Konica Minolta 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

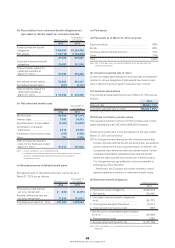

At March 31, 2014 and 2013, the signifi cant components of

deferred tax assets and liabilities in the consolidated fi nancial

statements are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Deferred tax assets:

Net operating tax losses

carried forward .......................

¥ 35,192 ¥ 50,283 $ 341,935

Accrued retirement benefi ts ....

—22,099 —

Net defi ned benefi t liability ......

24,723 — 240,216

Tax effects related to

investments ...........................

8,907 1,866 86,543

Depreciation and amortization

...

4,558 4,323 44,287

Accrued bonuses .....................

3,789 3,405 36,815

Write-down of assets ...............

3,768 3,460 36,611

Elimination of unrealized

intercompany profi ts ..............

3,069 3,009 29,819

Allowance for doubtful

accounts .................................

1,143 966 11,106

Accrued enterprise taxes .........

148 975 1,438

Other ........................................

11,893 10,687 115,556

Gross deferred tax assets ........

97,196 101,077 944,384

Valuation allowance ..................

(18,442) (37,682) (179,188)

Total deferred tax assets ..........

¥ 78,753 ¥ 63,395 $ 765,187

Deferred tax liabilities:

Retained earnings of

foreign subsidiaries ................

(4,590) (3,226) (44,598)

Intangible assets recognized

in business combination .........

(2,834) (2,859) (27,536)

Unrealized gains on securities

...

(2,371) (1,413) (23,037)

Gains on securities contributed

to employees’ retirement

benefi t trust ............................

(2,010) (2,083) (19,530)

Special tax-purpose reserve

for condensed booking of

fi xed assets ............................

(5) (15) (49)

Other ........................................

(3,890) (3,948) (37,796)

Total deferred tax liabilities.......

¥(15,703) ¥(13,546) $(152,575)

Net deferred tax assets ...........

¥ 63,050 ¥ 49,849 $ 612,612

Deferred tax liabilities related

to revaluation:

Deferred tax liabilities on

land revaluation ......................

¥ (3,269) ¥ (3,269) $ (31,763)

Net deferred tax assets are included in the following items in the

consolidated balance sheets:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Current assets—

deferred tax assets ......................

¥18,806 ¥20,259 $182,724

Fixed assets—deferred tax assets ...

48,040 33,000 466,770

Current liabilities—

other current liabilities .................

(836) (711) (8,123)

Long-term liabilities—

other long-term liabilities .............

(2,959) (2,699) (28,750)

Net deferred tax assets .................

¥63,050 ¥49,849 $612,612

Adjustment of Deferred Tax Assets and Liabilities due to Changes in Corporate Tax Rates

In Japan, “the Act for Partial Revision of the Income Tax Act, etc. (Act No. 10 of 2014)”

was promulgated on March 31, 2014, and as such, Special Reconstruction Surtax will

not be imposed for fi scal years beginning on or after April 1, 2014. In addition, “the Act

of Local Corporate Tax (Act No. 11 of 2014)” was promulgated on March 31, 2014,

resulting in a newly imposed “Local Corporate tax” which lowers the corporate

residence tax rates for fi scal years beginning on or after October 1, 2014.

As a result, the statutory income tax rates used to calculate deferred taxes will be

reduced from 38.01% to 35.64% for temporary differences expected to be recovered

or settled in fi scal years beginning on or after April 1, 2014. In addition, the portion of

corporate taxes and the portion of residence taxes related to temporary differences

expected to be recovered or settled in fi scal years beginning on or after October 1,

2014, will change from 23.71% to 24.75%, and from 4.91% to 3.86%, respectively.

As a result of these changes, net deferred tax assets and unrealized gains or losses

on hedging derivatives, net of taxes as of March 31, 2014 decreased ¥2,139 million

($20,783 thousand) and ¥1 million ($10 thousand) ,and deferred income taxes for the

year ended March 31, 2014 increased ¥2,137 million ($20,764 thousand).

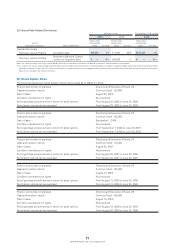

9. Business Combination

(Reorganization in the Group‘s management system)

The Company absorbed seven group companies, including

Konica Minolta Business Technologies, Inc. on April 1, 2013.

(1) Purpose of Business Combination

This reorganization of the Group’s management system will

further speed up various initiatives to increase corporate value

and is designed to achieve“innovative management capabilities

in the Business Technologies Business,” “strategic and agile

utilization of management resources,” and “systems to support

effi cient operation.”

(2) Legal Form of the Business Combination

(i) Method of absorption-type merger

An absorption-type merger was conducted with the Company as

the surviving entity and the seven group companies were

terminated.

(ii) Contents of allocations and contracts related to the

absorption-type merger

Because the seven Group companies are the Company’s wholly

owned subsidiaries, no issuance of new shares, capital increases,

or delivery of money resulted from the merger.

63

KONICA MINOLTA, INC. Annual Report 2014