MoneyGram 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

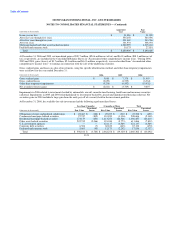

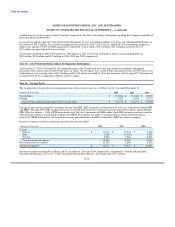

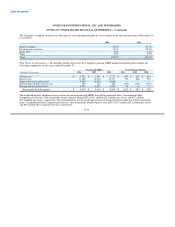

operations, cash requirements, prospects and such other factors as the Board of Directors may deem relevant. During 2006 and 2005, the

Company paid $14.4 million and $6.1 million, respectively, in dividends on its common stock. Prior to the spin-off, dividends totaling

$15.6 million were paid in 2004 on Viad common stock. The following is a summary of common stock issued and outstanding for

December 31:

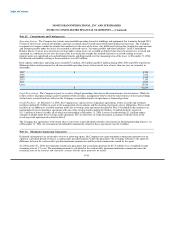

(Amounts in thousands) 2006 2005

Common shares issued 88,556 88,556

Treasury stock (4,286) (2,701)

Restricted stock (323) (693)

Shares held in employee equity

trust (456) (918)

Common shares outstanding 83,491 84,244

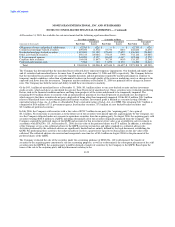

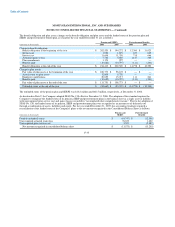

Treasury Stock: Through June 30, 2004, treasury stock represented Viad common stock repurchased and held by Viad. On November 18,

2004, the Board of Directors authorized a plan to repurchase, at the Company's discretion, up to 2,000,000 shares of MoneyGram

common stock with the intended effect of returning value to the stockholders and reducing dilution caused by the issuance of stock in

connection with stock-based compensation described in Note 14. On August 19, 2005, the Company's Board of Directors increased its

share buyback authorization by 5,000,000 shares to a total of 7,000,000 shares. On August 17, 2006, the Company's Board of Directors

approved a small stockholder selling/repurchasing program. This program enabled MoneyGram stockholders with less than 100 shares of

common stock as of August 21, 2006, to voluntarily purchase additional stock to reach 100 shares or sell all of their shares back to the

Company. During 2006, the Company repurchased 66,191 shares at an average cost of $30.65 per share under this program. As of

December 31, 2006, the small stockholder selling/repurchasing program has been completed.

During 2006 and 2005, the Company repurchased 2,195,241 and 2,275,651 shares, respectively, under all Board approved plans at an

average cost of $30.91 and $21.97, respectively, per share. At December 31, 2006, the Company has remaining authorization to

repurchase up to 1,825,000 shares. Following is a summary of treasury stock share activity during the twelve months ended December 31,

2006 and 2005:

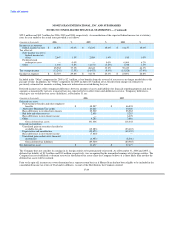

(Amounts in thousands) Treasury Stock Shares

Balance at December 31, 2004 801

Stock repurchases 2,276

Submission of shares for withholding taxes upon exercise of stock options and release of restricted stock, net of

issuances and forfeitures (376)

Balance at December 31, 2005 2,701

Stock repurchases 2,195

Submission of shares for withholding taxes upon exercise of stock options and release of restricted stock, net of

issuances and forfeitures (610)

Balance at December 31, 2006 4,286

F-31