IHOP 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

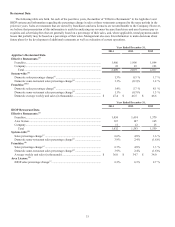

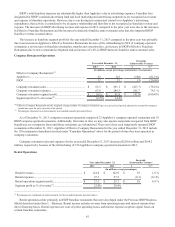

OTHER EXPENSE AND INCOME ITEMS

Year ended December 31,

Favorable

(Unfavorable) Variance

2014 2013 $% (1)

(In millions, except percentages)

General and administrative expenses .................................... $ 145.9 $ 143.6 $ (2.3) (1.6)%

Interest expense ..................................................................... 96.6 100.3 3.7 3.6 %

Loss on extinguishment of debt............................................. 64.9 0.1 (64.8) n.m.

Amortization of intangible assets .......................................... 12.1 12.3 0.2 1.8 %

Closure and impairment charges ........................................... 3.7 1.8 (1.9) (105.4)%

Debt modification costs......................................................... — 1.3 1.3 n.m.

Loss (gain) on disposition of assets....................................... 0.3 (0.2)(0.5) (247.5)%

Provision for income taxes .................................................... 15.1 38.6 23.5 60.7 %

_____________________________________________________

(1) Percentages calculated on actual amounts, not rounded amounts presented above

n.m. - not meaningful

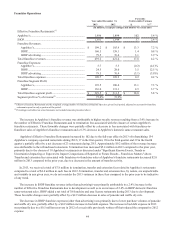

General and Administrative Expenses

The $2.3 million increase in G&A expenses for the year ended December 31, 2014 compared to the same period of the

prior year was primarily due to a $1.4 million increase in compensation costs and to charges associated with information

technology infrastructure projects. These unfavorable variances were partially offset by a decrease in costs for legal and other

professional services. The increase in compensation costs was primarily due to the impact of an increase in the per share price

of our common stock on certain long-term incentive compensation awards.

Interest Expense

As discussed under “Liquidity and Capital Resources - Refinancing of Long-Term Debt,” we refinanced $1.225 billion

principal amount of existing long-term debt that bore interest at a weighted average rate of approximately 7.3% with $1.3

billion principal amount of new long-term debt bearing interest at a fixed rate of 4.277%. The new debt was issued September

30, 2014, on which date $464 million of the old long-term debt was repaid. On October 30, 2014, after a required 30-day notice

period, the remaining $761 million of old long-term debt was repaid. The decrease of $3.7 million in interest expense for the

year ended December 31, 2014 compared to the same period of the prior year is primarily due to the 3% reduction in our

weighted average interest rate on long-term debt for the last three months of 2014, partially offset by approximately $6 million

of interest paid during the 30-day period in which both the new long-term debt and a portion of the old long-term debt were

outstanding.

Loss on Extinguishment of Debt

As discussed under “Liquidity and Capital Resources - Refinancing of Long-Term Debt,” we recognized a loss on debt

extinguishment of $64.9 million, comprised of a $36.1 million make-whole premium required for the early retirement of debt and

the write-off of unamortized debt discount and issuance costs associated with the extinguished debt of $28.8 million. We do not

expect to recognize any significant losses or gains on extinguishment of debt in the foreseeable future.

Amortization of Intangible Assets

Amortization of intangible assets relates to intangible assets arising from the November 2007 acquisition of Applebee's,

primarily franchising rights. The annual amount of amortization expense will decline to approximately $10 million per year

beginning in 2015 as certain intangible assets with an estimated life of seven years became fully amortized in November 2014.