MoneyGram 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

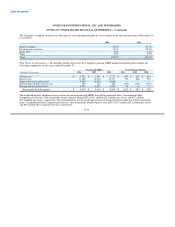

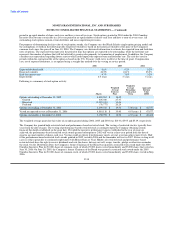

variable receive rate of 4.6 percent and 3.9 percent, respectively. See Note 5 for further information regarding the Company's portfolio of

derivative financial instruments.

In connection with the spin-off, Viad repurchased substantially all of its outstanding medium-term notes and subordinated debentures in

the amount of $52.6 million. The amounts not paid off were retained by New Viad. Viad also repaid all of its outstanding commercial

paper in the amount of $188.0 million and retired its industrial revenue bonds of $9.0 million. The Company incurred a loss of

$3.5 million in connection with these activities.

All amounts classified as debt on December 31, 2006 mature in June 2010. Total cash paid for interest on outstanding debt was

$8.5 million, $5.8 million and $2.0 million in 2006, 2005 and 2004, respectively.

Note 10. $4.75 Preferred Stock Subject to Mandatory Redemption

At December 31, 2003, Viad had 442,352 authorized shares of $4.75 preferred stock that were subject to mandatory redemption

provisions with a stated value of $100.00 per share, of which 328,352 shares were issued. Of the total shares issued, 234,983 shares were

outstanding at a net carrying value of $6.7 million, and 93,369 shares were held by Viad. In connection with the spin-off, Viad redeemed

its preferred stock for an aggregate call price of $23.9 million.

Note 11. Income Taxes

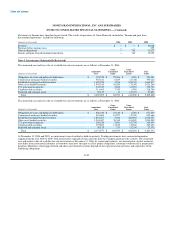

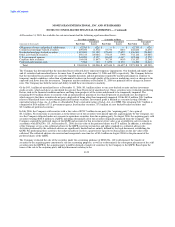

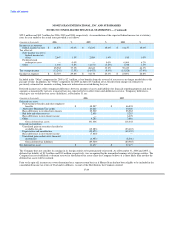

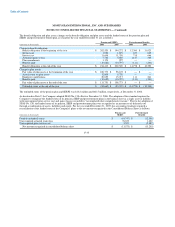

The components of income from continuing operations before income taxes are as follows for the year ended December 31:

(Amounts in thousands) 2006 2005 2004

United States $ 171,681 $ 111,868 $ 53,507

Foreign 5,092 34,508 35,513

Income from continuing operations before income taxes $ 176,773 $ 146,376 $ 89,020

Foreign income consists primarily of statutory income from MIL. MIL recognizes revenue based on a Services Agreement between MIL

and MPSI. Through 2005, MIL recognized revenue associated with the money transfer transactions generated by agents signed through

MIL. Effective January 1, 2006, MPSI entered into a new Services Agreement with MIL under which MIL recognizes revenue based on

their operating expenses incurred and reimbursed by MPSI. This change was made to recognize that the money transfer product is

licensed by MPSI and therefore, the transaction revenue and related costs should be reflected by MPSI for statutory purposes.

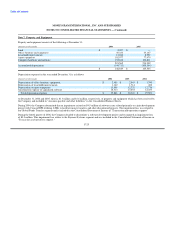

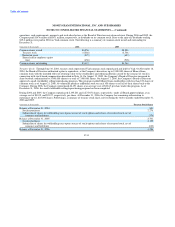

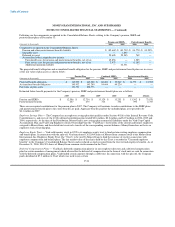

Income tax expense related to continuing operations for the year ended:

(Amounts in thousands) 2006 2005 2004

Current:

Federal $ 13,716 $ 27,324 $ 4,386

State 2,968 (1,038) 4,962

Foreign 2,880 5,004 8,261

Current income tax expense 19,564 31,290 17,609

Deferred income tax expense 33,155 2,880 6,282

Income tax expense $ 52,719 $ 34,170 $ 23,891

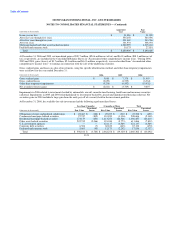

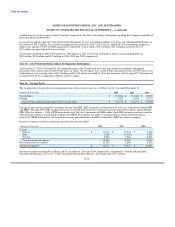

Income tax expense totaling $0.5 million, and $13.8 million in, 2005 and 2004, respectively, is included in "Income and gain from

discontinued operations, net of tax" in the Consolidated Statement of Income. Taxes paid were $38.7 million,

F-28