Konica Minolta 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

KONICA MINOLTA, INC. Annual Report 2014

Financial Review and Data

Management’s Discussion and Analysis

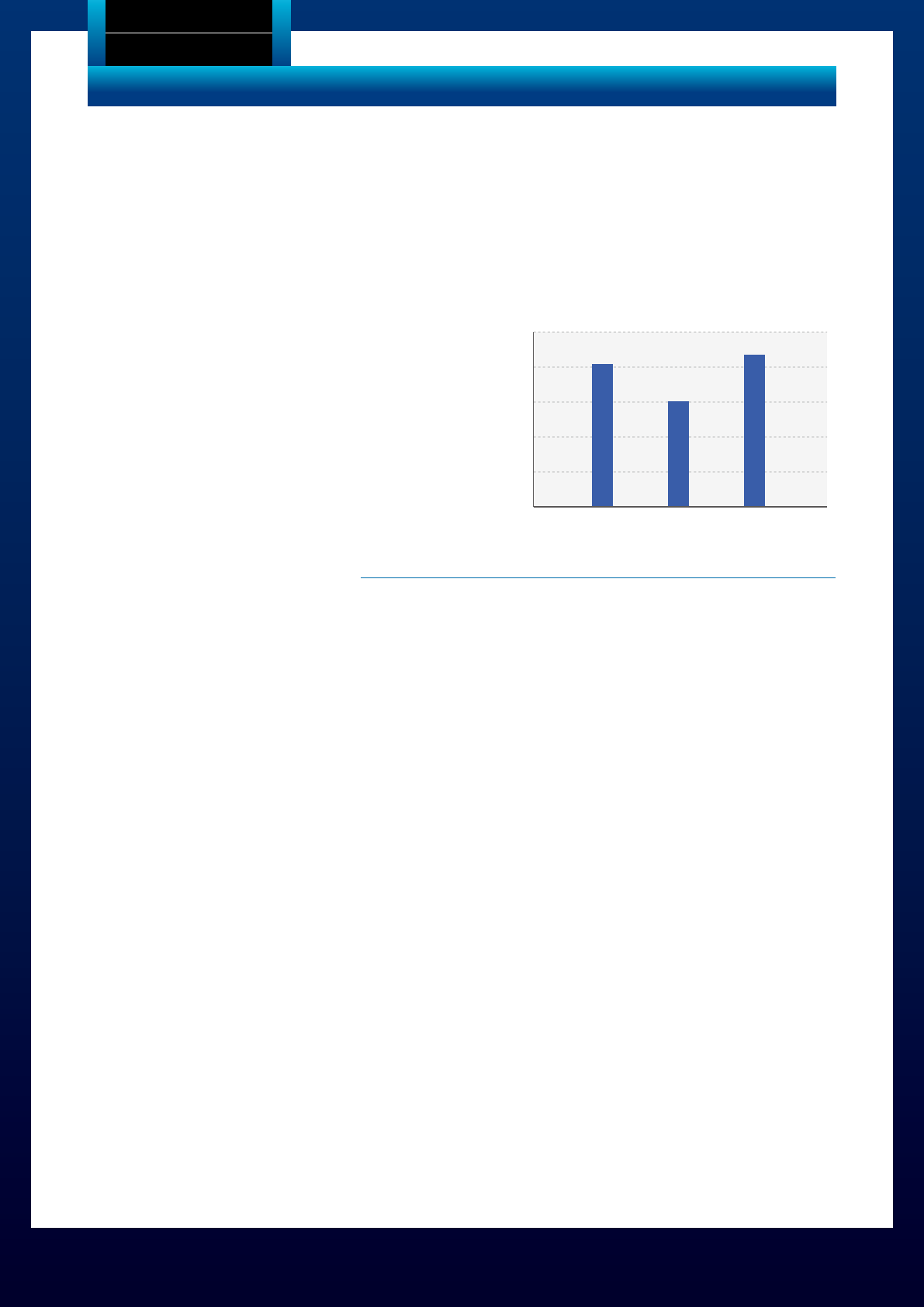

Net Income

Net income increased 44.5% year on year to ¥21.8 billion, due in part

to tax effects related to the revision of deferred tax assets in line with

reorganization of the Group’s administrative structure implemented in

April 2013.

Income before Income Taxes and Minority Interests

Income before income taxes and minority interests fell 30.5% year on year to ¥23.5 billion, due primarily to a loss on withdrawal from the business

of glass substrates for HDDs and an impairment loss on structures associated with the termination of the Group’s production of film for the

Healthcare Business.

Net income

FY2013FY2012FY2011

(Billions of yen)

21.8

15.1

20.4

0

5

10

15

20

25

Operating Results by Segment

Business Technologies Business

In the office field, sales of A3 color MFPs remained strong and sales

volumes increased significantly compared with the previous fiscal

year in all regions, including Japan, the United States and Europe.

The increasing share of high-end models contributed to sales expan-

sion. In Optimized Print Services (OPS), we strengthened our global

business structure, further expanded the service menu, and rein-

forced business-generating and proposal-making capabilities, thereby

steadily securing more customers and expanding the operating base.

Furthermore, we established a hybrid-type sales model for small- and

medium-sized companies in Europe and the United States that com-

bines IT business solution services with MFPs. By doing so, we culti-

vated new customers, expanded the scale of projects and realized

added value.

In the production print field, sales volumes of color units and mono-

chrome units grew year on year. In addition, we expanded operations

related to high-mix, small-lot on-demand print services as well as

production and print services for sales promotion materials through

Kinko’s Japan Co., Ltd. and Charterhouse Print Management Limited

(headquartered in the UK), both of which were acquired in the previ-

ous fiscal year. As a result, we are providing a wider range of options

to meet customers’ printing needs. In Europe, we formed a capital

and business alliance with France-based MGI Digital Graphic

Technology S.A., which operates a unique business in such growth

markets as plastic cards. This alliance is aimed at developing applica-

tions for package printing, in addition to paper output in the existing

commercial printing market.

As a result, net sales to external customers in the Business Technologies

Business climbed 25.5% year on year to ¥729.8 billion and segment

profit soared 101.8% to ¥63.8 billion. The increase in net sales was

attributable to the effect of the steadily weak yen on foreign

exchange rates, sales growth of mainstay color units, improved prod-

uct mix and acquisitions. The considerable jump in segment profit

was due to an increase in gross profit resulting from sales expansion,

the effect of foreign exchange rates, and the full year impact of mea-

sures to reduce production costs. These cost reductions included

decreasing fixed costs by promoting production reform and unit pro-

curement in the production division, conducting centralized purchas-

ing of raw materials and digital components, and implementing value

engineering.