Konica Minolta 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(4) Measurement of recoverable amount

The recoverable amount of a cash-generating unit is the fair

value less costs to sell. The fair value is supported by an

appraisal report for land and buildings and structures, or a

management estimate for rental business-use assets.

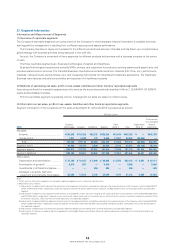

17. Loss on Business Withdrawal

Loss on business withdrawal includes the losses associated

with the decision to withdraw from the glass substrates for

HDDs business in the Industrial Business, which are impairment

loss of ¥11,899 million ($115,614 thousand) and loss on disposal

of inventories.

18. Business Structure Improvement Expenses

Business structure improvement expenses as of March 31,

2014 include expenses related to structural reform of sales sites

in Europe and the North America for the Business Technologies

Business, a review of the production system for lens units used

in mobile phones in the Industrial Business and termination of

the Group’s fi lm production in the Healthcare Business. Business

structure improvement expenses as of March 31, 2013 in the

previous fi scal year included expenses associated with the dis-

continuation of production and sales of lenses and prisms using

glass molds in the Industrial Business.

19. Group Restructuring Expenses

Group restructuring expenses refer to expenses associated with

the reorganization of the Group’s management system con-

ducted on April 1, 2013.

20. Special Extra Retirement Payments

Special extra retirement payments refer to extra retirement pay-

ments to early retirees in line with the implementation of an

early retirement incentive program.

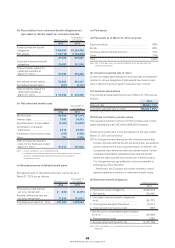

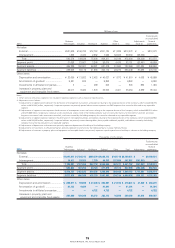

21. Other Comprehensive Income

Recycling and Tax Effect Relating to Other Comprehensive

Income.

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Unrealized gains on securities

Increase during the year ...........

¥ 2,713 ¥ 3,241 $ 26,360

Reclassifi cation adjustments ....

(17) (53) (165)

Sub-total, before tax ..................

2,696 3,188 26,195

Tax expense ..............................

(957) (1,031) (9,298)

Sub-total, net of tax ...................

1,738 2,156 16,887

Unrealized gains (losses)

on hedging derivatives

Decrease during the year ..........

(1,503) (1,297) (14,604)

Reclassifi cation adjustments ....

1,426 1,683 13,855

Sub-total, before tax ..................

(77) 385 (748)

Tax (expense) or benefi t ............

36 (155) 350

Sub-total, net of tax ...................

(40) 230 (389)

Foreign currency translation

adjustments

Increase during the year ...........

23,376 21,939 227,128

Share of other comprehensive

income of associates accounted

for using equity method

Increase during the year ...........

2 13 19

Total other comprehensive

income ........................................

¥25,077 ¥24,340 $243,655

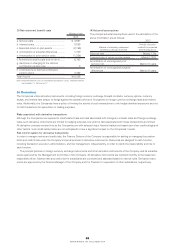

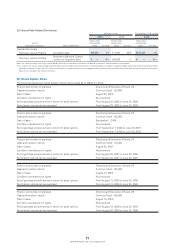

22. Lease Transactions

Pro forma information on the Company and its domestic consoli-

dated subsidiaries’ fi nance lease transactions (except for those

which are deemed to transfer ownership of the leased assets to

the lessee) and operating lease transactions is as follows:

As Lessee

1) Finance Leases (not involving transfer of ownership com-

mencing on or before March 31, 2008)

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Purchase cost:

Buildings and structures ...........

¥5,174 ¥5,690 $50,272

Machinery and equipment ........

— 24 —

Tools and furniture ....................

22 236 214

5,196 5,951 50,486

Less: Accumulated

depreciation .............................

(4,803) (5,341) (46,667)

Loss on impairment of

leased assets ..........................

— (0) —

Net book value ..............................

¥ 392 ¥ 609 $ 3,809

66

KONICA MINOLTA, INC. Annual Report 2014