Konica Minolta 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

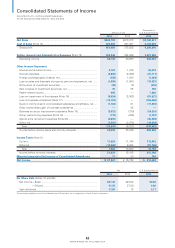

Consolidated Statements of Income

Konica Minolta, Inc. and Consolidated Subsidiaries

For the fi scal years ended March 31, 2014 and 2013

Millions of yen

Thousands of

U.S. dollars (Note 3)

2014 2013 2014

Net Sales ................................................................................................... ¥943,759 ¥813,073 $9,169,831

Cost of Sales (Note 14) ............................................................................. 492,269 437,487 4,783,026

Gross profi t 451,490 375,585 4,386,805

Selling, General and Administrative Expenses (Note 15) ...................... 393,346 334,926 3,821,862

Operating income ................................................................................... 58,144 40,659 564,944

Other Income (Expenses):

Interest and dividend income .................................................................. 2,122 1,476 20,618

Interest expenses ................................................................................... (2,852) (2,499) (27,711)

Foreign exchange gains (losses), net ...................................................... (126) 1,508 (1,224)

Loss on sales and disposals of property, plant and equipment, net ....... (1,999) (1,661) (19,423)

Write-down of investment securities ...................................................... (49) (2) (476)

Gain on sales of investment securities, net ............................................ 75 55 729

Patent-related income ............................................................................. 809 —7,860

Loss on impairment of fi xed assets (Note 16) ........................................ (5,524) (2,902) (53,673)

Loss on business withdrawal (Note 17) .................................................. (16,122) —(156,646)

Equity in income (loss) of unconsolidated subsidiaries and affi liates, net

......

(1,163) 61 (11,300)

Other extraordinary gain of overseas subsidiaries .................................. —95 —

Business structure improvement expenses (Note 18) ........................... (3,532) (379) (34,318)

Group restructuring expenses (Note 19) ................................................. (118) (296) (1,147)

Special extra retirement expenses (Note 20) .......................................... (4,655) —(45,229)

Other, net ................................................................................................ (1,503) (2,278) (14,604)

Total ..................................................................................................... (34,641) (6,823) (336,582)

Income before income taxes and minority interests .............................. 23,503 33,836 228,362

Income Taxes (Note 8):

Current .................................................................................................... 11,624 11,745 112,942

Deferred .................................................................................................. (10,060) 6,934 (97,746)

Total ..................................................................................................... 1,564 18,680 15,196

Income before minority interests ............................................................ 21,939 15,155 213,166

Minority Interests in Net Income of Consolidated Subsidiaries 77 30 748

Net Income ................................................................................................ ¥ 21,861 ¥ 15,124 $ 212,408

Yen U.S. dollars (Note 3)

2014 2013 2014

Per Share Data (Notes 10 and 28):

Net income—Basic ................................................................................. ¥41.38 ¥28.52 $0.40

—Diluted .............................................................................. 41.28 27.86 0.40

Cash dividends ........................................................................................ 17.50 15 0.17

The accompanying Notes to the Consolidated Financial Statements are an integral part of these fi nancial statements.

52

KONICA MINOLTA, INC. Annual Report 2014