IHOP 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

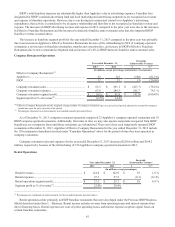

Critical Accounting Policies and Estimates

Our significant accounting policies are comprehensively described in Note 2 of Notes to the Consolidated Financial

Statements. We believe the accounting policies discussed below are particularly important to the understanding of our

consolidated financial statements and require us to make significant judgments in the preparation of those consolidated

financial statements. In exercising those judgments, we make estimates and assumptions that affect the carrying values of assets

and liabilities at the date of the financial statements and the reported amounts of net revenues and expenses in the reporting

periods covered by the financial statements. On an ongoing basis, we evaluate our estimates based on historical experience,

current conditions and various other assumptions that we believe to be reasonable under the circumstances. We adjust such

estimates and assumptions when facts and circumstances dictate. Accounting assumptions and estimates are inherently

uncertain and actual results may differ materially from our estimates. Changes in estimates and judgments could significantly

affect our results of operations, financial condition and cash flow in the future.

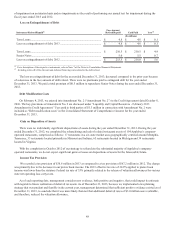

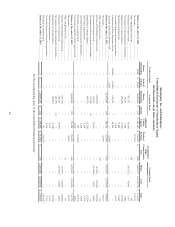

Revenue Recognition

We record revenue in four categories: franchise operations, company restaurant operations, rental operations and financing

operations.

The franchise operations revenue consists primarily of royalty revenues, sales of proprietary IHOP products, IHOP

advertising fees and the portion of the franchise fees allocated to our intellectual property. Company restaurant sales are retail

sales at company-operated restaurants. Rental operations revenue includes revenue from operating leases and interest income

from direct financing leases. Financing operations revenue consists of interest income from the financing of franchise fees and

equipment leases, as well as sales of equipment associated with refranchised IHOP restaurants and a portion of franchise fees

for restaurants taken back from franchisees not allocated to IHOP intellectual property.

Revenues from franchised and area licensed restaurants include royalties, continuing rent and service fees and initial

franchise fees. Royalties are recognized in the period in which the sales are reported to have occurred. Continuing rent and fees

are recognized in the period earned. Initial franchise fees are recognized upon the opening of a restaurant, which is when we

have performed substantially all initial services required by the franchise agreement. Fees from development agreements are

deferred and recorded into income as restaurants under the development agreement are opened.

Sales by company-operated restaurants are recognized when food and beverage items are sold. Company restaurant sales

are reported net of sales taxes collected from guests that are remitted to the appropriate taxing authorities.

We record a liability in the period in which a gift card is sold. We recognize costs associated with our administration of the

gift card programs as prepaid assets when the costs are incurred. As gift cards are redeemed, the liability and prepaid asset are

reduced. We recognize revenue and related administrative costs when gift cards are redeemed at company-operated restaurants.

When gift cards are redeemed at a franchisee-operated restaurant, the revenue and related administrative costs are recognized

by the franchisee. We recognize gift card breakage income on gift cards when the assessment of the likelihood of redemption of

the gift card becomes remote. This assessment is based upon Applebee's and IHOP's individual historical experience with gift

card redemptions in their own program.

Goodwill and Intangibles

Goodwill is recorded when the aggregate purchase price of an acquisition exceeds the estimated fair value of the net

identified tangible and intangible assets acquired. Intangible assets resulting from the acquisition are accounted for using the

purchase method of accounting and are estimated by management based on the fair value of the assets received. Identifiable

intangible assets are comprised primarily of trademarks, tradenames and franchise agreements. Identifiable intangible assets

with finite lives (franchise agreements, recipes, menus and favorable leaseholds) are amortized over the period of estimated

benefit using the straight-line method and estimated useful lives. Goodwill and intangible assets considered to have an

indefinite life (primarily tradename and liquor licenses) are not subject to amortization. The determination of indefinite life is

subject to reassessment if changes in facts and circumstances indicate the period of benefit has become finite.

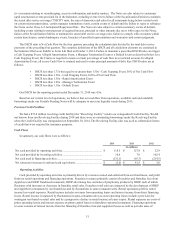

Goodwill has been allocated to three reporting units, the Applebee's company-operated restaurants unit (“Applebee's

company unit”), the Applebee's franchised restaurants unit (“Applebee's franchise unit”) and the IHOP franchised restaurants

unit (“IHOP franchise unit”), in accordance with U.S. GAAP. The significant majority of our goodwill resulted from the

November 29, 2007 acquisition of Applebee's and was allocated between the two Applebee's units. The goodwill allocated to

the Applebee's company unit was fully impaired in 2008.

We perform a quantitative impairment test of the goodwill of the Applebee's franchise unit and the tradename of the

Applebee's company and franchise units as of October 31 of each year. The goodwill of the IHOP franchise unit is assessed

qualitatively as of December 31 of each year. In addition to the annual test of impairment, goodwill and indefinite life