Konica Minolta 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

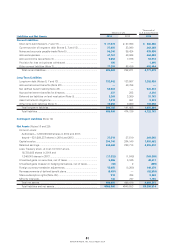

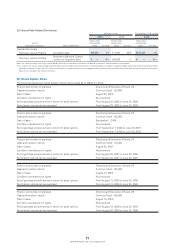

6. Investment Securities

(1) Other Securities with Quoted Market Values

Millions of yen Thousands of U.S. dollars

2014 2013 2014

Market value

at the

consolidated

balance

sheet date

Original

purchase

value

Unrealized

gains (losses)

Market value

at the

consolidated

balance

sheet date

Original

purchase

value

Unrealized

gains (losses)

Market value

at the

consolidated

balance

sheet date

Original

purchase

value

Unrealized

gains (losses)

Securities for which the amounts

in the consolidated balance sheet

exceed the original purchase value

(1) Shares ...................................

¥ 21,763 ¥ 12,741 ¥9,021 ¥ 15,259 ¥ 9,556 ¥5,703 $ 211,455 $ 123,795 $87,651

(2) Bonds ....................................

— — — 6,001 6,000 1 — — —

(3) Other

(i) Short-term investment

securities ..........................

(Negotiable deposits)

— — — — — — — — —

(ii) Other ..................................

20 10 9 15 10 4 194 97 87

Subtotal

¥ 21,784 ¥ 12,752 ¥9,031 ¥ 21,276 ¥ 15,566 ¥5,709 $ 211,660 $ 123,902 $87,748

Securities for which the amounts

in the consolidated balance sheet

do not exceed the original

purchase value

(1) Shares ...................................

¥ 4,340 ¥ 4,998 ¥ (658) ¥ 3,629 ¥ 4,572 ¥ (942) $ 42,169 $ 48,562 $ (6,393)

(2) Bonds ....................................

5,999 6,000 (0) 2,999 3,000 (0) 58,288 58,298 (0)

(3) Other

(i) Short-term investment

securities ..........................

(Negotiable deposits)

87,000 87,000 — 111,500 111,500 — 845,317 845,317 —

(ii) Other ..................................

4 5 (1) 4 5 (0) 39 49 (10)

Subtotal ......................................

¥ 97,343 ¥ 98,004 ¥ (660) ¥118,134 ¥119,077 ¥ (943) $ 945,812 $ 952,235 $ (6,413)

Total ...........................................

¥119,127 ¥110,757 ¥8,370 ¥139,411 ¥134,644 ¥4,766 $1,157,472 $1,076,147 $81,325

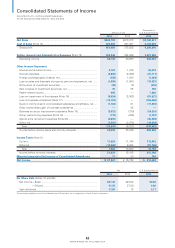

(2) Other Securities Sold during the Years Ended March 31, 2014 and 2013

Millions of yen Thousands of U.S. dollars

2014 2013 2014

Sale value Total profi t Total loss Sale value Total profi t Total loss Sale value Total profi t Total loss

Shares ............................................

¥397 ¥75 ¥— ¥298 ¥55 ¥— $3,857 $729 $—

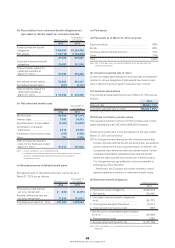

(3) Securities for Which Loss on Impairment is Recognized

The Companies have recognized loss on impairment for securities of ¥49 million ($476 thousand) and ¥2 million for the years ended

March 31, 2014 and 2013, respectively.

For securities with quoted market values, if the market value has declined by more than 50% from the acquisition cost at the end

of the period, or if the market value has declined by more than 30% but not more than 50% from the acquisition cost at the end of the

period for two years in succession and has declined more than in the preceding year, the Companies record an impairment loss, taking

into consideration recoverability and other factors, assuming that the market value has “signifi cantly declined.”

For securities without quoted market values, if the net assets per share have fallen by more than 50% from the acquisition cost,

the Companies recognize an impairment loss, assuming that the market value has “signifi cantly declined.”

61

KONICA MINOLTA, INC. Annual Report 2014