Konica Minolta 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

KONICA MINOLTA, INC. Annual Report 2014

Financial Review and Data

Management’s Discussion and Analysis

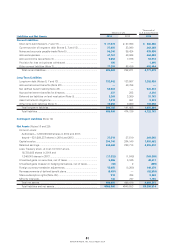

Assets

Total assets at March 31, 2014 were up ¥25.5 billion, or 2.7%, from the

previous fiscal year-end to ¥966.0 billion. Current assets rose ¥9.7 bil-

lion, or 1.7%, to ¥589.3 billion (61.0% of total assets) while fixed assets

rose ¥15.7 billion, or 4.4%, to ¥376.7 billion (39.0% of total assets).

With respect to current assets as of March 31, 2014, cash on hand

and in banks increased ¥2.0 billion from the previous fiscal year-end

to ¥95.4 billion, but short-term investment securities decreased ¥27.5

billion to ¥92.9 billion, and cash and cash equivalents decreased

¥25.4 billion to ¥188.4 billion. Meanwhile, notes and accounts receiv-

able–trade increased ¥26.0 billion to ¥220.1 billion, and lease receiv-

ables and investment assets increased ¥5.2 billion to ¥21.2 billion.

Inventories increased ¥2.7 billion to ¥115.2 billion.

In fixed assets, property, plant and equipment decreased ¥6.5 billion

from the previous fiscal year-end to ¥173.3 billion due primarily to

depreciation linked to the withdrawal from the business of glass sub-

strates for HDDs, despite capital investment in the Business

Technologies Business and Industrial Business as well as the construc-

Financial Position and Liquidity

Total assets

FY2013FY2012FY2011

(Billions of yen) 966.0

940.5

902.0

0

200

400

600

800

1,000

FY2013FY2012FY2011

(Billions of yen) (%)

227.9

231.9

224.8

213.9

196.1

188.5

0

50

100

150

200

250

300

-0.02

0.00

0.02

0.04

0.06

0.08

0.10

-0.01

0.02 0.02

Interest-bearing debt Cash and short-term investment securities

Net debt-equity ratio

Liabilities

Total liabilities increased ¥11.8 billion, or 2.5%, year on year to

¥486.0 billion (equivalent to 50.3% of total assets). Notes and

accounts payable–trade increased ¥10.8 billion to ¥96.2 billion and

accounts payable–other and accrued expenses increased ¥12.8 billion

to ¥74.3 billion. Provision for bonuses increased ¥2.1 billion. Net

defined benefit liability increased ¥9.8 billion due to the application of

accounting standards for retirement benefits. Interest-bearing debt

(total of short-term and long-term debt and bonds) decreased ¥28.7

billion to ¥196.1 billion.

tion of a new R&D building. Intangible fixed assets increased ¥0.4 bil-

lion to ¥111.3 billion.

In investments and other assets, investment securities increased ¥6.0

billion year on year to ¥29.2 billion as of March 31, 2014. Deferred

tax assets increased ¥15.0 billion to ¥48.0 billion due primarily to a

revision of recoverable amount in light of reorganization of the

Group’s administrative structure conducted in April 2013.

Net Assets

Net assets at March 31, 2014 were up ¥13.6 billion, or 2.9% from a

year earlier to ¥480.0 billion (49.7% of total assets). Retained earn-

ings increased ¥12.7 billion year on year to ¥242.4 billion, reflecting

the ¥21.8 billion in net income for the period and cash dividends paid

of ¥9.2 billion. Furthermore, treasury stock increased ¥15.7 billion due

to repurchases. In accumulated other comprehensive income, foreign

currency translation adjustments rose ¥23.3 billion due mainly to the

continued weakness of the yen, mainly against the U.S. dollar and the

euro, while the Company recorded negative remeasurements of

defined benefit plans of ¥8.4 billion due to the application of

accounting standards for retirement benefits.

Net assets

FY2013FY2012FY2011

(Billions of yen)

480.0

466.4

434.9

0

100

200

300

400

500

600