Konica Minolta 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

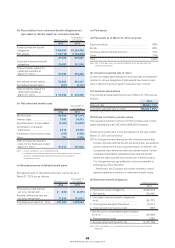

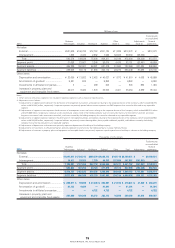

27. Segment Information

Information and Measurement of Segments

(1) Overview of reportable segments

The Company’s reportable segments are components of the Company for which separate fi nancial information is available and evalu-

ated regularly by management in deciding how to allocate resources and assess performance.

The Company has sites in Japan and overseas for the different products and services it handles and has drawn up a comprehensive

global strategy with business activities being deployed in line with this.

As such, the Company is comprised of three segments for different products and services with a business company at the center

of each.

The three reportable segments are: Business Technologies, Industrial and Healthcare.

Business Technologies manufactures and sells MFPs, printers, and equipment for production printing systems and graphic arts, and

provides related solution services. The Industrial Business manufactures and sells electronic materials (TAC fi lms, etc.), performance

materials, optical products (pickup lenses, etc.), and measuring instruments for industrial and healthcare applications. The Healthcare

Business manufactures and sells consumables and equipment for healthcare systems.

(2) Methods of calculating net sales, profi t or loss, assets, liabilities and other items by reportable segments

Accounting methods for reportable segments are the same as the accounting methods described in Note 2. SUMMARY OF SIGNIFI-

CANT ACCOUNTING POLICIES.

Profi t by reportable segment is operating income. Intersegment net sales are based on market values.

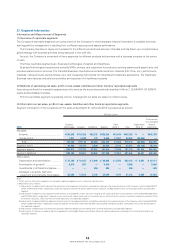

(3) Information on net sales, profi t or loss, assets, liabilities and other items by reportable segments

Segment information of the Companies for the years ended March 31, 2014 and 2013 is presented as follows:

Millions of yen

2014

Business

Technologies Industrial Healthcare Subtotal

Other

(Note 1) Total

Adjustments

(Note 2)

Total amounts

in consolidated

fi nancial

statements

Net sales

External ...................................................

¥729,848 ¥116,126 ¥82,375 ¥928,350 ¥15,409 ¥943,759 ¥ — ¥943,759

Intersegment ..........................................

1,901 2,988 178 5,069 21,891 26,960 (26,960) —

Total .....................................................

731,749 119,115 82,554 933,419 37,300 970,719 (26,960) 943,759

Segment profi t ............................................

63,895 15,155 4,500 83,552 3,723 87,275 (29,130) 58,144

Segment assets ..........................................

556,872 119,760 68,991 745,624 37,509 783,134 182,926 966,060

Segment liabilities ......................................

296,195 62,601 48,962 407,759 13,803 421,563 64,441 486,005

Other items

Depreciation and amortization ................

¥ 27,786 ¥ 10,261 ¥ 2,800 ¥ 40,848 ¥ 2,255 ¥43,103 ¥ 4,267 ¥ 47,371

Amortization of goodwill ........................

8,414 991 — 9,406 — 9,406 — 9,406

Investments in affi liated companies .......

— — 486 486 — 486 — 486

Increases in property, plant and

equipment and intangible fi xed assets

...

23,384 13,302 2,708 39,395 1,707 41,103 6,280 47,383

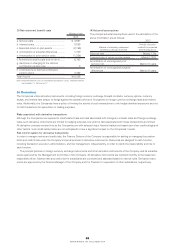

Notes:

1. ‘Other’ consists of business segments not included in reporting segments such as Industrial Inkjet Business.

2. Adjustments are as follows:

(1) Adjustments of segment profi t represent the elimination of intersegment transactions and expenses relating to the corporate division of the Company, which totaled ¥(5,817)

million and ¥(23,313) million, respectively. Corporate expenses are primarily general administration expenses and R&D expenses that cannot be allocated to any reportable

segment.

(2) Adjustments of segment assets represent the elimination of intersegment assets and assets relating to the corporate division of the Company, which totaled ¥(90,308) million

and ¥273,234 million, respectively. Corporate assets are primarily surplus funds (cash on hand and in banks and short-term investment securities), long-term investment funds

(investment securities), and assets that cannot be allocated to any reportable segment.

(3) Adjustments of segment liabilities represent the elimination of intersegment liabilities and liabilities relating to the corporate division of the Company, which totaled ¥(33,048)

million and ¥97,490 million, respectively. Corporate liabilities are primarily interest-bearing debts (loans payable and bonds payable), and liabilities that cannot be allocated to

any reportable segment.

(4) Adjustments of depreciation and amortization primarily represent depreciation of buildings that cannot be allocated to any reportable segment.

(5) Adjustments of increases in property, plant and equipment and intangible fi xed assets primarily represent capital expenditure on buildings that cannot be allocated to any

reportable segment.

74

KONICA MINOLTA, INC. Annual Report 2014