Konica Minolta 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

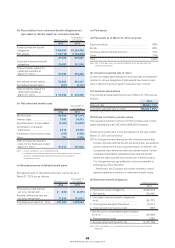

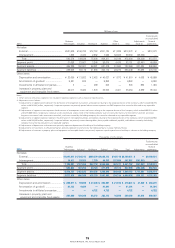

(iii) Reconciliation from retirement benefi t obligations and

plan assets to liability (asset) for retirement benefi ts

Millions of yen

Thousands of

U.S. dollars

2014 2014

Funded retirement benefi t

obligations ...................................

¥146,609 $1,424,495

Plan assets ...................................

(118,718) (1,153,498)

27,890 270,987

Unfunded retirement benefi t

obligations ...................................

25,452 247,299

Total net liability (asset) for

retirement benefi ts at

March 31, 2014 ...........................

53,342 518,286

Net defi ned benefi t liability ...........

53,563 520,433

Net defi ned benefi t asset .............

(221) (2,147)

Total net liability (asset) for

retirement benefi ts at

March 31, 2014 ...........................

¥ 53,342 $ 518,286

(iv) Net retirement benefi t costs

Millions of yen

Thousands of

U.S. dollars

2014 2014

Service costs ................................

¥4,849 $47,114

Interest costs ................................

3,583 34,813

Expected return on plan assets ....

(2,565) (24,922)

Amortization of actuarial

differences ..................................

2,414 23,455

Amortization of prior service costs

...

(767) (7,452)

Other ............................................

298 2,895

Total net retirement benefi t

costs for the fi scal year ended

March 31, 2014 ...........................

¥7,812 $75,904

Note: 1. Certain subsidiaries use a simplifi ed method.

2. In addition to the retirement benefi t costs above special extra retirement

payments of ¥4,655 million ($45,229 thousand) were recorded in

Extraordinary losses.

(v) Remeasurements of defi ned benefi t plans

Remeasurements of defi ned benefi t plans, before tax as of

March 31, 2014 are as follows:

Millions of yen

Thousands of

U.S. dollars

2014 2014

Prior service costs that are

yet to be recognized ...................

¥ (230) $ (2,235)

Actuarial differences that are

yet to be recognized ...................

11,536 112,087

Total balance at March 31, 2014 ...

¥11,305 $109,843

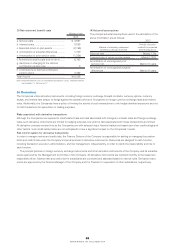

(vi) Plan assets

(a) Plan assets as of March 31, 2014 comprise:

Equity securities ............................................................

44%

Bonds ............................................................................

29%

Insurance assets (General account) ...............................

10%

Other .............................................................................

17%

Total ...............................................................................

100%

Note: 16% of total plan assets are retirement benefi t trusts contributed to the

corporate pension plan.

(b) Long-term expected rate of return

Current and target asset allocations and historical and expected

returns on various categories of plan assets have been consid-

ered in determining the long-term expected rate of return.

(vii) Actuarial assumptions

The principal actuarial assumptions as of March 31, 2014 are as

follows:

2014

Discount rate ..................................................

Mainly 1.7%

Long-term expected rate of return .................

Mainly 1.25%

(3) Defi ned contributory pension plans

The required contribution amount for the Company and consoli-

dated subsidiaries is ¥4,102 million ($39,856 thousand).

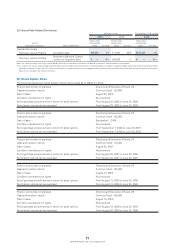

Retirement benefi t plans of the Companies for the year ended

March 31, 2013 are as follows:

(1) The Companies have defi ned benefi t retirement plans that

include corporate defi ned benefi t pensions plans, tax-qualifi ed

pension plans and lump-sum payment plans. In addition, the

Companies have defi ned contributory pension plans. Certain

overseas consolidated subsidiaries have defi ned benefi t

retirement plans and defi ned contribution retirement plans.

The Companies may pay additional retirement benefi ts to

employees at their discretion.

Additionally, the Company and certain domestic consoli-

dated subsidiaries contribute to retirement benefi t trusts.

(2) Retirement benefi t obligations

Millions of yen

2013

a. Retirement benefi t obligations ....................

¥(168,817)

b. Plan assets ..................................................

109,085

c. Unfunded retirement benefi t obligations

(a+b) .............................................................

(59,731)

d. Unrecognized actuarial differences .............

18,214

e. Unrecognized prior service costs ................

(987)

f. Net amount on consolidated balance sheets

(c+d+e) .........................................................

(42,504)

g. Prepaid pension costs .................................

1,249

h. Accrued retirement benefi ts (f-g) ................

¥ (43,754)

Note: Certain subsidiaries use a simplifi ed method for the calculation of benefi t

obligation.

68

KONICA MINOLTA, INC. Annual Report 2014