Konica Minolta 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

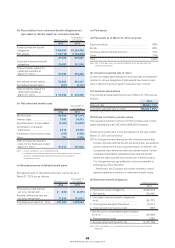

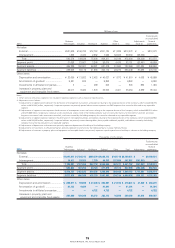

(2) Interest Rate-Related Derivatives

Millions of yen Thousands of U.S. dollars

2014 2013 2014

Type of

derivatives transactions Major hedged items

Contract value

(notional principal

amount)

Fair value

Contract value

(notional principal

amount)

Fair value

Contract value

(notional principal

amount)

Fair value

Interest rate swaps:

Pay fi xed, receive fl oating Long-term debt

¥22,450 (*) ¥ 3,000 ¥(23) $218,131 (*)

Pay fi xed, receive fl oating Short-term debt and Current

portion of long-term debt

¥ — ¥— ¥28,608 (*) $ — $—

Note: Fair value of interest rate swaps is provided by the fi nancial institutions with whom the derivative contracts were entered into and agreed.

(*) As interest rate swaps used to hedge long-term debt,short-term debt and current portion of long-term debt are subject to specifi ed hedge accounting under accounting principles

generally accepted in Japan, their fair values are included as a single line item with the hedged underlying liability,long-term debt,short-term debt and current portion of long-term

debt are not included in the above information.

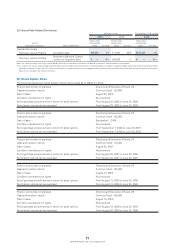

25. Stock Option Plans

The following tables summarize details of stock option plans as of March 31, 2014.

Position and number of grantees Directors and Executive Offi cers: 26

Class and number of stock Common Stock: 194,500

Date of issue August 23, 2005

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 23, 2005 to June 30, 2006

Period stock options can be exercised From August 23, 2005 to June 30, 2025

Position and number of grantees Directors and Executive Offi cers: 23

Class and number of stock Common Stock: 105,500

Date of issue September 1, 2006

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From September 1, 2006 to June 30, 2007

Period stock options can be exercised From September 2, 2006 to June 30, 2026

Position and number of grantees Directors and Executive Offi cers: 24

Class and number of stock Common Stock: 113,000

Date of issue August 22, 2007

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 22, 2007 to June 30, 2008

Period stock options can be exercised From August 23, 2007 to June 30, 2027

Position and number of grantees Directors and Executive Offi cers: 25

Class and number of stock Common Stock: 128,000

Date of issue August 18, 2008

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 18, 2008 to June 30, 2009

Period stock options can be exercised From August 19, 2008 to June 30, 2028

Position and number of grantees Directors and Executive Offi cers: 25

Class and number of stock Common Stock: 199,500

Date of issue August 19, 2009

Condition of settlement of rights No provisions

Period grantees provide service in return for stock options From August 19, 2009 to June 30, 2010

Period stock options can be exercised From August 20, 2009 to June 30, 2029

71

KONICA MINOLTA, INC. Annual Report 2014