IHOP 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

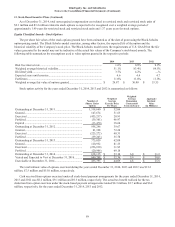

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

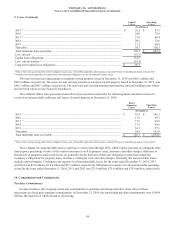

7. Long-Term Debt (Continued)

79

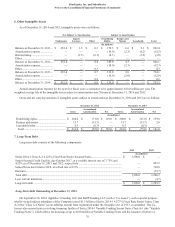

Weighted Average Effective Interest Rate

Taking into account the deferred financing costs that were amortized as additional non-cash interest expense, the weighted

average effective interest rate for the Notes as of December 31, 2014 was 4.45%.

Maturities of Long-term Debt

The Class A-2 Anticipated Repayment Date is in September 2021.

Long-Term Debt Outstanding at December 31, 2013

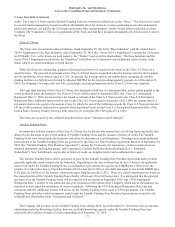

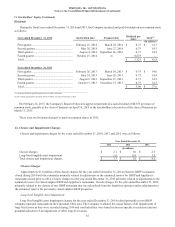

Senior Secured Credit Facility

On October 8, 2010, the Company entered into a Credit Agreement, by and among the Company, a group of lenders and

other financial institutions party thereto (the “Credit Agreement”). The Credit Agreement established a senior secured credit

facility (the “Credit Facility”) that consisted of a $900.0 million senior secured term loan facility maturing in October 2017 (the

“Term Facility”) and a $50.0 million senior secured revolving credit facility maturing in October 2015 (the “Revolving

Facility”). The Revolving Facility originally provided for borrowings up to $50.0 million, with sub-limits for the issuance of

letters of credit and for swing-line borrowings, and could be used for general corporate purposes, including working capital,

permitted acquisitions, capital expenditures, dividends and investments. The Credit Agreement also provided for an

uncommitted incremental facility that permitted the Company, subject to certain conditions, to increase the Credit Facility by

up to $250.0 million, provided that the aggregate amount of the commitments under the Revolving Facility did not exceed

$150.0 million. See “Amendments to Credit Agreement”. The Company did not utilize the Revolving Facility during 2014 or

2013. On September 30, 2014, the Company repaid the entire outstanding principal balance of $463.6 million of the Credit

Facility. See “2014 Refinancing of Long-term Debt.”

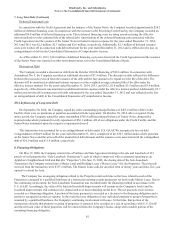

Interest Rate

Loans made under the Term Facility (“Term Loans”) and the Revolving Facility (“Revolving Loans”) bore interest, at the

Company's option, at an annual rate equal to (i) a LIBOR-based rate (originally subject to a floor of 1.50%) plus a margin

(originally 4.50%) or (ii) the base rate (the “Base Rate”) (originally subject to a floor of 2.50%) which was equal to the highest

of (a) the federal funds rate plus 0.50%, (b) the prime rate and (c) the one month LIBOR rate (originally subject to a floor of

1.50%) plus 1.00%, plus a margin of 3.50%. The margin for the Revolving Facility was subject to debt leverage-based step-

downs. Both the Term Facility and the Revolving Facility were subject to upfront fees of 1.00% of the principal amount

thereof. See “Amendments to Credit Agreement”.

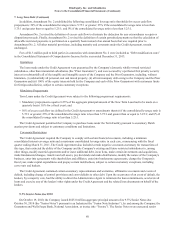

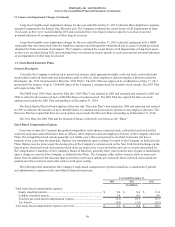

Amendments to Credit Agreement

On February 25, 2011, the Company entered into Amendment No. 1 (“Amendment No. 1”) to the Credit Agreement.

Pursuant to Amendment No. 1, the interest rate margin applicable to LIBOR-based Term Loans was reduced from 4.50% to

3.00%, and the interest rate floors used to determine the LIBOR and Base Rate reference rates for Term Loans was reduced

from 1.50% to 1.25% for LIBOR-based Term Loans and from 2.50% to 2.25% for Base Rate-denominated Term Loans. In

addition, Amendment No. 1 increased the lender commitments under the Revolving Facility from $50.0 million to $75.0

million. Amendment No. 1 also modified certain restrictive covenants of the Credit Agreement, including those relating to

repurchases of other debt securities, permitted acquisitions and payments on equity.

The Company paid $12.3 million in fees and costs related to Amendment No. 1, of which $7.4 million in fees paid to

lenders was recorded as additional discount on debt and $0.8 million of costs related to the increase in the Revolving Facility

was recorded as deferred financing costs. Fees paid to third parties of $4.0 million were charged against income.

On February 4, 2013, the Company entered into Amendment No. 2 (“Amendment No. 2”) to the Credit Agreement.

Pursuant to Amendment No. 2, the interest rate margin applicable to LIBOR-based Term Loans was reduced from 3.00% to

2.75%, and the interest rate floors used to determine the LIBOR and Base Rate reference rates for Term Loans was reduced

from 1.25% to 1.00% for LIBOR-based Term Loans and from 2.25% to 2.00% for Base Rate-denominated Term Loans. The

interest rate margin for Revolving Loans was reduced from 3.50% to 1.75% for Base Rate loans and from 4.50% to 2.75%

LIBOR Rate loans. The commitment fee for the unused portion of the Revolving Facility was reduced from 0.75% to 0.50%

and, if the consolidated leverage ratio was reduced below 4.75:1, from 0.50% to 0.375%.