IHOP 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

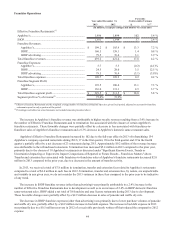

39

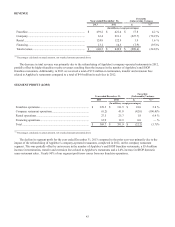

Rental Operations

Year ended December 31,

Favorable

(Unfavorable) Variance

2014 2013 $ %(1)

(In millions, except percentages)

Rental revenues ..................................................................... $ 122.9 $ 124.8 $ (1.9) (1.5)%

Rental expenses ..................................................................... 94.6 97.3 2.7 2.7 %

Rental operations segment profit........................................... $ 28.3 $ 27.5 $ 0.8 3.0 %

Segment profit as % of revenue (1) 23.0% 22.0%

_____________________________________________________

(1) Percentages calculated on actual amounts, not rounded amounts presented above

Rental operations relate primarily to IHOP franchise restaurants that were developed under the Previous IHOP Business

Model described under Item 1. - Business. Rental income includes revenue from operating leases and interest income from

direct financing leases. Rental expenses are costs of prime operating leases and interest expense on prime capital leases on

certain franchise restaurants.

Rental revenue for the year ended December 31, 2014 decreased primarily due to an increase in write-offs of deferred lease

revenue associated with franchise restaurants whose lease agreements were prematurely terminated and a decline in interest

income as direct financing leases are repaid. These unfavorable variances were partially offset by higher contingent rental

income resulting from an increase in IHOP domestic same-restaurant sales.

Rental expenses for the year ended December 31, 2014 decreased primarily due to a $1.0 million decline in interest on

capital lease obligations and lower operating costs of rental properties.

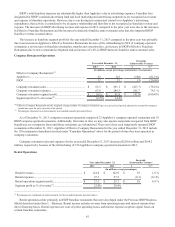

Financing Operations

Year ended December 31, Favorable

(Unfavorable) Variance

2014 2013 $ %(1)

(In millions, except percentages)

Financing revenues................................................................ $ 13.5 $ 13.1 $ 0.4 2.8 %

Financing expenses................................................................ 0.8 0.2 (0.6) (236.7)%

Financing operations segment profit ..................................... $ 12.7 $ 12.9 $ (0.2) (1.7)%

Segment profit as % of revenue (1) 93.9% 98.1%

_____________________________________________________

(1) Percentages calculated on actual amounts, not rounded amounts presented above

Financing operations relate primarily to IHOP franchise restaurants that were developed under the Previous IHOP Business

Model described under Item 1. - Business. Financing operations revenue primarily consists of interest income from the

financing of franchise fees and equipment leases. We also sell equipment associated with IHOP franchise restaurants we have

reacquired when those restaurants are subsequently refranchised to a new franchisee. Financing expenses are primarily the cost

of the restaurant equipment sold. Sales of equipment associated with reacquired IHOP restaurants are, by nature, unpredictable

and variable in any given year.

The increase in financing revenue for the year ended December 31, 2014 was primarily due to fees of $1.4 million

associated with the negotiated early termination of two leases. Early lease terminations such as these occur relatively

infrequently and should not be considered indicative of any trend with respect to financing segment revenue. The increase from

these termination fees was partially offset by a $0.8 million decrease in interest revenue resulting from the progressive decline

in note balances due to repayments.

The increase in financing expenses for the year ended December 31, 2014 was due to increased cost of sales of equipment

associated with reacquired IHOP restaurants that were refranchised during 2014.