Konica Minolta 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

KONICA MINOLTA, INC. Annual Report 2014

Financial Review and Data

Management’s Discussion and Analysis

Basic Dividend Policy

The Company’s basic policy regarding the payment of dividends is to sus-

tain distribution of earnings to shareholders after comprehensive consid-

eration of factors including consolidated business results and strategic

investment in growth areas. The Company’s specific medium- to long-

term dividend benchmark for dividends is a consolidated payout ratio of

25% or higher. The Company also considers factors such as financial

position and share price in making decisions about share repurchases as

another means of distributing earnings to shareholders.

Based on Article 459, Paragraph 1 of the Japanese Corporate Law, the

Company’s articles of incorporation specify the Board of Directors as the

decision-making body with regard to the payment of dividends from

retained earnings. The Company does not have a basic policy as to the

Looking at the global economic conditions surrounding the Group,

moderate economic recovery is expected in Europe while corporate

results are projected to remain strong in the United States and Japan.

Economies in emerging countries are forecast to keep expanding due

to recovery in the economies of industrialized countries, despite lin-

gering uncertainty in the Chinese economy.

As for the outlook for demand in the Group’s main markets, in the

Business Technologies Business, we expect demand for A3 color MFPs

for the office to continue expanding in Europe and the United States.

In emerging countries, demand for monochrome units and the overall

market are projected to expand alongside economic growth. In the

production print field, we expect sales of color units to expand and

the number of units in the market to increase worldwide. In the

Industrial Business, the market for notebook PCs is expected to con-

tinue contracting, while continued strong growth is forecast for smart-

phones and tablets, and the TV market is projected to expand

moderately as well. In addition, as the use of smartphones and tablets

spreads, displays for mobile devices are expected to increase in vol-

ume terms and capital investment is forecast to increase in the manu-

facturing sector. In digital cameras, the market for compact cameras is

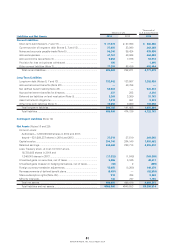

Dividends for the Fiscal Year Ended March 31, 2014 and

Planned Dividends for the Fiscal Year Ending March 31, 2015

With respect to dividends from retained earnings for the fiscal year under review, the Company will distribute a year-end dividend of ¥7.5 per share,

as planned. Combined with the dividend of ¥10 per share paid at the end of the second quarter (comprising an ordinary dividend of ¥7.5 and com-

memorative dividend of ¥2.5), the total annual dividend will be ¥17.5 per share. The Company plans to increase annual dividends per share ¥2.5 to

¥20 for the fiscal year ending March 31, 2015.

Dividend Policy

Outlook for the Fiscal Year Ending March 31, 2015

Cash dividends per share

FY2013FY2012FY2011

(Yen)

17.5

15.0

15.0

0

5

10

15

20

25

30

number of times per year that dividends are paid, but, per the articles of

incorporation, can pay dividends from retained income on March 31,

September 30, and other record dates.

Performance forecast for the fiscal year

ending March 31, 2015 As of May 9, 2014

(Billions of yen)

Net sales 1,000

Operating income 62

Operating income ratio 6.2%

Net income 26

Capital expenditure 60

Depreciation 55

Research and development costs 75

Free cash flow 2

Investment and financing 40

expected to continue contracting due to smartphone growth, while

sales of models with interchangeable lenses are projected to remain

firm. In the Healthcare Business, robust growth is forecast for cassette

digital x-ray systems in all regions.

Cash dividends per share ¥20.00

We assume exchange rates of JPY 100 to USD 1 and JPY 135 to EUR 1.