Konica Minolta 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

thousand) which were approved by the Board of Directors and

paid in May 2014.

The amount available for dividends under the Japanese Cor-

porate Law is based on the amount recorded in the Company’s

nonconsolidated books of account in accordance with account-

ing principles generally accepted in Japan.

On October 31, 2013, the Board of Directors approved cash

dividends to be paid to shareholders of record as of September

30, 2013, totaling ¥5,303 million ($51,525 thousand), at a rate

of ¥10.0 per share. (This includes the ordinary year-end dividend

of ¥7.5 per share and the commemorative dividend of ¥2.5

per share.)

On May 9, 2014, the Board of Directors approved cash

dividends to be paid to shareholders of record as of March 31,

2014, totaling ¥3,862 million ($37,524 thousand), at a rate of

¥7.5 per share.

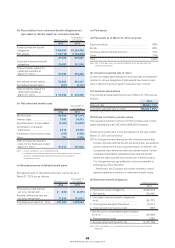

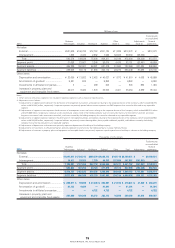

11. Inventories

Inventories as of March 31, 2014 and 2013 are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2013 2014

Merchandise and fi nished goods

...

¥ 87,807 ¥ 82,788 $ 853,158

Work in process ............................

9,609 10,610 93,364

Raw materials and supplies ..........

17,858 19,080 173,513

Total ..............................................

¥115,275 ¥112,479 $1,120,045

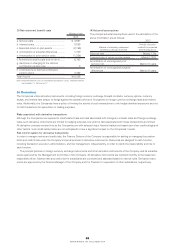

12. Contingent Liabilities

The Companies were contingently liable at March 31, 2014 for

debt and lease guarantees of ¥427 million ($4,149 thousand) and

at March 31, 2013 for debt and lease guarantees of ¥456 million.

13. Collateral Assets

Assets pledged as collateral at March 31, 2014 for short-term

debt, current portion of long-term debt and long-term debt of

¥15 million ($146 thousand) are accounts receivable–trade and

vehicles of ¥16 million ($155 thousand). Assets pledged as

collateral at March 31, 2013 for short-term debt of ¥31 million

are accounts receivable–trade and lease investment assets of

¥31 million.

14. Cost of Sales

The Companies have recognized valuation losses associated

with the write-down of inventories of ¥1,552 million ($15,080

thousand) and ¥979 million for the years ended March 31, 2014

and 2013, respectively, due to the decline in profi tability. These

losses are included within the cost of sales.

15. Research and Development Costs

Research and development costs included in selling, general and

administrative expenses for the years ended March 31, 2014

and 2013 are ¥71,184 million ($691,644 thousand) and ¥71,533

million, respectively.

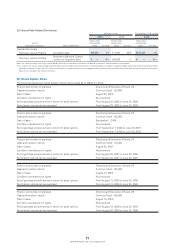

16. Loss on Impairment of Fixed Assets

The Companies have recognized losses on impairment of

¥17,424 million ($169,297 thousand) and ¥2,902 million for the

following groups of assets for the years ended March 31, 2014

and 2013, respectively:

Amount

Millions of yen

Thousands of

U.S. dollars

Description Classifi cation 2014 2013 2014

Manufacturing

equipment of

glass substrates

for HDDs, others

Machinery and

equipment, Buildings,

Others

¥11,899 ¥ — $115,614

Manufacturing

equipment of

glass pickup lenses

Machinery and

equipment, Tools

and furniture, Others

— 365 —

Buildings for

manufacturing of

radiographic fi lms

Buildings and

structures

3,566 — 34,648

Manufacturing

equipment of

radiographic fi lms

Machinery and

equipment, Construction

in Progress, Others

— 1,058 —

Rental assets Rental business-use

assets

25 44 243

Idle assets

Buildings and structures,

Machinery and

equipment, Others

1,699 1,399

16,508

Others —

233 34 2,264

Total

¥17,424 ¥2,902 $169,297

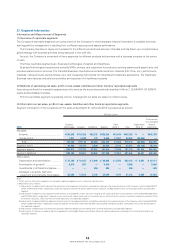

(1) Cash-generating units have been identifi ed based on product

lines and geographical areas as a group of assets. For rental

assets, cash generating units are identifi ed based on rental

contracts and each geographical area. Each idle asset is also

identifi ed as a cash-generating unit.

(2) Fixed assets have been written down to the recoverable

amount and the corresponding impairment losses have been

recognized due to the decision to withdraw from the glass

substrates for HDDs business, discontinuation of production

of radiographic fi lms, and the poor performance and profi t-

ability of rental and idle assets. In addition, the revaluation

of the other assets category has contributed to the write

down amount.

(3) Details of impairment of fi xed assets

Details of impairment of fi xed assets as of March 31, 2014

are as follows:

Buildings and structures ¥9,382 million ($91,158 thousand),

Machinery and equipment ¥7,194 million ($69,899 thousand),

Tools and furniture ¥640 million ($6,218 thousand), Others

¥206 million ($2,002 thousand).

Details of impairment of fi xed assets as of March 31, 2013

are as follows:

Machinery and equipment ¥2,626 million, Tools and furni-

ture ¥125 million, Construction in progress ¥48 million,

Others ¥101 million.

65

KONICA MINOLTA, INC. Annual Report 2014