Konica Minolta 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

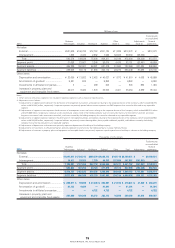

The scheduled maturities of future lease rental payments on

such lease contracts at March 31, 2014 and 2013 are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Due within one year .....................

¥187 ¥166 $1,817

Due over one year ........................

205 443 1,992

Total ..............................................

¥392 ¥610 $3,809

Lease rental expenses and depreciation equivalents under the

fi nance leases that are accounted for in the same manner as

operating leases for the years ended March 31, 2014 and 2013

are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Lease rental expenses for

the period ....................................

¥216 ¥238 $2,099

Depreciation equivalents ..............

215 238 2,089

Depreciation equivalents are calculated based on the straight-line

method over the lease terms of the leased assets.

Accumulated loss on impairment of leased assets as of March

31, 2014 and 2013 is as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Reserve for loss ............................

¥— ¥0 $—

2) Operating Leases

The scheduled maturities of future rental payments of operating

noncancelable leases as of March 31, 2014 and 2013 are as

follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Due within one year .....................

¥ 7,532 ¥ 6,051 $ 73,183

Due over one year ........................

13,989 15,545 135,921

Total ..............................................

¥21,521 ¥21,597 $209,104

As Lessor

Operating Leases

The scheduled maturities of future rental incomes of operating

noncancelable leases as of March 31, 2014 and 2013 are as

follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Due within one year .....................

¥2,076 ¥2,092 $20,171

Due over one year ........................

3,010 2,832 29,246

Total ..............................................

¥5,087 ¥4,924 $49,427

23. Retirement Benefi t Plans

Retirement benefi t plans of the Companies for the year ended

March 31, 2014 are as follows:

(1) The Companies have defi ned benefi t retirement plans that

include corporate defi ned benefi t pensions plans, tax-qualifi ed

pension plans and lump-sum payment plans. In addition, the

Companies have defi ned contributory pension plans. Certain

foreign consolidated subsidiaries have defi ned benefi t retire-

ment plans and defi ned contribution retirement plans. The

Companies may pay additional retirement benefi ts to employ-

ees at their discretion.

Additionally, the Company contributes to retirement benefi t

trusts.

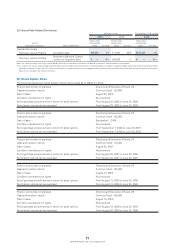

(2) Defi ned benefi t retirement plans

(i) Movement in retirement benefi t obligations

Millions of yen

Thousands of

U.S. dollars

2014 2014

Balance at April 1, 2013 ................

¥168,817 $1,640,274

Service costs .............................

4,849 47,114

Interest costs ............................

3,583 34,813

Actuarial differences .................

(1,045) (10,154)

Benefi ts paid .............................

(9,453) (91,848)

Foreign currency translation ......

4,702 45,686

Other .........................................

608 5,908

Balance at March 31, 2014 ...........

¥172,061 $1,671,794

Note: Certain subsidiaries use a simplifi ed method for the calculation of benefi t

obligation.

(ii) Movement in plan assets

Millions of yen

Thousands of

U.S. dollars

2014 2014

Balance at April 1, 2013 ................

¥109,085 $1,059,901

Expected return on plan assets

...

2,565 24,922

Actuarial differences .................

2,958 28,741

Contributions paid by the

employer .................................

7,104 69,024

Benefi ts paid .............................

(7,881) (76,574)

Foreign currency translation ......

3,907 37,962

Other .........................................

979 9,512

Balance at March 31, 2014 ...........

¥118,718 $1,153,498

Note: Certain subsidiaries use a simplifi ed method for the calculation of plan assets.

67

KONICA MINOLTA, INC. Annual Report 2014