Konica Minolta 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

KONICA MINOLTA, INC. Annual Report 2014

ReviewofOperations/Strategy

Business Technologies Business (Office Field)

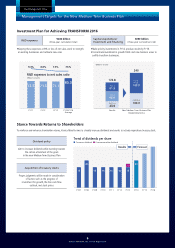

Sales volume of A3 multi-functional peripherals (MFPs) grew 4% year on year, within

which color MFPs grew 10%. Strong sales of color MFPs continued, with significantly

increased sales volumes compared with the previous fiscal year in all regions, includ-

ing Japan, the United States and Europe. At the same time, the increasing share of

high-end models, such as 40 ppm3 and faster medium- and high-speed devices, which

grew 15%, contributed to profit growth. Monochrome equipment was buoyed by

new products, and, despite the shrinking market, secured sales for the year on par

with those of the previous year.

In OPS, we strengthened our global business structure, further expanded the service

menu, and reinforced business-generating and proposal-making capabilities. As a

result, the number of OPS customers grew steadily, sales jumped 55% year on year to

¥45.4 billion, and we successfully expanded the operating base of this business.

In global major accounts (GMA4), we strengthened our abilities to win accounts in the

Asia-Pacific region, adding to our strength in Europe, resulting in a 41% year-on-year

increase in sales.

Furthermore, we established a hybrid-type sales model for small- and medium-sized

companies in Europe and the United States that combines IT business solution servic-

es with MFPs and reinforced our proposal capabilities for improving customers’ work

processes. By doing so, we cultivated new customers, expanded the scale of projects

with individual customers and realized higher added value.

1. VE (Value Engineering) : A systematic approach to increasing value by understanding the relationship between

value, the functions that provide it, and the cost of those functions

2. OPS (Optimized Print Services) : Services that optimize customers’ print environment (output and document

management environment) to reduce costs and increase efficiency

3. ppm (Pages Per Minute) : The number of pages a device can output in one minute

4. GMA (Global Major Account) : Large, global-scale corporate customers (and our businesses targeting them)

Business Technologies Business Summary

Net sales to external customers in the Business Technologies Business climbed 26% year on year to ¥729.8 billion and operating income reached

¥63.8 billion, double that of the previous fiscal year. The increase in net sales was attributable to the effect of the steadily weak yen on foreign

exchange rates, sales growth of mainstay color units, improved product mix and acquisitions. The considerable jump in segment profit was due to

an increase in gross profit resulting from sales expansion, the effect of foreign exchange rates, and the full year impact of measures to reduce pro-

duction costs. These cost reductions included decreasing fixed costs by promoting production reform and unit procurement in the production divi-

sion, conducting centralized purchasing of raw materials and digital components, and implementing value engineering.1

Profit supported by growth in color units, especially

high-end units, and steady increase in OPS2 customers

1. Fiscal 2013 Results

Non-hardware sales growth

(excl. currency exchange rate effects)

A3 MFP volume sales growth

Sales growth by region (excl. currency exchange rate effects)

106100

FY2013FY2012

17

13

8987

Existing

New areas +35%

+1%

104100

54

55

50

45

(1%)

+10%

*Base index: FY2012=100

color

Mono-

chrome

FY2013FY2012

Japan

+1%

U.S.

+1%

Europe

+7%

China

+6%

Overall

+4%