IHOP 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

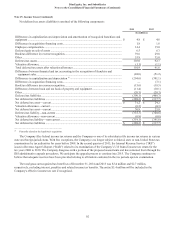

Note 15. Income Taxes (Continued)

93

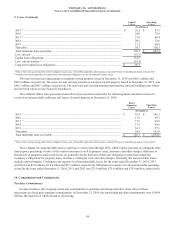

The Company estimates the unrecognized tax benefits may decrease over the upcoming 12 months by an amount up to

$0.7 million related to settlements with taxing authorities and the lapse of statutes of limitations. A reconciliation of the

beginning and ending amount of unrecognized tax benefits is as follows:

Year Ended December 31,

2014 2013 2012

Unrecognized tax benefit as of January 1...................................................... $ 2.7 $ 6.7 $ 8.2

Changes for tax positions of prior years ........................................................ 1.2 0.8 0.8

Increases for tax positions related to the current year.................................... 0.1 — 0.2

Decreases relating to settlements and lapsing of statutes of limitations........ (0.6) (4.8) (2.5)

Unrecognized tax benefit as of December 31 ................................................ $ 3.4 $ 2.7 $ 6.7

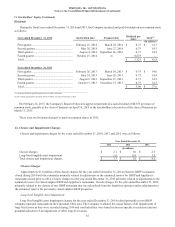

As of December 31, 2014, the accrued interest and penalties were $3.9 million and $0.1 million, respectively, excluding

any related income tax benefits. As of December 31, 2013, the accrued interest and penalties were $2.9 million and $0.1

million, respectively, excluding any related income tax benefits. The increase of $1.0 million of accrued interest is primarily

related to an increase in unrecognized tax benefits as a result of recent audits by taxing authorities. The Company recognizes

interest accrued related to unrecognized tax benefits and penalties as a component of the income tax provision recognized in the

Consolidated Statements of Comprehensive Income.

The valuation allowance of $1.1 million as of both December 31, 2014 and 2013 related to the Massachusetts enacted

legislation requiring unitary businesses to file combined reports. As of each reporting date, the Company’s management

considers new evidence, both positive and negative, that could impact management’s view with regards to future realization of

deferred tax assets. As of December 31, 2014, management determined that, based on available evidence, there was no change

to the valuation allowance.

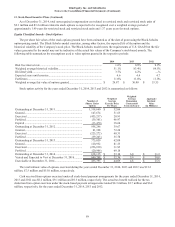

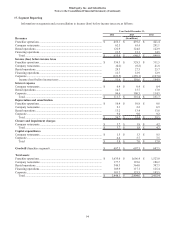

16. Net Income Per Share

The computation of the Company's basic and diluted net income per share is as follows:

Year Ended December 31,

2014 2013 2012

(In thousands, except per share data)

Numerator for basic and diluted income per common share:

Net income ...................................................................................................... $ 36,453 $ 72,037 $ 127,674

Less: Accretion of Series B preferred stock............................................... — — (2,498)

Less: Net income allocated to unvested participating restricted stock....... (521)(1,200)(2,718)

Net income available to common stockholders - basic................................... 35,932 70,837 122,458

Effect of unvested participating restricted stock........................................ — 4 127

Effect of dilutive securities: .......................................................................

Convertible Series B preferred stock ...................................................... — — 2,498

Numerator - net income available to common shareholders - diluted ............ $ 35,932 $ 70,841 $ 125,083

Denominator:

Weighted average outstanding shares of common stock - basic..................... 18,753 18,871 17,992

Effect of dilutive securities: .......................................................................

Stock options ........................................................................................... 203 270 264

Convertible Series B preferred stock ...................................................... — — 621

Weighted average outstanding shares of common stock - diluted.................. 18,956 19,141 18,877

Net income per common share:

Basic ........................................................................................................... $ 1.92 $ 3.75 $ 6.81

Diluted........................................................................................................ $ 1.90 $ 3.70 $ 6.63