Konica Minolta 2014 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

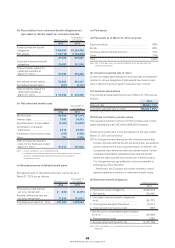

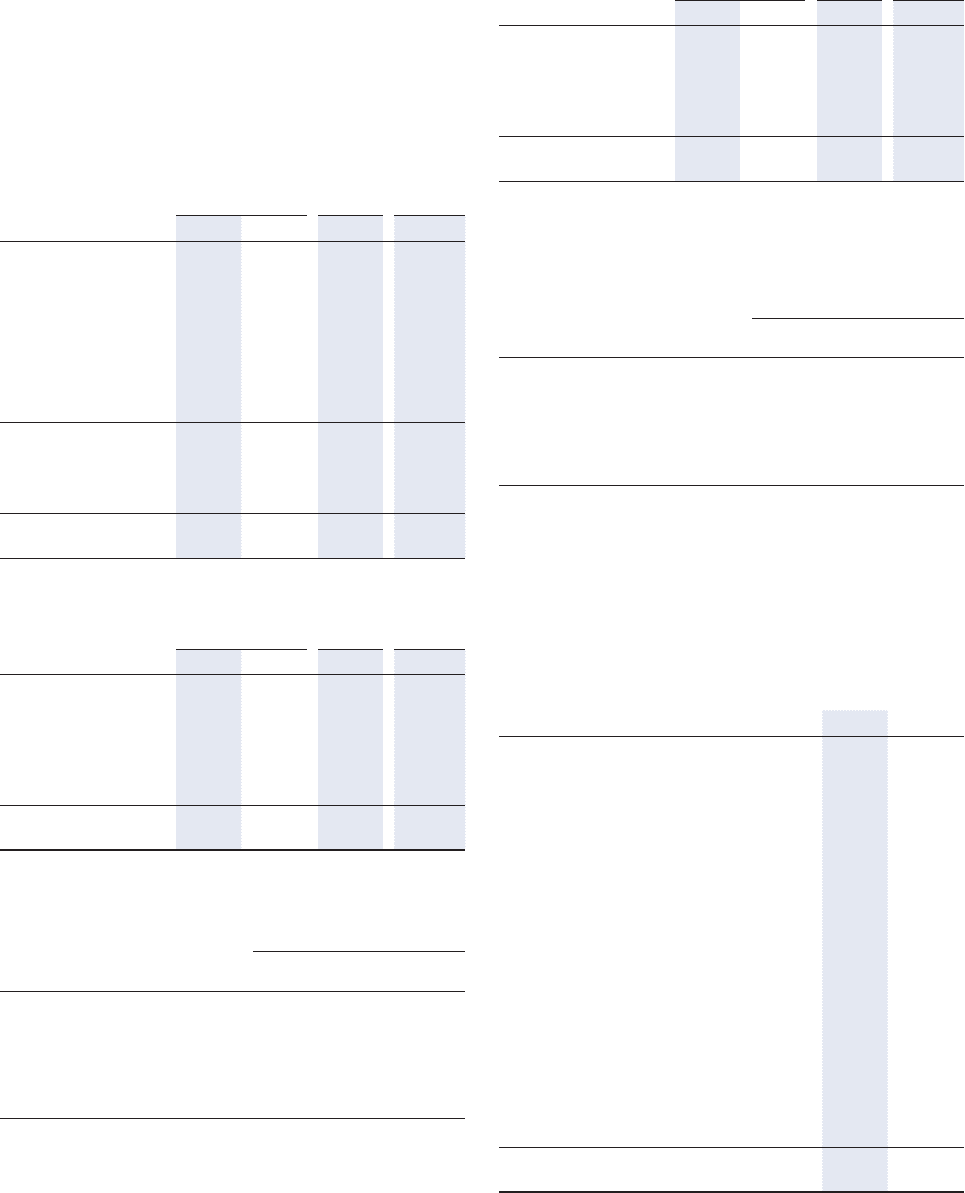

7. Short-Term Debt, Long-Term Debt and Lease

Obligations

Short-term debt is primarily unsecured and generally represents

bank overdrafts. The amounts as of March 31, 2014 and 2013

were ¥37,078 million ($360,260 thousand) and ¥67,398 million,

respectively, with weighted-average interest rates of approxi-

mately 1.0% and 0.8%, respectively.

Long-term debt as of March 31, 2014 and 2013, including the

current portion, is as follows:

Bonds

Millions of yen

Interest

rate

Thousands of

U.S. dollars

2014 2013 2014 2014

1st Unsecured Bonds

due in 2015 ................

¥20,000 ¥20,000 0.609% $194,326

2nd Unsecured Bonds

due in 2017 ................

10,000 10,000 0.956% 97,163

3rd Unsecured Bonds

due in 2016 ................

20,000 20,000 0.610% 194,326

4th Unsecured Bonds

due in 2018 ................

20,000 20,000 0.902% 194,326

¥70,000 ¥70,000 $680,140

Less—Current portion

included in current

liabilities .......................

— — —

Bonds, less current

portion .........................

¥70,000 ¥70,000 $680,140

Long-term debt

Millions of yen

Interest

rate

Thousands of

U.S. dollars

2014 2013 2014 2014

Loans principally

from banks, due

through 2022 .............

¥89,045 ¥87,498 $865,187

Less—Current

portion included in

current liabilities .........

(27,003) (23,990)

0.5% (262,369)

Long-term loans,

less current portion ....

¥62,042 ¥63,507

1.0% $602,818

The aggregate annual maturities of long-term loans at March 31,

2014 are as follows:

Amount

Fiscal year Millions of yen

Thousands of

U.S. dollars

2015.............................................

¥ 5,001 $ 48,591

2016.............................................

4,001 38,875

2017.............................................

9,001 87,456

2018.............................................

3,000 29,149

2019 and thereafter .....................

41,038 398,737

Lease obligations

Lease obligations are included in other liabilities.

Millions of yen

Interest

rate*

Thousands of

U.S. dollars

2014 2013 2014 2014

Lease obligations,

due through 2026 ......

¥6,131 ¥5,340

—

$59,571

Less—Current

portion included in

current liabilities .........

(1,907) (1,609)

—

(18,529)

Lease obligations,

less current portion ....

¥4,223 ¥3,730

—

$41,032

*

Since the book value of lease obligations includes the equivalent of interest payable,

interest rates of lease obligations are not represented in the table above.

The aggregate annual maturities of long-term lease obligations at

March 31, 2014 are as follows:

Amount

Fiscal year Millions of yen

Thousands of

U.S. dollars

2015.............................................

¥2,279 $22,143

2016.............................................

1,086 10,552

2017.............................................

555 5,393

2018.............................................

179 1,739

2019 and thereafter .....................

122 1,185

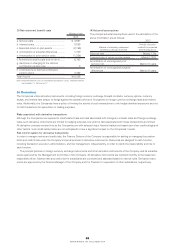

8. Income Taxes

The income taxes of the Company and its domestic consolidated

subsidiaries comprise corporate income taxes, local inhabitants’

taxes and enterprise taxes.

The reconciliation of the Japanese statutory income tax rate

to the effective income tax rate for the years ended March 31,

2014 and 2013 is as follows:

2014 2013

Statutory income tax rate ............................

38.0% 38.0%

Decrease in valuation allowance ..............

(79.2) (5.4)

Tax credits for research and

development costs and others ...............

(2.0) (0.8)

Non-taxable income .................................

(2.3) (0.9)

Difference in statutory tax rates of

foreign subsidiaries ................................

(7.6) (2.4)

Expenses not deductible for tax purposes

...

4.0 2.7

Amortization of goodwill ..........................

15.6 11.2

Retained earnings of foreign subsidiaries

...

6.3 2.7

Ineffective portion of unrealized

gains/losses ............................................

15.7 3.3

Effect of liquidation of consolidated

subsidiaries ............................................

(8.9) —

Expiration of net losses carried forward

...

9.6 7.4

Effects of changes in corporate tax rates

...

9.1 —

Other, net .................................................

8.5 (0.6)

Effective income tax rate per consolidated

statements of income ................................

6.7% 55.2%

62

KONICA MINOLTA, INC. Annual Report 2014