sales, mergers,

acquisitions and liens.

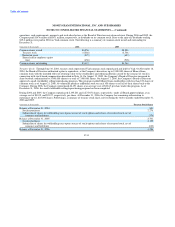

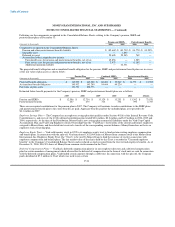

In September 2005, the Company entered into two interest rate swap agreements with a total notional amount of $150.0 million to hedge our

variable rate debt. These swap agreements are designated as cash flow hedges. At December 31, 2006, and 2005, the interest rate debt swaps

had an average fixed pay rate of 4.3 percent and an average

F-27