MoneyGram 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

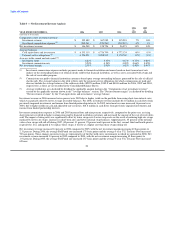

rate for future periods has been assumed to be 5.86 percent, which is the rate in effect on December 31, 2006. Operating leases consist of

various leases for buildings and equipment used in our business. Derivative financial instruments represent the net payable (receivable)

under our interest rate swap agreements. Other obligations are unfunded capital commitments related to our limited partnership interests

included in our investment portfolio.

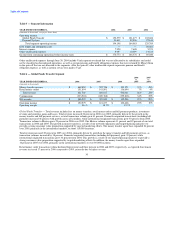

MoneyGram has funded, noncontributory pension plans. Our funding policy is to contribute at least the minimum contribution required

by applicable regulations. During 2006, MoneyGram contributed $18.3 million to the funded pension plans. There are no required

contributions for the pension plan in 2007; however, the Company may choose to make contributions. MoneyGram also has certain

unfunded pension and postretirement plans that require benefit payments over extended periods of time. During 2006, we paid benefits

totaling $3.3 million related to these unfunded plans. The Company will continue to contribute to its unfunded plans as benefit payments

are required. Benefit payments under these unfunded plans are expected to be $4.1 million in 2007. Expected contributions and benefit

payments under these plans are not included in the table above. See "Critical Accounting Policies — Pension obligations" for further

discussion of these plans. In August 2006, Congress approved the Pension Protection Act of 2006, which requires new funding rules for

defined benefit plans. We are currently reviewing the impact of this new law.

Included in the Consolidated Balance Sheets under "Accounts payable and other liabilities" and "Property and equipment" is $1.3 million

of property and equipment received by the Company but not paid as of December 31, 2006. These amounts were paid by the Company in

January and February 2007.

We have agreements with clearing banks that provide processing and clearing functions for money orders and official checks. One

clearing bank contract has covenants that include maintenance of total cash and cash equivalents, receivables and investments

substantially restricted for payment services obligations at least equal to total outstanding payment service obligations, as well as

maintenance of a minimum ratio of total assets held at that bank to instruments clearing through that bank of 103 percent. We were not in

compliance with one covenant at December 31, 2006; however, the noncompliance was cured on January 19, 2007, through a shift in our

investment portfolio.

Working in cooperation with various financial institutions, we established separate consolidated entities (special purpose entities) and

processes that provide these financial institutions with additional assurance of our ability to clear their official checks. These processes

include maintenance of specified ratios of segregated investments to outstanding payment instruments, typically 1 to 1. We remain liable

to satisfy the obligations, both contractually and/or by operation of the Uniform Commercial Code, as issuer and drawer of the official

checks. Accordingly, the obligations have been recorded in the Consolidated Balance Sheets under "Payment service obligations." Under

limited circumstances, clients have the right to either demand liquidation of the segregated assets or replace us as the administrator of the

special-purpose entity. Such limited circumstances consist of material (and in most cases continued) failure of MoneyGram to uphold its

warranties and obligations pursuant to its underlying agreements with the financial institution clients. While an orderly liquidation of

assets would be required, any of these actions by a client could nonetheless diminish the value of the total investment portfolio, decrease

earnings, and result in loss of the client or other customers or prospects. We offer the special purpose entity to certain financial institution

clients as a benefit unique in the payment services industry.

The Company has investment grade ratings of BBB/Baa2 and a stable outlook from the three major credit rating agencies. Our ability to

maintain an investment grade rating is important because it affects the cost of borrowing and certain financial institution customers

require that we maintain an investment grade rating. Any ratings downgrade could increase our cost of borrowing or require certain

actions to be performed to rectify such a situation. A downgrade could also have an effect on our ability to attract new customers and

retain existing customers.

Although no assurance can be given, we expect operating cash flows and short-term borrowings to be sufficient to finance our ongoing

business, maintain adequate capital levels, and meet debt and clearing agreement covenants and investment grade rating requirements.

Should financing requirements exceed such sources of funds, we believe we have adequate external financing sources available to cover

any shortfall, including unused commitments under our credit facilities.

The Company has an effective universal shelf registration on file with the Securities and Exchange Commission. The universal shelf

registration provides for the issuance of up to $500.0 million of our securities, including common stock, preferred stock and debt

securities. The securities may be sold from time to time in one or more series. The terms of the securities and any offering of the

securities will be determined at the time of the sale. The

36