IHOP 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

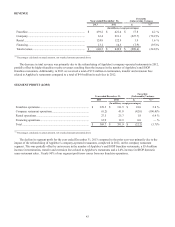

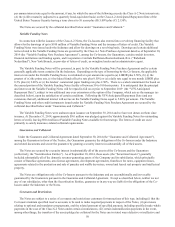

Free cash flow is considered to be a non-U.S. GAAP measure. Reconciliation of the cash provided by operating activities

to free cash flow is as follows:

Year Ended December 31,

2014 2013 2012

(In millions)

Cash flows provided by operating activities................................................... $ 118.5 $ 127.8 $ 52.9

Principal receipts from long-term receivables................................................ 15.3 14.0 12.2

Additions to property and equipment ............................................................. (5.9)(7.0)(17.0)

Principal payments on capital lease and financing obligations ...................... (11.8)(10.0)(10.8)

Mandatory debt service payments .................................................................. (3.6)(4.7)(7.4)

Free cash flow................................................................................................ $ 112.5 $ 120.1 $ 29.9

This non-U.S. GAAP measure is not defined in the same manner by all companies and may not be comparable to other

similarly titled measures of other companies. Non-U.S. GAAP measures should be considered in addition to, and not as a

substitute for, the U.S. GAAP information contained within our financial statements.

Free cash flow totaled $112.5 million during the year ended December 31, 2014 compared to $120.1 million in the same

period in 2013, a decrease of $7.5 million. This decrease was primarily due to the decrease in cash provided by operating

activities discussed above.

At December 31, 2014, our cash and cash equivalents totaled $104.0 million, including approximately $56.2 million of

cash held for gift card programs and advertising funds.

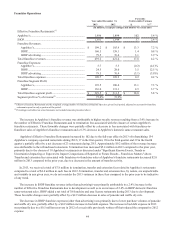

Dividends

During the fiscal years ended December 31, 2014 and 2013, we declared and paid dividends on our common stock as

follows:

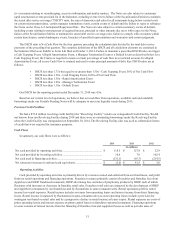

Year ended December 31, 2014 Declaration date Payment date Dividend per

share Total(1)

(In millions)

First quarter......................................................... February 25, 2014 March 28, 2014 $ 0.75 $ 14.3

Second quarter .................................................... May 28, 2014 June 27, 2014 0.75 14.3

Third quarter ....................................................... August 4, 2014 September 26, 2014 0.75 14.2

Fourth quarter ..................................................... October 27, 2014 (2) 0.875 —

Total.................................................................... $ 3.125 $ 42.8

Year ended December 31, 2013

First quarter......................................................... February 26, 2013 March 29, 2013 $ 0.75 $ 14.6

Second quarter .................................................... May 14, 2013 June 28, 2013 0.75 14.4

Third quarter ....................................................... August 2, 2013 September 27, 2013 0.75 14.3

Fourth quarter ..................................................... October 3, 2013 December 27, 2013 0.75 14.3

Total.................................................................... $ 3.00 $ 57.6

____________________________________________

(1) Includes dividend equivalents paid on restricted stock units.

(2) The fourth quarter 2014 dividend of $16.6 million was paid on January 9, 2015.

On February 24, 2015, our Board of Directors approved payment of a cash dividend of $0.875 per share of common stock,

payable at the close of business on April 10, 2015 to the stockholders of record as of the close of business on March 13, 2015.