Konica Minolta 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

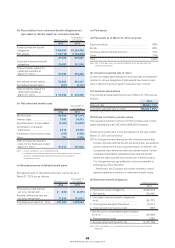

”Guidance No. 25”)) except the article 35 of the Statement No.

26 and the article 67 of the Guidance No. 25 and unrecognized

actuarial differences and unrecognized prior service costs have

been recognized and the difference between retirement benefi t

obligations and plan assets has been recognized as net defi ned

benefi t liability in the consolidated balance sheets.

In accordance with the article 37 of the Statement No. 26,

the effect of the change in accounting policies arising from initial

application has been recognized in remeasurements of defi ned

benefi t plans in accumulated other comprehensive income.

As a result of the application, net defi ned benefi t liability in

the amount of ¥53,563 million ($520,433 thousand) has been

recognized, and accumulated other comprehensive income has

decreased by ¥8,497 million ($82,559 thousand), at the end of

the fi scal year ended March 31, 2014.

The effects of this change on earnings per share are described

in related note.

(p) Accounting Standards Issued but Not Yet Applied

Accounting Standard for Retirement Benefi ts

ASBJ Statement No. 26, “Accounting Standard for Retirement

Benefi ts”, issued by the ASBJ on May 17, 2012 and ASBJ Guid-

ance No. 25, “Guidance on Accounting Standard for Retirement

Benefi ts”, issued by the ASBJ on May 17, 2012.

(1) Summary

The treatment of unrecognized actuarial differences and unrec-

ognized prior service costs, and calculation of accrued retire-

ment benefi ts and service costs were amended.

(2) Effective dates

The amendment of the method for calculating the present value

of retirement benefi t obligation and service costs is scheduled to

be adopted from the beginning of the fi scal year ending March

31, 2015.

(3) Effect of adoption

The effect of adopting this revised accounting standard on the

consolidated fi nancial statements is under assessment at the

time of preparation of these accompanying consolidated fi nan-

cial statements.

3. U.S. Dollar Amounts

The translation of Japanese yen amounts into U.S. dollars is

included solely for the convenience of the reader, using the

prevailing exchange rate at March 31, 2014, of ¥102.92 to U.S.

$1.00. The translations should not be construed as representa-

tions that the Japanese yen amounts have been, could have

been, or could in the future be, converted into U.S. dollars at this

or any other exchange rate.

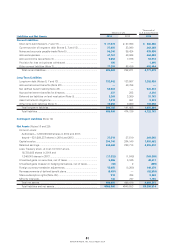

4. Cash and Cash Equivalents

Cash and cash equivalents as of March 31, 2014 and 2013, are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Cash on hand and in banks ...............................................................................

¥ 95,490 ¥ 93,413 $ 927,808

Short-term investment securities .....................................................................

92,999 120,501 903,605

Cash and cash equivalents ...............................................................................

¥188,489 ¥213,914 $1,831,413

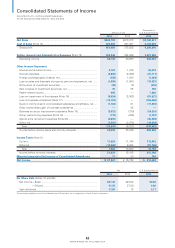

5. Financial Instruments

Conditions of Financial Instruments

The Companies raise short-term working capital mainly through bank borrowings and invest temporary surplus funds in fi nancial

instruments deemed to have low risk. The Companies enter into derivative transactions based on the need for these transactions in

accordance with their internal policies.

In principle, the risk of currency fl uctuations related to receivables and payables denominated in foreign currencies are hedged

using forward exchange contracts and currency options. With respect to the interest rate volatility risk and cost fl uctuation risk for

future capital procurement arising on certain long-term debt, the Companies lock in interest expenses using currency swaps and

interest-rate swaps.

Investment securities comprise mainly stocks, and the market values of listed stocks are determined on a quarterly basis.

The Companies try to reduce the credit risk of customers arising on notes and accounts receivable–trade through regular monitor-

ing and comprehensive management of aging balances.

58

KONICA MINOLTA, INC. Annual Report 2014