MoneyGram 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

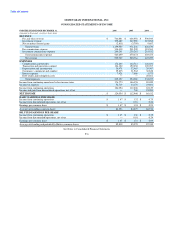

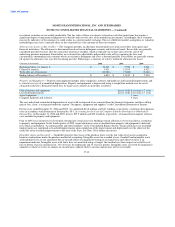

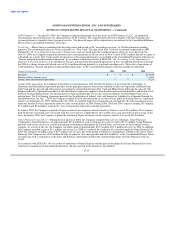

We have unrestricted cash and cash equivalents, receivables and investments to the extent those assets exceed all payment service

obligations. These amounts are generally available; however, management considers a portion of these amounts as providing additional

assurance that regulatory requirements are maintained during the normal fluctuations in the value of investments. The following table

shows the total amount of unrestricted assets at December 31:

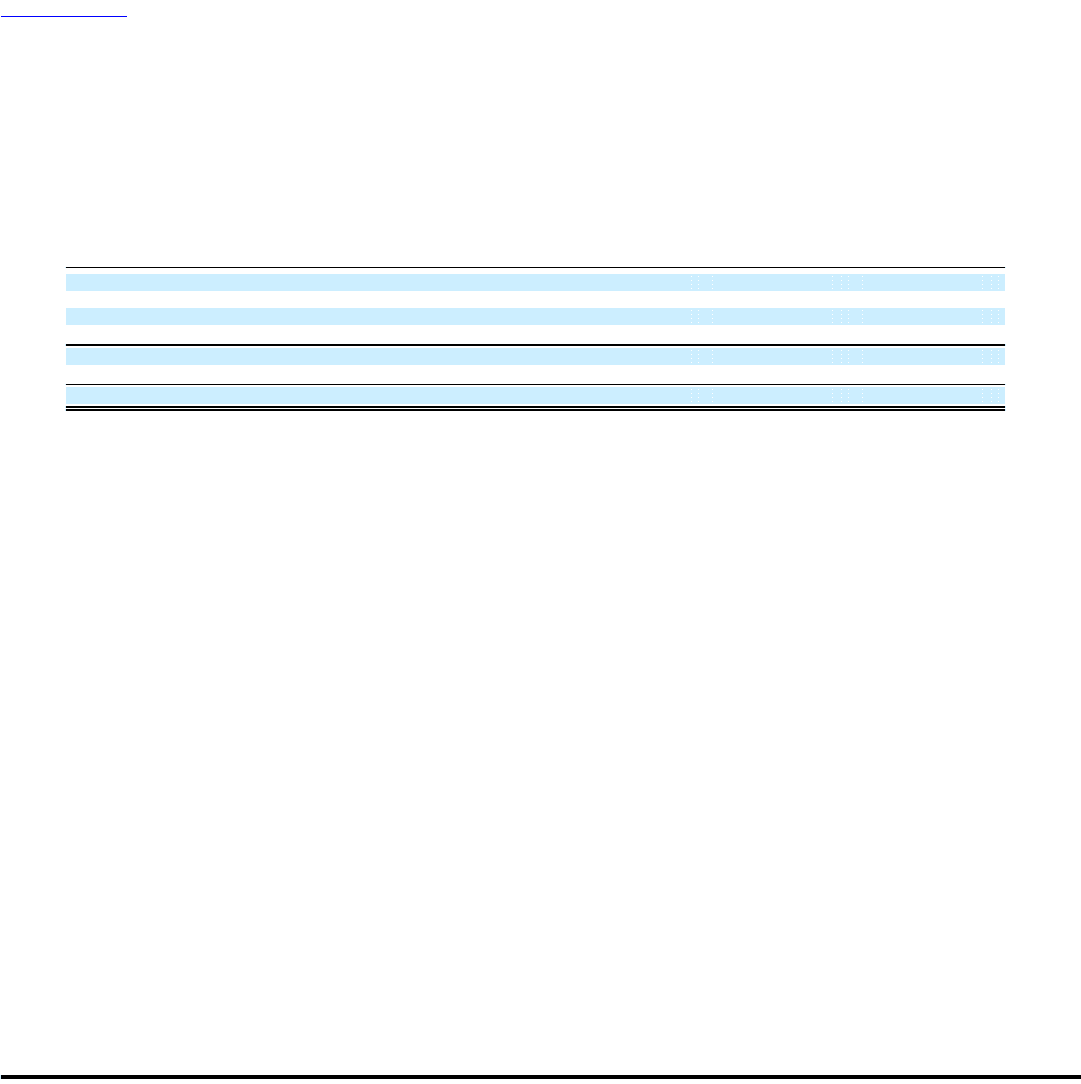

(Amounts in thousands) 2006 2005

Cash and cash equivalents $ 973,931 $ 698,691

Receivables, net 1,758,682 1,425,622

Trading investments 145,500 167,700

Available for sale investments 5,690,600 6,233,333

8,568,713 8,525,346

Amounts restricted to cover payment service obligations (8,209,789) (8,159,309)

Unrestricted assets $ 358,924 $ 366,037

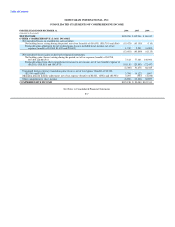

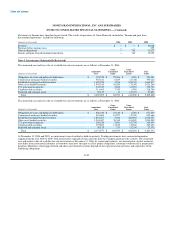

Payment Service Obligations — Payment service obligations primarily consist of: outstanding payment instruments; amounts owed to

financial institutions for funds paid to the Company to cover clearings of official check payment instruments, remittances and clearing

adjustments; amounts owed to agents for funds paid to consumers on behalf of the Company; amounts owed under our sale of receivables

program for collections on sold receivables; amounts owed to investment brokers for purchased securities or reverse repurchase

agreements; and unclaimed property owed to various states. These obligations are recognized by the Company at the time the underlying

transactions occur.

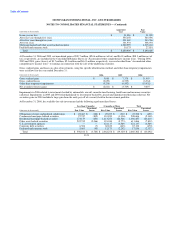

Derivative Financial Instruments — We recognize derivative instruments as either assets or liabilities on the Consolidated Balance Sheet

and measure those instruments at fair value. The accounting for changes in the fair value depends on the intended use of the derivative

and the resulting designation.

For a derivative instrument designated as a fair value hedge, we recognize the gain or loss in earnings in the period of change, together

with the offsetting loss or gain on the hedged item. For a derivative instrument designated as a cash flow hedge, we initially report the

effective portion of the derivative's gain or loss in "Accumulated other comprehensive (loss) income" in the Consolidated Statement of

Stockholders' Equity and subsequently reclassify the net gain or loss into earnings when the hedged exposure affects earnings. For fair

value hedges, changes in fair value are recognized immediately in earnings, consistent with the underlying hedged item.

The Company evaluates hedge effectiveness of its derivatives designated as cash flow hedges at inception and on an on-going basis.

Derivatives designated as fair value hedges are generally evaluated for effectiveness using the short-cut method. Hedge ineffectiveness, if

any, is recorded in earnings on the same line as the underlying transaction risk. When a derivative is no longer expected to be highly

effective, hedge accounting is discontinued. Any gain or loss on derivatives designated as hedges that are terminated or discontinued is

recorded in the "Net securities gains and losses" component in the Consolidated Statements of Income. For a derivative instrument that

does not qualify, or is not designated, as a hedge, the change in fair value is recognized in "Transaction and operations support" in the

Consolidated Statements of Income.

Cash flows resulting from derivative financial instruments are classified in the same category as the cash flows from the items being

hedged.

We do not use derivative instruments for trading or speculative purposes and we limit our exposure to individual counterparties to

manage credit risk.

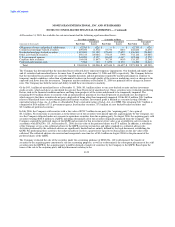

Fair Value of Financial Instruments — Financial instruments consist of cash and cash equivalents, investments, derivatives, receivables,

payment service obligations, accounts payable and debt. The carrying values of cash and cash equivalents, receivables, accounts payable

and payment service obligations approximate fair value due to the short-term nature of these instruments. The carrying values of debt

approximate fair value as interest related to the debt is variable rate. The fair value of investments and derivatives is generally based on

quoted market prices. However, certain

F-13