Konica Minolta 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

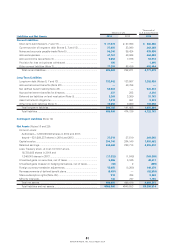

Fair Values of Financial Instruments

The book value on the consolidated balance sheets, fair value, and differences as of March 31, 2014 and 2013 are as follows:

Millions of yen Thousands of U.S. dollars

2014 2013 2014

Book value Fair value Differences Book value Fair value Differences Book value Fair value Differences

Assets

(1) Cash on hand and in banks ........

¥ 95,490 ¥ 95,490 ¥ — ¥ 93,413 ¥ 93,413 ¥ — $ 927,808 $ 927,808 $ —

(2) Notes and accounts

receivable-trade .......................

220,120 220,120 — 194,038 194,038 — 2,138,749 2,138,749 —

(3)

Short-term investment securities

and investment securities

(i) Held-to-maturity securities ......

10 10 — 10 10 — 97 97 —

(ii) Other securities ......................

119,127 119,127 — 139,411 139,411 — 1,157,472 1,157,472 —

Total

¥434,748 ¥434,748 ¥ — ¥426,872 ¥426,872 ¥ — $4,224,135 $4,224,135 $ —

Liabilities

(1)

Notes and accounts payable-trade ...

¥ 96,240 ¥ 96,240 ¥ — ¥ 85,424 ¥ 85,424 ¥ — $ 935,095 $ 935,095 $ —

(2) Short-term debt .........................

37,078 37,078 — 67,398 67,398 — 360,260 360,260 —

(3)

Current portion of long-term debt

...

27,003 27,008 5 23,990 24,094 104 262,369 262,417 49

(4) Bonds ........................................

70,000 71,040 1,040 70,000 71,309 1,309 680,140 690,245 10,105

(5) Long-term debt ..........................

62,042 60,918 (1,123) 63,507 63,346 (161) 602,818 591,897 (10,911)

Total ............................................

¥292,364 ¥292,286 ¥ (77) ¥310,321 ¥311,573 ¥1,251 $2,840,692 $2,839,934 $ (748)

Derivatives (*) .................................

¥ (529) ¥ (529) ¥ — ¥ (1,058) ¥ (1,058) ¥ — $ (5,140) $ (5,140) $ —

(*) Derivative assets and liabilities are presented on a net basis, and the net liability position is enclosed in parentheses.

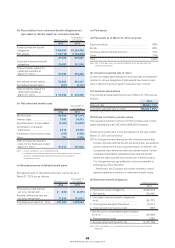

(i) Methods of calculating the fair value of fi nancial instruments and securities and derivative transactions

Assets

(1) Cash on hand and in banks and (2) Notes and accounts receivable–trade

The fair value equates to the book value due to the short-term nature of these instruments.

(3) Short-term investment securities and Investment securities

(i) Held-to-maturity securities

The fair value approximates the book value as the securities are entirely school bonds and credit risk of the issuers has not

changed signifi cantly since the date of acquisition.

(ii) Other securities

The fair value of equity securities is determined based on the prevailing market price. The fair value of bonds is based on the

prevailing market price or the price provided by third-party fi nancial institutions. These other securities are described further in

Note 6. INVESTMENT SECURITIES.

Liabilities

(1) Notes and accounts payable–trade and (2) Short-term debt

The fair value equates to the book value due to the short-term nature of these instruments.

(3) Current portion of long-term debt and (5) Long-term debt

The fair value of long-term debt with fi xed interest rates is based on the present value of future cash fl ows discounted using the

current borrowing rate for similar debt of a comparable maturity.

The fair value of long-term debt with variable interest rates approximates book value as the Company’s credit risk has not signifi -

cantly changed since the date of commencement of the borrowing.

For debt subject to currency swaps under designated hedge accounting or interest-rate swaps under specifi ed hedge accounting

(please see ‘Derivatives’ below), the total amount of the principal and interest that were accounted for as a single item with the

relevant currency swaps or interest-rate swaps is discounted with a rate that is assumed to be applied when a new, similar debt

is issued.

(4) Bonds

The fair value of bonds payable is based on the value provided by third-party fi nancial institutions.

59

KONICA MINOLTA, INC. Annual Report 2014