IHOP 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

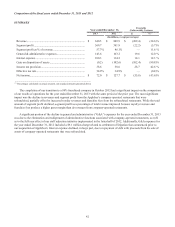

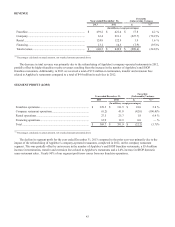

48

of impairment on an interim basis and no impairments as the result of performing our annual test for impairment during the

fiscal years ended 2013 and 2012.

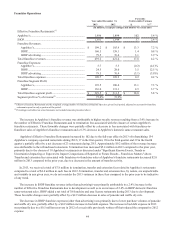

Loss on Extinguishment of Debt

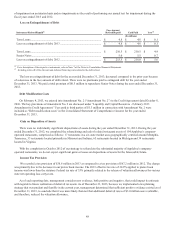

Instrument Retired/Repaid(1) Face Amount

Retired/Repaid Cash Paid

Loss(2)

(In millions)

Term Loans................................................................................................... $ 4.8 $ 4.8 $ 0.1

Loss on extinguishment of debt, 2013 ......................................................... $ 4.8 $ 4.8 $ 0.1

Term Loans................................................................................................... $ 210.5 $ 210.5 $ 4.9

Senior Notes ................................................................................................. 5.0 5.5 0.7

Loss on extinguishment of debt, 2012 ......................................................... $ 215.5 $ 216.0 $ 5.6

_____________________________________________________

(1) For a description of the respective instruments, refer to Note 7 of the Notes to Consolidated Financial Statements.

(2) Including write-off of the discount and deferred financing costs related to the debt retired.

The loss on extinguishment of debt for the year ended December 31, 2013, decreased compared to the prior year because

of a decrease in the face amount of debt retired. There were no premiums paid to extinguish debt for the year ended

December 31, 2013. We paid a total premium of $0.5 million to repurchase Senior Notes during the year ended December 31,

2012.

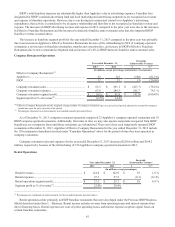

Debt Modification Costs

On February 4, 2013, we entered into Amendment No. 2 (“Amendment No. 2”) to the Credit Agreement dated October 8,

2010. The key provisions of Amendment No. 2 are discussed under “Liquidity and Capital Resources - February 2013

Amendment to Credit Agreement.” Fees paid to third parties of $1.3 million in connection with Amendment No. 2 were

included as “Debt modification costs” in the Consolidated Statement of Comprehensive Income for the year ended

December 31, 2013.

Gain on Disposition of Assets

There were no individually significant dispositions of assets during the year ended December 31, 2013. During the year

ended December 31, 2012, we completed the refranchising and sale of related restaurant assets of 154 Applebee's company-

operated restaurants, comprised as follows: 17 restaurants in a six-state market area geographically centered around Memphis,

Tennessee; 33 restaurants located primarily in Missouri and Indiana; 65 restaurants located in Michigan and 39 restaurants

located in Virginia.

With the completion in October 2012 of our strategy to refranchise the substantial majority of Applebee's company-

operated restaurants, we do not expect significant gains or losses on dispositions of assets for the foreseeable future.

Income Tax Provision

We recorded a tax provision of $38.6 million in 2013 as compared to a tax provision of $67.2 million in 2012. The change

was primarily due to the decrease in our pretax book income. The 2013 effective tax rate of 34.9% applied to pretax book

income was lower than the statutory Federal tax rate of 35% primarily related to the release of valuation allowances for various

state net operating loss carryovers.

As of each reporting date, management considers new evidence, both positive and negative, that could impact its estimate

with regards to future realization of deferred tax assets. As of December 31, 2013, because we implemented a tax planning

strategy that was prudent and feasible in the current year, management determined that sufficient positive evidence existed as of

December 31, 2013, to conclude that it was more likely than not that additional deferred taxes of $3.0 million were realizable,

and therefore, reduced the valuation allowance.