IHOP 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

91

14. Employee Benefit Plans

401(k) Savings and Investment Plan

Effective January 1, 2013, the Company amended the DineEquity, Inc. 401(k) Plan to (i) modify the Company matching

formula and (ii) eliminate the one year completed service requirement that previously had to be met to become eligible for

Company matching contributions. As amended, the Company matches 100% of the first four percent of the employee's eligible

compensation deferral and 50% of the next two percent of the employee's eligible compensation deferral. All contributions

under this plan vest immediately. DineEquity common stock is not an investment option for employees in the 401(k) plan, other

than shares transferred from a prior employee stock ownership plan. Substantially all of the administrative cost of the 401(k)

plan is borne by the Company. The Company's matching contribution expense was $2.3 million, $2.3 million and $2.2 million

for the years ended December 31, 2014, 2013 and 2012, respectively.

15. Income Taxes

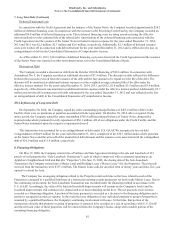

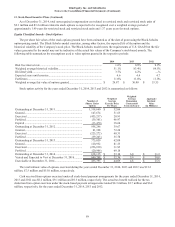

The provision (benefit) for income taxes for the years ended December 31, 2014, 2013 and 2012 was as follows:

Year Ended December 31,

2014 2013 2012

(In millions)

Provision (benefit) for income taxes:

Current

Federal ................................................................................................... $ 33.2 $ 48.5 $ 77.4

State ....................................................................................................... 3.6 2.1 1.9

Foreign................................................................................................... 2.7 2.4 1.8

39.5 53.0 81.1

Deferred

Federal ................................................................................................... (22.1) (13.5) (12.2)

State ....................................................................................................... (2.3) (0.9) (1.7)

(24.4) (14.4) (13.9)

Provision for income taxes......................................................................... $ 15.1 $ 38.6 $ 67.2

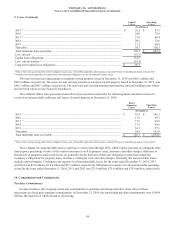

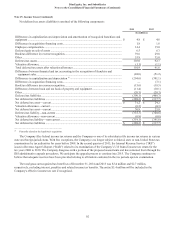

The provision for income taxes differs from the expected federal income tax rates as follows:

Year Ended December 31,

2014 2013 2012

Statutory federal income tax rate ................................................................ 35.0% 35.0% 35.0%

State and other taxes, net of federal tax benefit .......................................... 2.4 2.9 2.8

Change in unrecognized tax benefits .......................................................... 2.4 1.4 (0.2)

Change in valuation allowance ................................................................... — (2.7) 0.7

Domestic production activity deduction ..................................................... (6.0) — —

Research and experimentation tax credit .................................................... (3.4) — —

State adjustments including audits and settlements .................................... (1.1) (1.1) 0.2

Compensation related tax credits, net of deduction offsets......................... (0.8) (0.6) (0.9)

Changes in tax rates and state tax laws ....................................................... — — (3.2)

Other............................................................................................................ 0.8 — 0.1

Effective tax rate ......................................................................................... 29.3% 34.9% 34.5%

The Company retroactively adopted the domestic production activity deduction and the federal research and

experimentation credit in 2014. Deductions related to 2014 domestic production activity lowered the 2014 tax rate by 2.3%,

while deductions related to domestic production activity in prior years lowered the 2014 tax rate by 3.7%. Similarly, tax credits

related to 2014 research activity lowered the 2014 tax rate by 0.5%, while tax credits related to research activity in prior years

lowered the 2014 tax rate by 2.9%.