MoneyGram 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

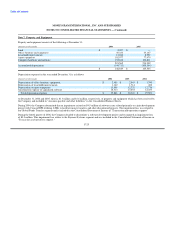

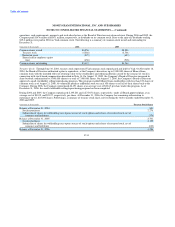

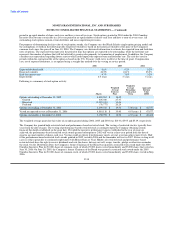

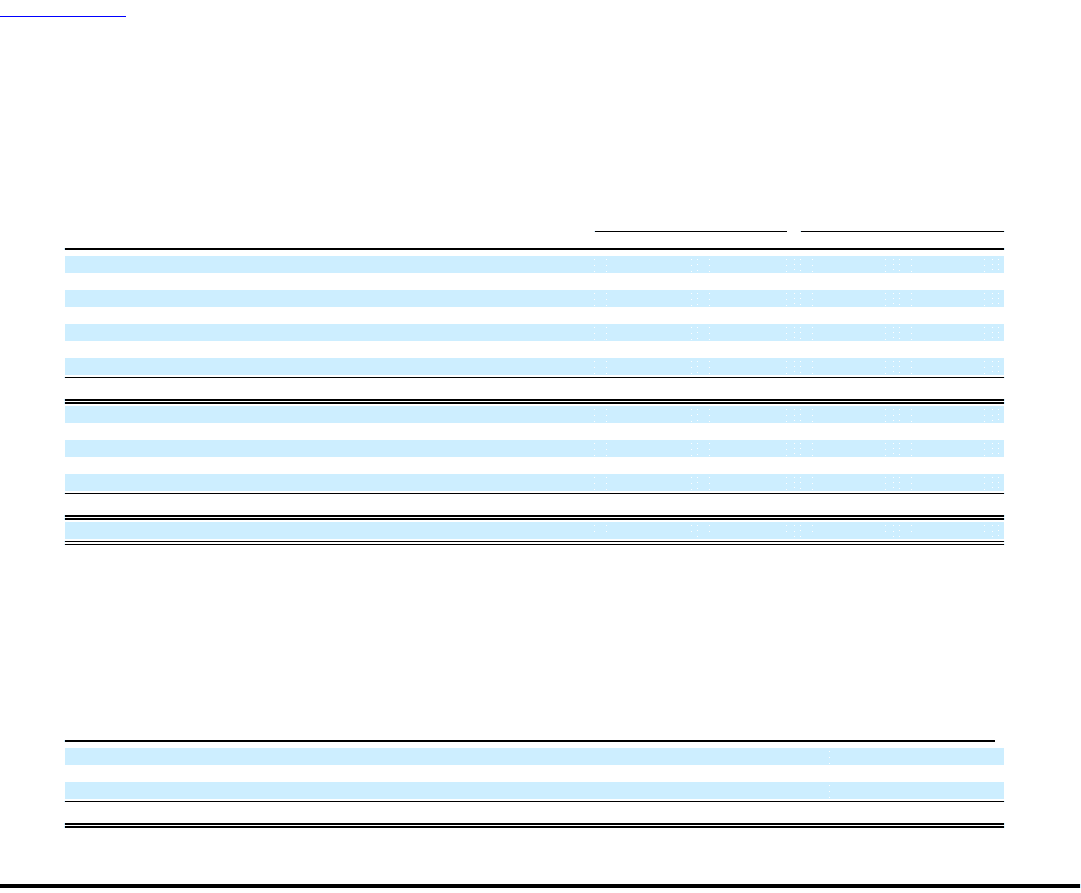

The benefit obligation and plan assets, changes to the benefit obligation and plan assets and the funded status of the pension plan and

SERPs and postretirement benefit plan as of and for the year ended December 31 are as follows:

Pension and SERPs Postretirement Benefits

(Amounts in thousands) 2006 2005 2006 2005

Change in benefit obligation:

Benefit obligation at the beginning of the year $ 202,520 $ 194,272 $ 12,390 $ 11,023

Service cost 1,922 1,893 637 619

Interest cost 11,698 11,320 715 644

Actuarial (gain) or loss 7,781 5,605 1,147 345

Plan amendments 1,174 227 — —

Benefits paid (10,682) (10,797) (111) (241)

Benefit obligation at the end of the year $ 214,413 $ 202,520 $ 14,778 $ 12,390

Change in plan assets:

Fair value of plan assets at the beginning of the year $ 108,773 $ 98,125 $ — $ —

Actual return on plan assets 12,805 5,728 — —

Employer contributions 20,855 15,717 111 241

Benefits paid (10,682) (10,797) (111) (241)

Fair value of plan assets at the end of the year $ 131,751 $ 108,773 $ — $ —

Unfunded status at the end of the year $ (82,662) $ (93,747) $ (14,778) $ (12,390)

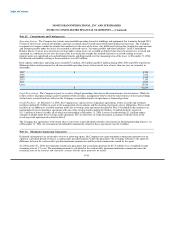

The unfunded status of the pension plan and SERPS was $14.2 million and $68.5 million, respectively, at December 31, 2006.

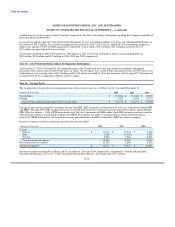

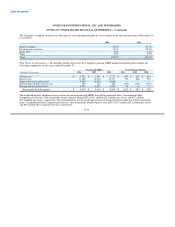

As disclosed in Note 2, the Company adopted SFAS No. 158 effective December 31, 2006. The adoption of this standard requires the

Company to recognize the funded status of its pension, SERP and postretirement plans in the balance sheet as a single asset or liability,

with unrecognized prior service cost and gains (losses) recorded in "Accumulated other comprehensive income." Prior to the adoption of

SFAS No. 158, the funded status of its pension, SERP and postretirement plans was recognized as an amount net of deferred costs

through a combination of assets, liabilities and equity. For the year ended December 31, 2005, this accounting treatment required a

reconciliation of the funded status of the Company's plans to the net amount recognized in the Consolidated Balance Sheet as follows:

Pension and Postretirement

(Amounts in thousands) SERPs Benefits

Funded (unfunded) status $ (93,747) $ (12,390)

Unrecognized actuarial (gain) loss 76,653 1,622

Unrecognized prior service cost 3,521 (2,487)

Net amount recognized in consolidated balance sheet $ (13,573) $ (13,255)

F-35